In Q1 2021, $1.3 billion was raised in VC funding by Battery Storage, Smart Grid, and Energy Efficiency companies, a 410% increase from the $252 million raised in Q1 2020.

To get a copy of the report, visit: https://mercomcapital.com/product/q1-2021-funding-ma-report-storage-grid-efficiency

Battery Storage

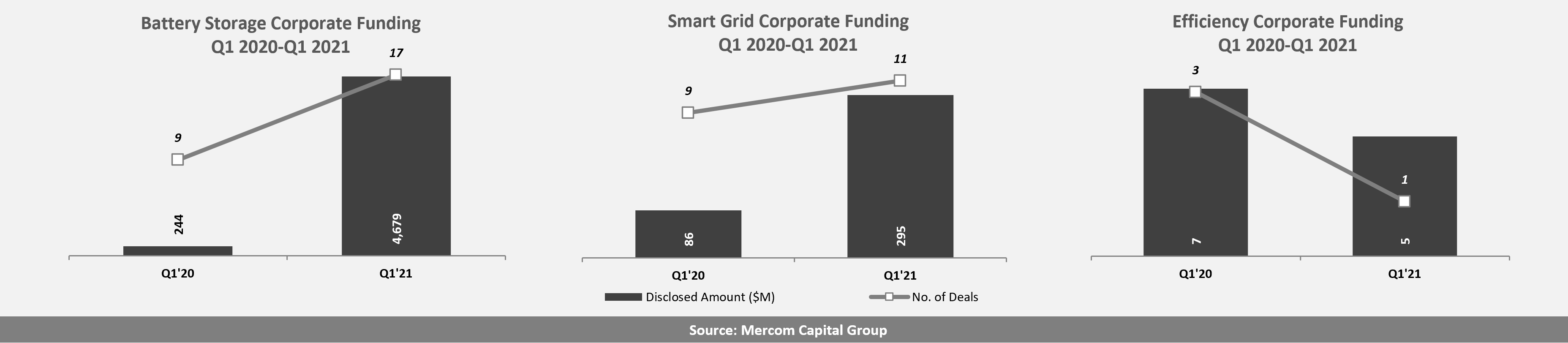

Total corporate funding (including VC, Debt, and Public Market Financing) in Battery Energy Storage came to $4.7 billion in 17 deals compared to $3.1 billion in 19 deals in Q4 2020. Funding was up significantly year-over-year (YoY) compared to $244 million in nine deals in Q1 2020.

Venture capital (VC) funding (including private equity and corporate venture capital) raised by Battery Storage companies in Q1 2021 came to $994 million in 13 deals compared to $164 million in six deals in Q1 2020. Quarter-over-quarter funding was 183% higher compared to $351 million in 11 deals in Q4 2020.

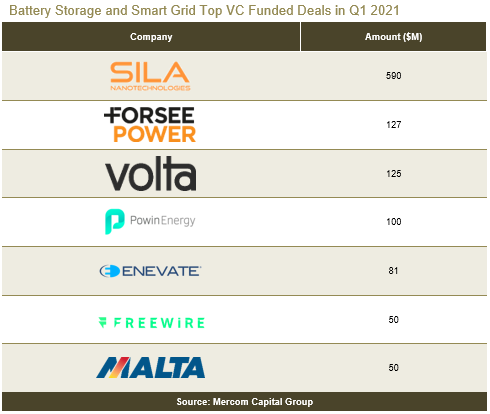

The top VC funded Battery Storage companies this quarter were: Sila Nanotechnologies, which raised $590 million from Coatue, T. Rowe Price Associates, 8VC, Bessemer Venture Partners, Canada Pension Plan Investment Board, and Sutter Hill Ventures; Forsee Power raised $127 million from European Investment Bank; Powin Energy raised $100 million from Trilantic Capital Management and Energy Impact Partners; Enevate raised $81 million from Fidelity Management & Research Company, Mission Ventures, and Infinite Potential Technologies, and Malta raised $50 million from Proman, Dustin Moskovitz, Alfa Laval, and Breakthrough Energy Ventures.

Thirty-three VC investors participated in Battery Storage funding this quarter.

In Q1 2021, announced debt and public market financing for Battery Storage technologies were higher, with $3.7 billion in four deals compared to $2.7 billion in eight deals in Q4 2020 and $80 million in three deals in Q1 2020.

There were four M&A transactions involving Battery Storage companies in Q1 2021, of which none disclosed transaction amounts. In Q4 2020, there were eight M&A transactions (one disclosed). There were four Battery Storage M&A transactions in Q1 2020, of which none disclosed transaction amounts.

There were nine Battery Storage project M&A transactions in Q1 2021, of which only one disclosed the transaction amount.

Total corporate funding in Smart Grid was 243% higher, with $295 million in 11 deals compared to $86 million in nine deals in Q1 2020.

VC funding for Smart Grid companies increased 254% in Q1 2021 with $287 million in 10 deals compared to $81 million in seven deals in Q1 2020.

The top 5 VC funded Smart Grid companies included: Volta Charging, which secured $125 million; FreeWire Technologies raised $50 million from Riverstone Holdings, bp ventures, Energy Innovation Capital, and TRIREC, Alumni Ventures Group; Wallbox raised $40 million from Cathay Innovation, Wind Ventures, Iberdrola, and Seaya Ventures; David Energy raised $19 million from Equal Ventures, Hartree Partners, Operator Partners, Box Group, Greycroft, Sandeep Jain, Xuan Yong, Kiran Bhatraju, and MCJ Collective; and WiTricity raised $18 million from Future Shape and Stage 1 Ventures.

Twenty-eight investors participated in Smart Grid VC funding rounds this quarter, with a Smart Charging company raising the most.

Eight million dollars was raised in one public market financing deal in Q1 2021. There were no debt and public market financing deals in Q4 2020. YoY, $5 million was raised in two debt financing deals in Q1 2020.

In Q1 2021, there were six M&A transactions compared to three in Q4 2020 and five transactions in Q1 2020.

Efficiency

Total corporate funding in Energy Efficiency came to $5 million in one deal compared to $196 million in five deals in Q4 2020. In a YoY comparison, $7 million was raised in three deals in Q1 2020.

VC funding raised by Energy Efficiency companies in Q1 2021 came to $5 million in one deal compared to $196 million in five deals in Q4 2020. In a YoY comparison, $7 million was raised in three deals in Q1 2020.

One investor participated in VC funding this quarter.

There were no M&A transactions in Q1 2021 and Q4 2020. In Q1 2020, there was one M&A transaction for $1.4 billion.

To get a copy of the report, visit: https://mercomcapital.com/product/q1-2021-funding-ma-report-storage-grid-efficiency