Swift Current Energy, a company that develops, commercializes, owns, and operates utility-scale solar, wind, and energy storage projects, has secured tax equity financing and $248

Swift Current Energy, a company that develops, commercializes, owns, and operates utility-scale solar, wind, and energy storage projects, has secured tax equity financing and $248

ENCAVIS, a solar and wind project developer, has announced the closure of a non-recourse project financing of €135 million (~$157.10 million) for the acquisition of

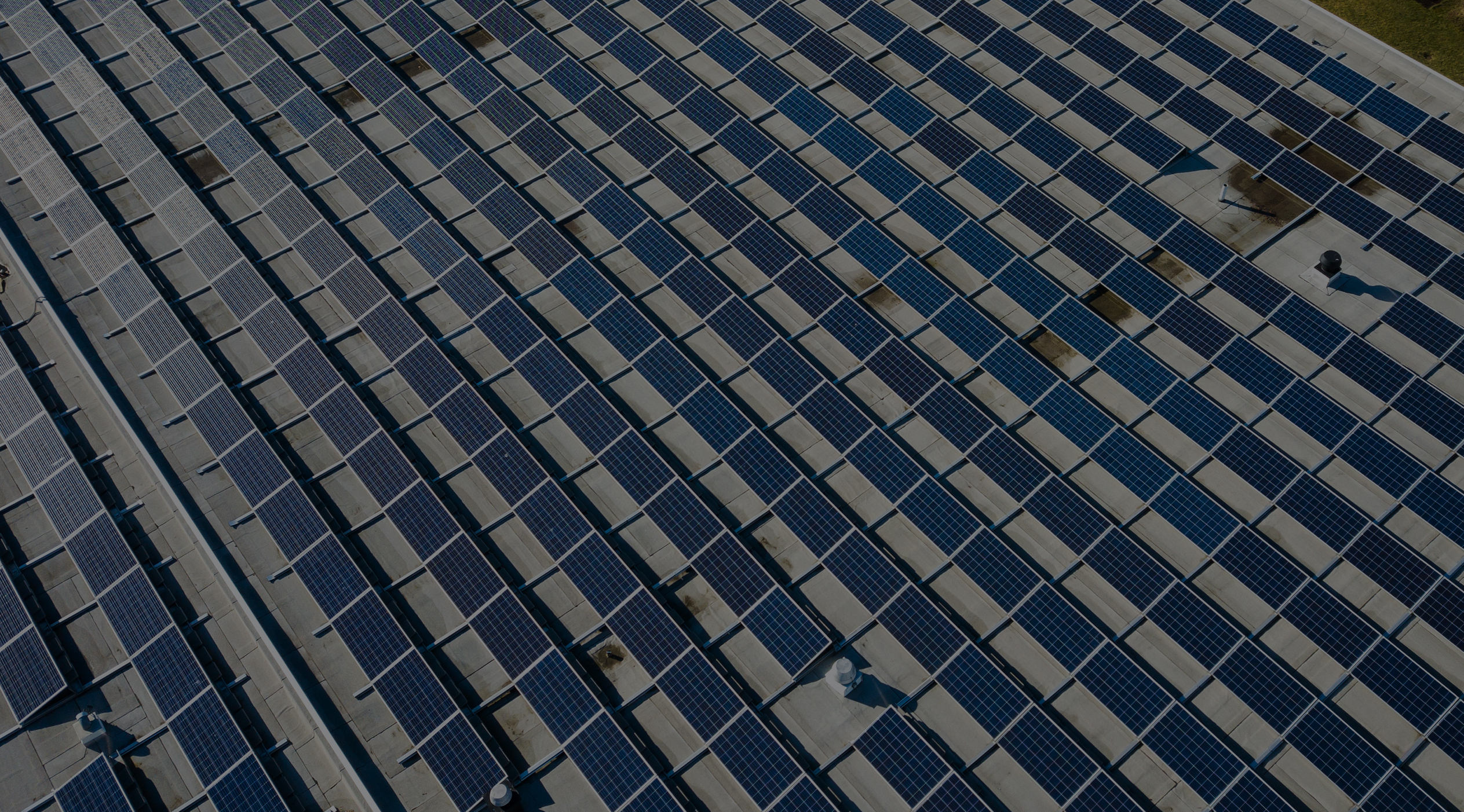

Swift Current Energy, a company that develops, commercializes, owns, and operates utility-scale solar, wind, and energy storage projects, announced the sale of the 150 MW/600

Enfinity Global, a renewable energy project developer, raised €316 million (~$368 million) in financing to support the construction of eight utility-scale solar projects with a

Swift Current Energy, a utility-scale solar, wind, and energy storage project developer, raised $242 million in project financing for its 150 MW/600 MWh Prospect Power

Capital Dynamics, an independent global private asset management firm, secured €185 million (~$199.54 million) in project financing for two solar projects—currently under construction—with a total

Swift Current Energy, a utility-scale solar, wind, and energy storage project developer, announced the closing of tax equity financing with PNC Bank for its 138 MWdc

Swift Current Energy, a utility-scale solar, wind, and energy storage project developer, secured tax equity investment from Google to develop an 800 MWdc (593 MWac)

Swift Current Energy, a utility-scale solar, wind, and energy storage project developer, secured tax equity investment from Google to develop an 800 MWdc (593 MWac)

SUSI Partners, a Swiss-based fund manager, and SMT Energy, an energy storage project developer, have secured a tax equity investment from specialized tax equity investor