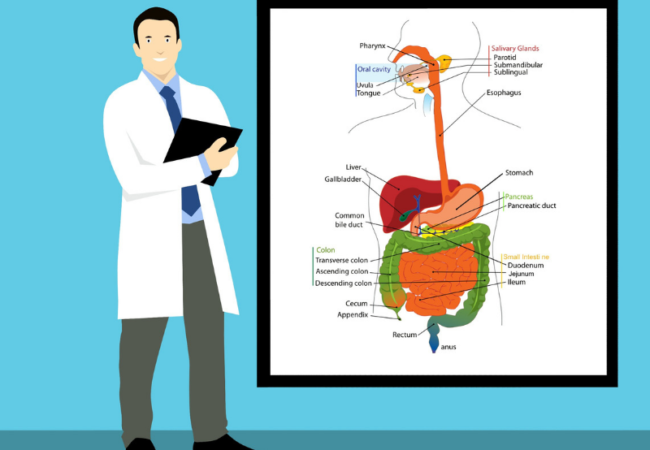

Teladoc Health Acquires Telehealth Company, InTouch Health, for $600 Million

Teladoc Health, a telemedicine and virtual healthcare company, has entered into a definitive agreement to acquire InTouch Health, a provider of telehealth solutions for hospitals

Telemedicine Company KRY Raises $155 Million in Series C Funding

KRY, a telemedicine company, raised $155 million in a Series C funding round that was led by Ontario Teachers’ Pension Plan (Ontario Teachers’) through its

Venture Capital Funding in Digital Health Sector Reaches $8.9 Billion in 2019

Global venture capital (VC) funding in digital health, including private equity and corporate venture capital, declined in 2019 with $8.9 billion raised in 615 deals,

Total Corporate Funding in Solar Sector Rises 20%, Reaching $11.7 Billion in 2019

Total corporate funding into the solar sector globally, including venture capital and private equity (VC), debt financing, and public market financing, came to $11.7 billion,

Clinical Decision Software Developer Repisodic Raises $1.75 Million

Repisodic, a developer of discharge decision-making software, raised $1.75 million with funding led by American Enterprise Ventures, a division of American Enterprise Group. Repisodic

HMS Holdings Acquires Accent for $155 Million

HMS Holdings, a provider of analytics and engagement solutions for healthcare, signed a definitive agreement to acquire Accent, a provider of healthcare payment integrity solutions.

ESO Acquires Clinical Data Management, Lancet Technology, and Digital Innovation

ESO, a provider of integrated software products for emergency medical service agencies, fire departments, and hospitals, acquired three trauma registry software companies Clinical Data Management,

Clinician Nexus Raises $1.5 Million in Seed Funding

Clinician Nexus, a shared clinical education management platform, raised $1.5 million in Seed funding, bringing its total investments to $2.3 million to date. The funding round

Digital Fitness Platform Trainiac Raises $2.2 Million in Seed Funding

Trainiac, a provider of one-on-one personal fitness training programs through its app, closed $2.2 million in a Seed funding round, according to GeekWire. Trainiac expects

19% of Americans Use Wearable Fitness Trackers and mHealth Apps

According to a new survey from Gallup, 19% of Americans are using a wearable fitness tracker and a mobile health app. About one in three Americans