Venture Capital (VC) funding in the HIT sector continued to scale new heights reaching $293 million in Q2 2012 in 28 deals. Both the total

Venture Capital (VC) funding in the HIT sector continued to scale new heights reaching $293 million in Q2 2012 in 28 deals. Both the total

The lackluster venture capital (VC) investing trend in smart grid continued into this year with a weak first quarter of $62 million going into 10

Venture Capital (VC) funding in the healthcare information technology (HIT) sector continued on a strong positive trend that started in the third quarter of 2011.

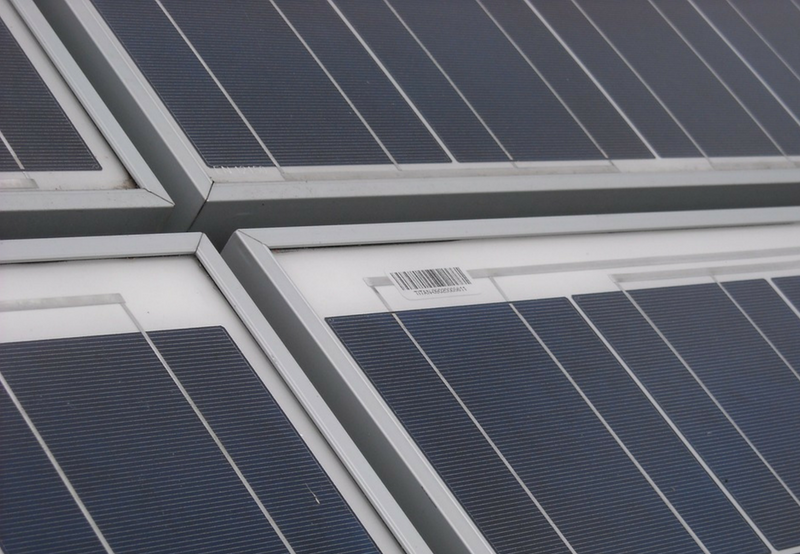

Venture Capital (VC) funding in the solar sector was off to a slow start in Q1 2012. VC funding for the quarter came to $329

Venture Capital (VC) funding in 2011 brought in $377 million in 50 deals (24 disclosed) compared to $769 million in 51 deals in 2010 (27

Health information management companies received most of the disclosed VC funding in 2011, totaling $336 million in 30 deals. Personal health record companies raised $83.3

Venture capital (VC) funding and M&A activity were strong in 2011, setting records for number of deals and M&A activity. “Investment activity in 2011 was

According to the preliminary numbers compiled by Mercom Capital Group, Venture Capital (VC) funding in the solar sector so far this year has surpassed 2010

Smart Grid venture capital (VC) funding in Q3 2011 came in at $97 million in 10 deals, compared to $104 million in 15 deals in

Venture capital (VC) funding in the solar sector was steady this quarter, coming in at $372 million, compared to $354 million in Q2 2011. Forty-two