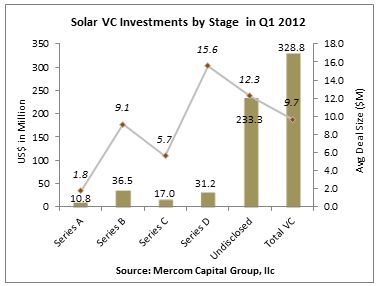

Venture Capital (VC) funding in the solar sector was off to a slow start in Q1 2012. VC funding for the quarter came to $329 million in 34 deals, the lowest dollar amount recorded since Q4 2010; however, VC investors were still very active in the sector with a record 34 deals funded, the highest ever recorded in the solar industry.

“While VC’s interest in the solar sector remains strong, their appetite for risk appears to be lower as the average VC funding round amount in Q1 was $10 million, compared to $18 million in 2011,” said Raj Prabhu, Managing Partner at Mercom Capital Group

“To add to the current over capacity problems, policy changes and lower tariff announcements in some of the largest solar markets, such as Germany and Italy, will all contribute to an uncertain 2012,” Prabhu continued. “We can expect a more cautious approach to investing in the solar sector this year.”

There was strong M&A activity in the solar sector totaling $5 billion in 14 transactions, however only three of these transactions disclosed details. The spike in M&A amounts was mainly due to the $4.7 billion acquisition of Solutia, a performance and specialty chemicals company with products in PV encapsulants, performance films for PV and CSP products and heat transfer fluids for CSP plants, by Eastman Chemicals Company. Another significant M&A transaction was the $275 million acquisition of Oerlikon Solar, a producer of equipment and turnkey manufacturing lines for thin film amorphous silicon and tandem junction technology, by Tokyo Electron.

The first quarter of 2012 also saw 11 new cleantech and solar-focused investment funds announced committing $5.7 billion. A significant positive event for the solar sector in Q1 was the Initial Public Offering (IPO) of the microinverter company Enphase Energy, which raised $62 million as part of its offering.

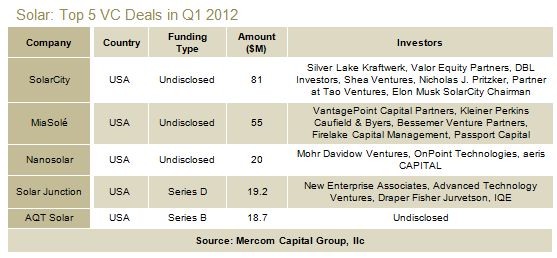

The top five funding deals made up about 60 percent of the total funding in this quarter, led by $81 million by SolarCity, a pioneer in the solar lease model. Three of the five top companies to receive funding also included MiaSolé, Nanosolar and AQT Solar, all CIGS companies, raising $94 million in total. Maintaining last year’s trend, with half a billion dollars raised in 2011, CIGS companies continued to receive the most amount of VC funding as a technology group.

There were 56 different VC investors that participated in the 34 deals. Venture capital firms that recorded multiple rounds included Black Coral Capital and Firelake Capital Management. The United States continued to be the dominant country for VC investments, accounting for about 80 percent of all VC funding in the first quarter.

To get a copy of this report, please email us at info@mercomcapital.com.