Hims & Hers, an online direct-to-consumer telehealth company that uses remote consultation to prescribe cosmetic and sexual health products, plans to go public through a merger with blank-check company Oaktree Acquisition Corp.

As of June 2020, the company had approximately 260,000 subscriptions on the platform. The merger deal will value the three-year-old San Francisco company – Hims – at roughly $1.6 billion.

Other digital health companies that have gone public this year include Accolade, Amwell (formerly American Well), GoodRx, and OliveX.

The merger deal is expected to raise as much as $280 million for the combined company by contributing up to $205 million of cash held in Oaktree’s trust and a $75 million private placement of common stock priced at $10 a share. Hims management and shareholders, including Founders Fund, Forerunner Ventures, Thrive Capital, and McKesson Ventures, will roll nearly 100% of their equity into the new company.

“We’re thrilled to partner with Oaktree Acquisition Corp. to usher Hims & Hers into our next phase of growth as we work to become the front door to the healthcare system, serving as the first stop for peoples’ health and wellness needs across hundreds of conditions,” said Andrew Dudum, CEO and founder of Hims & Hers.

Andrew Dudum added: “Hims & Hers was founded to make it easier and more affordable for everyone to get the healthcare they need. We remain committed to advancing that goal as we expand into new categories of care and build an enduring healthcare company that brings choice, affordability, and access to consumers.”

Hims & Hers, founded in 2017, has raised over 150 million venture capital to date. The company employs more than 100 people with an office in San Francisco.

Advisors: Advisors LionTree Advisors serves as an exclusive financial advisor to Hims & Hers, and Gunderson Dettmer Stough Villeneuve Franklin & Hachigian is serving as legal counsel. Credit Suisse and Deutsche Bank Securities are acting as financial advisors, capital markets advisors, and private placement agents to Oaktree Acquisition Corp. Kirkland & Ellis is serving as legal counsel to Oaktree Acquisition Corp.

IPO Activity: Recently, in a similar deal, Specialists On Call (dba SOC Telemed), a telemedicine technology provider, agreed to be acquired and taken public by Healthcare Merger Corporation, for an initial enterprise value of approximately $720 million. GoodRx, an online pharmacy platform that helps consumers compare medication prices and discounts, raised $1.1 billion in its initial public offering. The company sold 34.6 million shares of its stock at $33 per share.

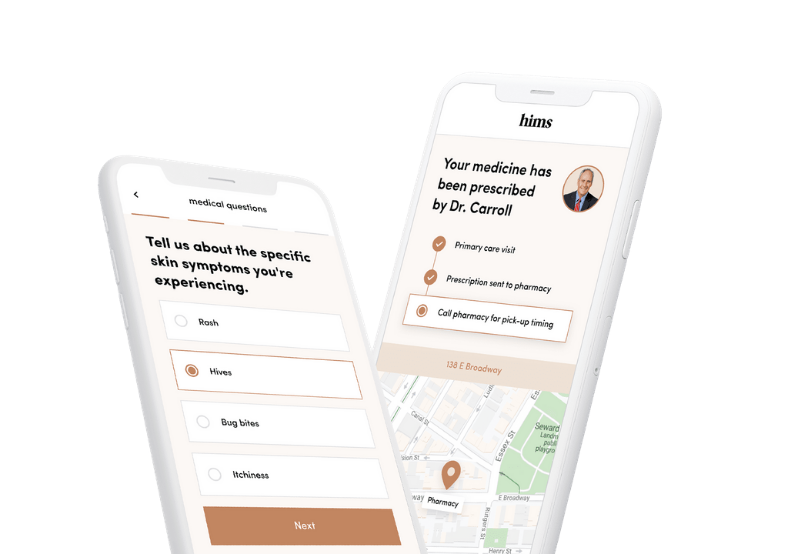

Image credit: Hims