Health information management companies received most of the disclosed VC funding in 2011, totaling $336 million in 30 deals. Personal health record companies raised $83.3 million in 12 deals. The top VC funding deal in 2011 was $75 million, in a Series C round, raised by online doctor appointment startup ZocDoc. Other top VC funding deals were $27 million raised by Awarepoint, a provider of real-time location systems, $27 million raised by ABILITY network, a web-based healthcare network, followed by $23 million raised by Humedica, a clinical informatics company and $23 million raised by Practice Fusion, a web-based EMR company (Practice Fusion also raised another $6 million in additional funding in 2011).

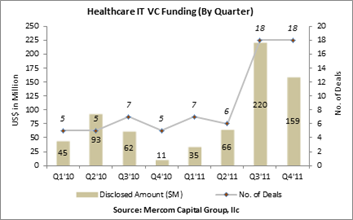

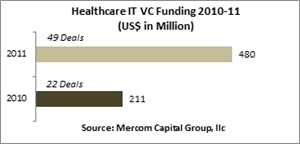

“2011 was a great year for Healthcare IT companies in terms of financial activity. Almost half a billion dollars came into the sector through venture capital investment compared to $211 million in 2010,” said Raj Prabhu, managing partner of Mercom Capital Group. “Several factors, including strategic acquisitions, consolidation and increasing market share, played a role in the increased M&A activity in the sector.”

Top VC investors in 2011 were HLM Venture Partners with four deals, followed by Cardinal Partners, Chrysalis Ventures, Founders Fund, Innovation Endeavors and Klein Perkins Caulfield & Byers, with three deals each. There were a total of 104 VC investors in 2011, compared to 62 in 2010.

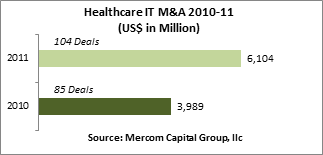

Merger and acquisition (M&A) activity was robust in 2011 with 104 recorded transactions totaling $6 billion, compared to $4 billion in 85 transactions in 2010.

Health information management (HIM) companies accounted for most of the M&A transactions with 61 transactions, followed by 19 transactions for revenue cycle management (RCM) companies and 16 transactions for service providers. In terms of dollars, RCM companies accounted for $3.9 billion, followed by HIM companies with $1.9 billion.

The top M&A transaction in 2011 was the acquisition of Emdeon, a provider of revenue and payment cycle management and clinical information exchange solutions, by Blackstone Capital Partners for $3 billion.

Other top M&A transactions were the $960 million acquisition of Vangent, a provider of health information technology and business systems to federal agencies, by General Dynamics, the $400 million acquisition of HealthDataInsights, a healthcare services company that specializes in the identification and recoupment of claim overpayments, by HMS Holdings, followed by the $320 million acquisition of Sage Healthcare, a supplier of business management software solutions by Vista Equity Partners, and the $273 million acquisition of Vital Images, a provider of advanced visualization and analysis software for physicians, by Toshiba Medical Systems.

To get a copy of this report, please email us at info@mercomcapital.com