HeartFlow, a precision heart care platform, and Longview Acquisition Corp. II, a special purpose acquisition company sponsored by affiliates of Glenview Capital Management, announced that they have entered into a definitive business combination agreement.

Upon completing the proposed transaction, the combined company will operate as HeartFlow Group, Inc. and is expected to be listed on the New York Stock Exchange (NYSE) under the symbol “HFLO.”

The transaction will also provide the combined company with an estimated $400 million in cash for growth capital, product development, and general corporate purposes.

The proposed transaction values HeartFlow at an initial pro forma enterprise value of approximately $2.4 billion and a fully distributed equity value of around $2.8 billion.

The transaction is expected to deliver up to $599 million of gross proceeds to HeartFlow (all coming from the $690 million cash in a trust held by Longview) to accelerate growth as well as repurchase up to $110 million of equity from long-time shareholders and employees, representing approximately 5% pro forma shares outstanding. Pro forma for the business combination, legacy shareholders of HeartFlow and its employees will own about 73.0% of the public company.

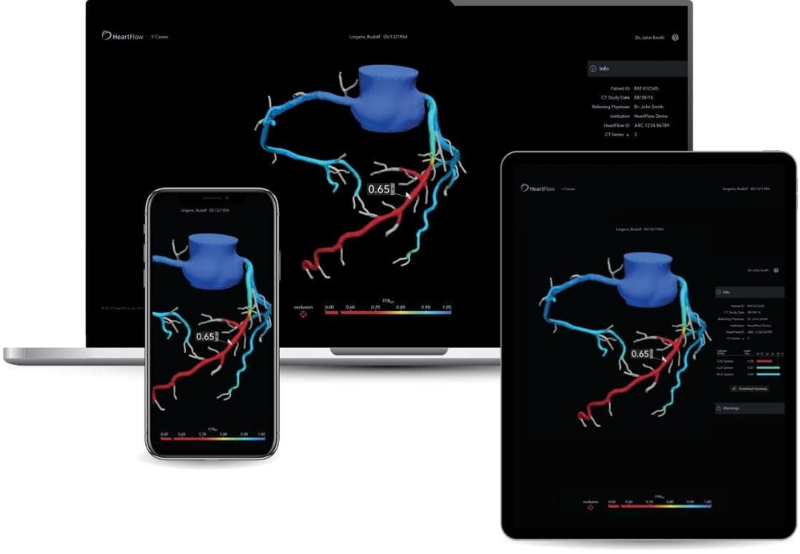

Founded in 2007, HeartFlow is transforming precision heart care with non-invasive, personalized cardiac tests and associated enterprise software suite solutions to address heart disease, the leading cause of death worldwide, according to the company. HeartFlow’s core product, the HeartFlow FFRCT Analysis, is a non-invasive cardiac test for stable symptomatic patients with coronary artery disease (CAD), the most common type of cardiovascular disease.

J.P. Morgan Securities and Cowen and Company are acting as financial advisors to HeartFlow. Cowen is acting as capital markets advisor to HeartFlow. King & Spalding is acting as legal advisor to HeartFlow. UBS Investment Bank is acting as sole financial and capital markets advisor to Longview. UBS and Cowen underwrote the IPO of Longview in March 2021. Ropes & Gray is acting as legal advisor to Longview.

SPACs deals are set to outpace traditional digital health IPOs in 2021. Recently, British telehealth company Babylon has agreed to go public in the United States via a merger deal with Alkuri Global Acquisition Corp (Alkuri Global), a special purpose acquisition company led by former Groupon chief Rich Williams.