Of the 29 digital health public companies Mercom tracks, 11 company stocks have outperformed the S&P 500 Index as of November end.

M&A was the only viable option for digital health companies in the past years due to the lack of IPOs. However, all that changed this year with a slew of IPOs and announcements of plans to go public. There have been five digital health IPOs so far in 2020.

Digital Health IPO activity during 2020

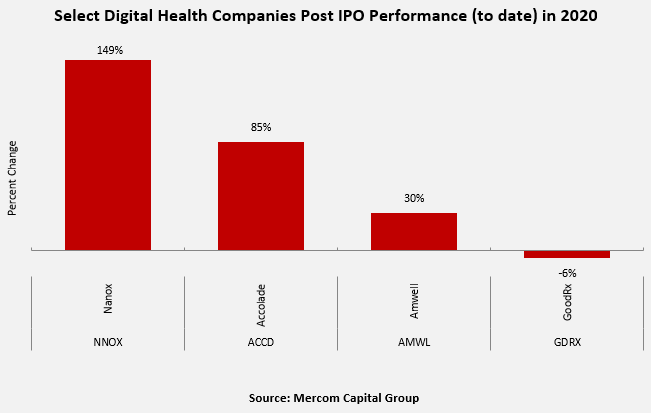

GoodRx, an online pharmacy platform that helps consumers compare medication prices and discounts, raised approximately $1.3 billion through its initial public offering of 39,807,691 shares of its Class A common stock at $33.00 per share. The company’s revenues grew 48% in the first half of 2020 to $257 million, up from $173 million in the first half of 2019. The company has been consistently profitable since 2016. It reported a net income of $55 million in the first half of 2020, compared to $31 million in the first half of 2019.

Amwell, a telehealth provider, raised approximately $922 million through its initial public offering of 47,405,555 shares of its Class A common stock at $18 per share. Founded in 2006, Amwell raised over $800 million in venture capital. The company employs more than 500 people with offices in Boston (HQ), Reston, Seattle, and Ramat Gan, Israel.

Accolade, a provider of cloud-based, on-demand technology-enabled healthcare concierge services for employers, health plans, and health systems, raised $220 million (at a valuation of $1.2 billion) through its initial public offering (IPO). The company, backed by Humana, Andreessen Horowitz, Carrick Capital Partners, Madrona Venture Group, McKesson Ventures, Cross Creek Advisors, Madera Technology Partners, had raised over $150 million in venture capital.

Founded in 2018, Nanox, a digital X-ray system startup, raised $165 million (at a valuation of about $1 billion) through its initial public offering of 9,178,744 ordinary shares at $18 per share.

IPO Plans Announced

Specialists On Call (dba SOC Telemed), a telemedicine technology provider, agreed to be acquired for $720 million and taken public by Healthcare Merger Corporation, a special purpose acquisition company. hims & hers, an online direct-to-consumer telehealth company, plans to go public through a merger with blank-check company Oaktree Acquisition Corp. Post-merger, the company will be valued at $1.6 billion. MDLive‘s chief executive officer announced intentions to take the company public early next year.