Netherlands-based APG and OMERS Infrastructure, an investor and asset manager, signed an agreement to acquire Groendus from NPM Capital.

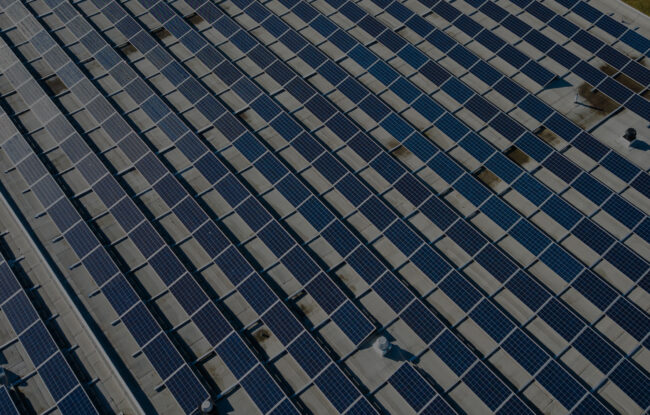

Groendus is an energy transition platform in the Netherlands founded in 2021 by merging six companies in the rooftop solar, metering, and energy services spaces.

APG’s investment is made on behalf of its pension fund client, ABP. OMERS Infrastructure is investing on behalf of OMERS, a Canadian public pension fund.

Groendus develops, builds, and operates energy assets and provides a portfolio of auxiliary services for its customers. Currently, the company owns more than 170 MW of solar capacity. It is committed to growing its portfolio of 300 solar projects and expects to provide customers with an increasing suite of energy transition solutions, such as EV charging and battery storage.

The deal is expected to close in Q3 2022, subject to customary regulatory approvals.

“There is an urgent need to transform the traditional energy supply into a sustainable, clean energy system. Jointly with our customers, Groendus makes a major contribution through its renewable energy assets, insights from smart metering data, and our unique peer-to-peer sustainable energy trading platform. We build on the support and strong financial backing of our shareholders. We are grateful for the huge impact NPM Capital has made during the initial years of bringing together six companies into the Groendus platform,” said Rene Raaijmakers, CEO of Groendus.

Voltiq, Rothschild, Latham & Watkins, Loyens & Loeff, Strategy&, Arcadis and EY advised APG and OMERS Infrastructure.

According to Mercom Research, in October 2021, Fotowatio Renewable Ventures (FRV), a developer of utility-scale renewable energy projects and part of Abdul Latif Jameel Energy, announced the sale of a 49% interest in FRV Australia Group (a solar project developer) to OMERS Infrastructure.

According to Mercom’s Q1 2022 solar funding and M&A report, a total of 29 solar M&A transactions were recorded in Q1 2022 compared to 43 in Q4 2021. In a YoY comparison, there were 20 solar M&A transactions in Q1 2021.