Bardavon Health Innovations, a digital workers’ compensation and musculoskeletal (MSK) healthcare practice management platform for therapy providers, raised a Series C funding of $90 million

Bardavon Health Innovations, a digital workers’ compensation and musculoskeletal (MSK) healthcare practice management platform for therapy providers, raised a Series C funding of $90 million

Citadel Group, a software and services firm, acquired Genie Solutions, a medical practice management software provider. This acquisition news comes as the company has held

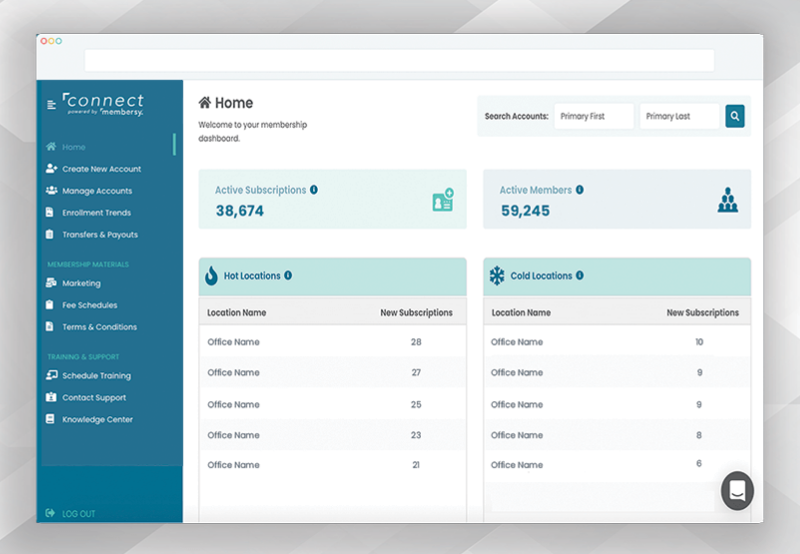

Membersy, a subscription-based dentistry management platform provider, has raised $66 million from Spectrum Equity, a growth equity firm focused on internet-enabled software and information services

Healthcare workflow management software developer symplr has agreed to acquire Halo Health, a clinical communication and collaboration software provider that streamlines clinical processes and interactions.

Appriss Health, a cloud-based care coordination software and analytics solutions focused on behavioral health and substance use disorders, has entered into a definitive agreement to

A total of 184 digital health companies were acquired in 2020, compared to 169 in 2019, a 9% increase in M&A activity in year-over-year, according

Mergers and acquisitions (M&A) continue to be a popular exit strategy for digital health companies. However, M&A activity in the digital health sector has remained

Global venture capital (VC) funding, including private equity and corporate VC into Digital Health companies in Q1 2020, came to a record $3.6 billion in

Bridge Connector, a provider of end-to-end data-driven healthcare workflow integration-platform-as-a-service, raised an additional $5 million, bringing its total VC funding to $25 million. The funding

Venture capital (VC) funding in the Health IT sector, including private equity and corporate venture capital, totaled $1.3 billion in 177 deals in Q3 2016