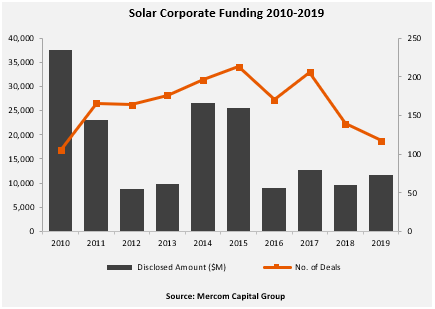

Total corporate funding into the solar sector globally, including venture capital and private equity (VC), debt financing, and public market financing, came to $11.7 billion, a 20% increase compared to the $9.7 billion raised in 2018.

To learn more about Mercom’s 2019 Solar Funding and M&A Report, visit: https://mercomcapital.com/product/2019-q4-annual-solar-funding-ma-report/

“Financial activity was up across the board in the solar sector in 2019 with venture funding, public market, and debt financing all increasing year-over-year. Solar equities also had a great year with six solar IPOs around the world. These notable metrics, along with robust debt financing activity including securitization deals, rounded off a strong year for the sector,” said Raj Prabhu, CEO of Mercom Capital Group.

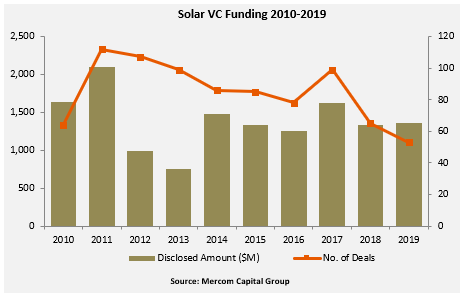

Global venture capital and private equity funding in the solar sector in 2019 came to $1.4 billion in 53 deals, compared to $1.3 billion in 65 transactions in 2018.

Of the $1.4 billion in VC/PE funding raised in 53 deals in 2019, $1 billion went to 30 Solar Downstream companies, which comprised 75% of total VC funding in 2019. Thin-film technology companies raised $126 million; PV companies raised $100 million; Balance of System (BOS) companies brought in $72 million; Solar Service Providers totaled $29 million; and Concentrated Solar Power (CSP) companies raised $7 million, followed by Manufacturing companies, which brought in $3 million.

The top solar VC/PE funded companies in 2019 were ReNew Power, which raised $300 million, Hero Future Energies with $150 million, followed by Avaada Energy with $144 million. Yellow Door Energy raised $65 million and Infinity Solar brought in $60 million.

There were 116 VC and PE investors that participated in funding deals in 2019, with ten involved in multiple rounds.

Public market financing increased by 9% in 2019, with $2.5 billion compared to the $2.3 billion raised in 2018. Initial Public Offerings (IPOs) were instrumental in higher public market funding activity in 2019, with $1.3 billion raised in six deals.

In 2019, announced debt financing rose 29% with $7.8 billion in 46 deals, compared to $6 billion in 53 deals in 2018. There were eight securitization deals totaling $1.6 billion in 2019, which was the largest amount of financing through securitization deals in the solar sector.

The top large-scale project funding deal was the $2 billion raised for the Noor Energy 1 Solar Project by Dubai Electricity and Water Authority (DEWA), ACWA Power, and Silk Road Fund.

The top investors to fund large-scale projects in 2019 included Natixis, Banco Sabadell, ING, IFC, and NORD/LB.

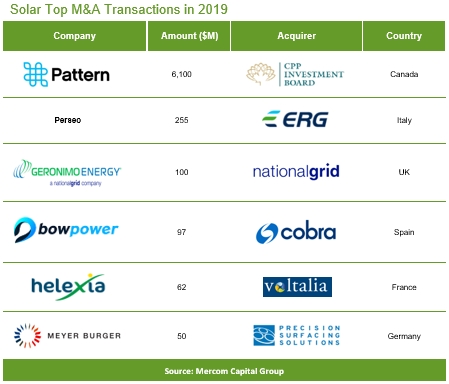

There were 65 Merger and Acquisition (M&A) transactions in the solar sector in 2019 compared to 82 in 2018. Most of the transactions involved Solar Downstream companies. In 2019 BayWa, EDF Renewables, and Engie acquired two companies each. The largest transaction in 2019 was the $6.1 billion acquisition of Pattern Energy by Canada Pension Plan Investment Board (CPPIB).

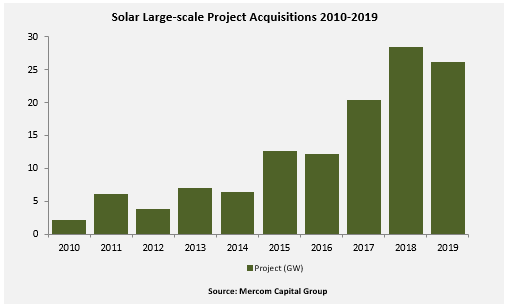

A total of 26 GW of large-scale solar projects changed hands in 2019 compared to 29 GW in 2018. There were 192 large-scale solar project acquisitions in 2019 compared to 218 large-scale solar project acquisitions in 2018.

“Investment firms acquired over 30 GW of large-scale solar projects in the past five years, a reflection of solar’s attractiveness as a long-term, low risk investment,” added Prabhu.

There were 812 companies and investors covered in this 109 page report, which contains 108 charts, graphs, and tables.

To learn more about Mercom’s 2019 Solar Funding and M&A Report, visit: https://mercomcapital.com/product/2019-q4-annual-solar-funding-ma-report/

Image credit: Sungrow