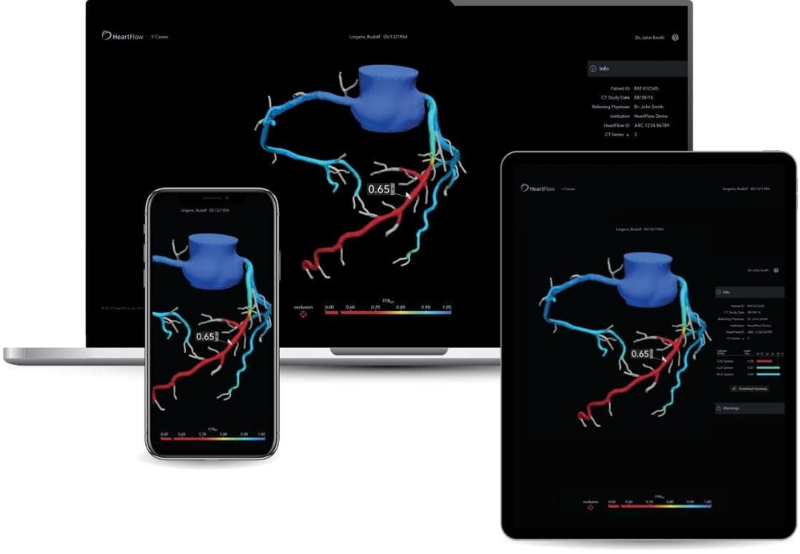

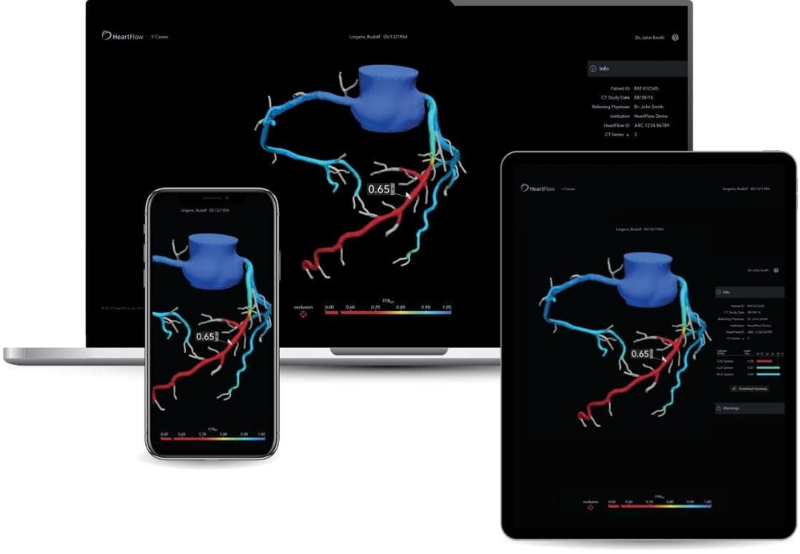

HeartFlow, a precision heart care platform, and Longview Acquisition Corp. II, a special purpose acquisition company sponsored by affiliates of Glenview Capital Management, announced that

HeartFlow, a precision heart care platform, and Longview Acquisition Corp. II, a special purpose acquisition company sponsored by affiliates of Glenview Capital Management, announced that

Global VC funding for Digital Health companies in the first half (1H) of 2021 shattered all previous 1H funding records, with $15 billion. Funding activity

M&A was the only viable option for digital health companies in the past years due to the lack of initial public offerings (IPOs). However, all

Global venture capital (VC) funding, including private equity and corporate VC into Digital Health companies in Q1 2021, came to a record $7.2 billion in

Better Therapeutics, a prescription digital therapeutics (PDT) company, announced plans to go public by merging with special purpose acquisition company Mountain Crest Acquisition Corp II.

The year 2020 is on course to become the year of the special purpose acquisition companies (SPACs) also known as blank check companies, in the

Global venture capital (VC) funding in Digital Health, including private equity and corporate venture capital, came to $14.8 billion in 637 deals, a 66% increase

Of the 29 digital health public companies Mercom tracks, 11 company stocks have outperformed the S&P 500 Index as of November end. M&A was the

Augmedix, a provider of apps for Google Glass that allows doctors to capture audio-visual data from the doctor-patient interaction and turn it into an EHR

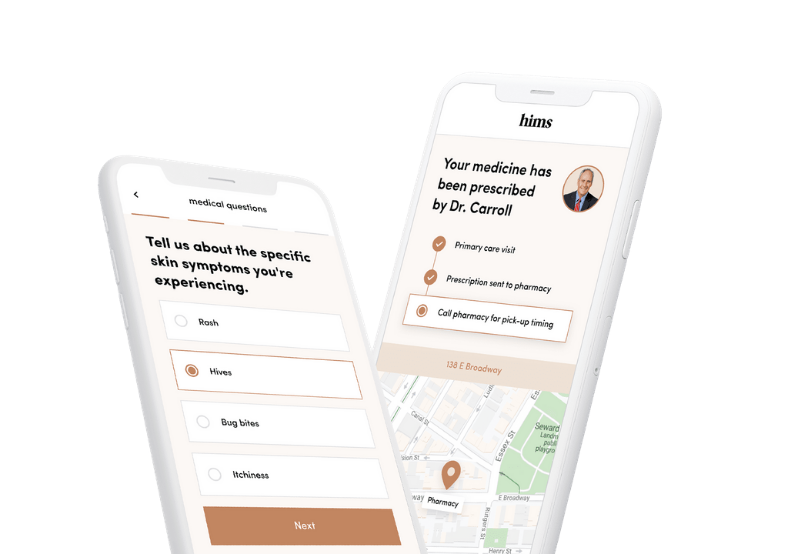

Hims & Hers, an online direct-to-consumer telehealth company that uses remote consultation to prescribe cosmetic and sexual health products, plans to go public through a