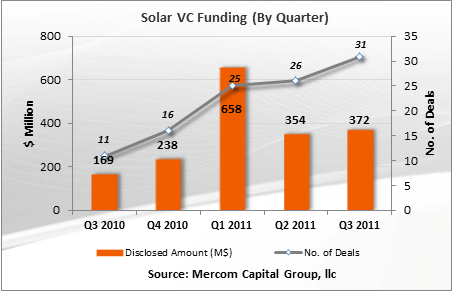

Venture capital (VC) funding in the solar sector was steady this quarter, coming in at $372 million, compared to $354 million in Q2 2011. Forty-two different VC investors participated in 29 disclosed deals.

“VC funding so far this year is on pace with 2010 and M&A activity is picking up,” commented Raj Prabhu, Managing Partner at Mercom Capital Group. “The number of M&A transactions in 2011 has already surpassed 2010 numbers, signaling that the move towards industry consolidation may have begun.”

The top five funding deals included a $85 million raise by HelioVolt, a manufacturer of thin-film Copper Indium Gallium Selenide (“CIGS”) modules; OneRoof Energy, a developer, owner and operator of solar energy generation systems for residential markets raised $50 million in Series A; Calisolar, a vertically integrated solar manufacturer, raised $26 million; Clean Power Finance, a provider of integrated services and financing solutions for the solar industry raised $25 million and Solexant, a producer of ultra thin film solar cells, raised $23.5 million in a Series D round.

Solar downstream companies attracted the most funding this quarter closely followed by thin-film companies, with $130 million of 11 deals and $125 million in five deals respectively.

M&A activity came in at $563 million in 20 transactions with details disclosed for only eight. This is the highest number of transactions in a quarter since 2010. The most prominent transactions included the acquisitions of Solar Silicon Valley by JA Solar for $180 million and Fotowatio Renewable Ventures by MEMC for $131 million.

Debt funding in Q3 2011 amounted to $452 million in five announced deals. The top three involved Chinese companies include China Sunergy, Daqo New Energy and Hanwha SolarOne.

To get a copy of this report, please email us at info@mercomcapital.com.