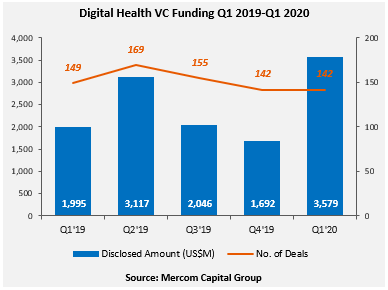

Global venture capital (VC) funding, including private equity and corporate VC into Digital Health companies in Q1 2020, came to a record $3.6 billion in 142 deals compared to $1.7 billion in 142 deals in Q4 2019. VC funding in Q1 2020 increased by 79% compared to the same quarter of last year (Q1 2019) when $2 billion was raised in 149 deals. This was the single largest funding quarter ever for Digital Health.

To learn more about the report and download a free executive summary, visit: https://mercomcapital.com/product/q1-2020-digital-health-healthcare-it-funding-ma-report

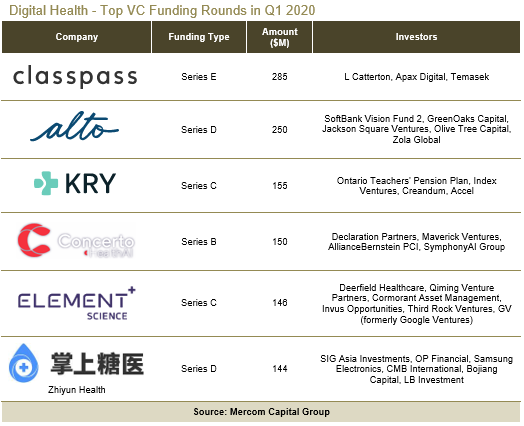

Several large VC deals spurred record funding. Of the $3.6 billion raised during the quarter, the top 10 deals (ClassPass, Alto Pharmacy, KRY, Concerto HealthAI, Element Science, Zhiyun Health, Tempus, Verana Health, Virta Health, and Hinge Health) accounted for about 42% of the total, bringing in $1.5 billion from some well-known investors, including GV (formerly Google Ventures), New Enterprise Associates (NEA), SoftBank Vision Fund 2, Bain Capital Ventures, and Bessemer Venture Partners.

Digital Health companies have brought in over $47 billion in VC funding in 4,905 deals since 2010.

“There was no evidence of coronavirus affecting digital health funding in Q1. Going forward, we anticipate investors to become more selective in this environment. The era of “I don’t want to miss out” investments may be over. That may not be a bad thing,” said Raj Prabhu, CEO of Mercom Capital Group.

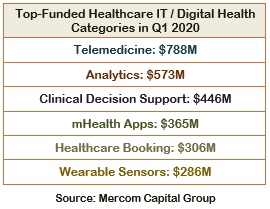

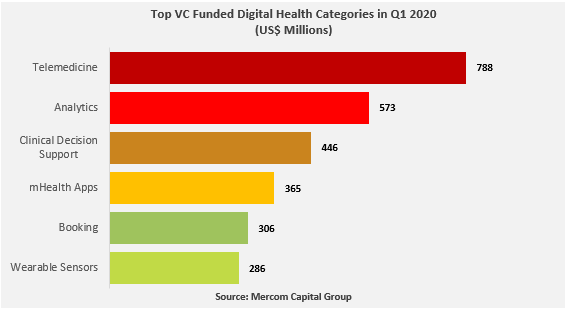

The top-funded categories in Q1 2020 were: Telemedicine with $788 million, followed by Data Analytics with $573 million, Clinical Decision Support with $446 million, mHealth Apps with $365 million, Healthcare Booking with $306 million, and Wearable Sensors with $286 million.

There were 36 early-round deals in Q1 2020 compared to 45 in Q4 2019. Most of the VC funding in early rounds in Q1 2020 went to Telehealth companies.

The top VC deals in Q1 2020 included: $285 million raised by Classpass, $250 million from Alto Pharmacy, $155 million raised by KRY, $150 million by Concerto HealthAI, $146 million raised by Element Science, and $144 million by Zhiyun Health.

A total of 433 investors participated in funding deals in Q1 2020 compared to 371 investors in Q1 2019.

There were 14 FDA approvals issued to Digital Health companies in Q1 2020.

VC investors that participated in more than three funding rounds in Q1 2020 were: Oak HC/FT, Venrock, Cigna Ventures, and UnityPoint Health Ventures.

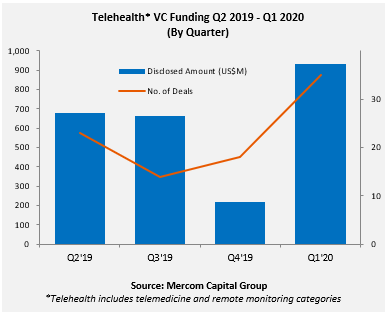

Telehealth category, including telemedicine and remote monitoring, received a total of $930 million from 35 deals.

Digital Health VC funding deals were distributed across 19 countries in Q1 2020. Almost 78% of Digital Health funding went to U.S. companies in Q1 2020, with $2.8 billion in 94 deals compared to $1.1 billion in 105 deals in Q1 2019.

“The healthcare industry is really leaning on digital health technologies, particularly telehealth solution to tackle the Coronavirus pandemic. We anticipate funding trends to shift among digital health technologies, and we also see investors lose interest in certain products and solutions which would have been funded in a pre-COVID world,” said Raj Prabhu, CEO of Mercom Capital Group.

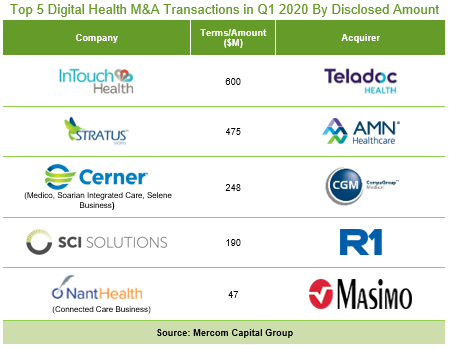

In Q1 2020, there were 41 M&A transactions involving Digital Health companies, six of which disclosed transaction amounts. By comparison, there were 44 M&A transactions in Q4 2019, 11 of which disclosed transaction amounts. In a YoY comparison, there were 45 M&A transactions (seven disclosed) in Q1 2019.

Practice Management Solutions companies led M&A activity with seven transactions followed by Data Analytics with four and Clinical Decision Support with three transactions.

The top disclosed M&A transactions included the $600 million acquisition of InTouch Health by Teladoc Health, followed by AMN Healthcare’s acquisition of Stratus Video for $475 million. CompuGroup Medical acquired Cerner’s Medico, Soarian Integrated Care, and Selene business for $248 million, R1 RCM acquired SCI Solutions for $190 million, and Masimo acquired NantHealth’s Connected Care business for $47 million.

A total of 657 companies and investors were covered in this report.

To learn more about the report and download a free executive summary, visit: https://mercomcapital.com/product/q1-2020-digital-health-healthcare-it-funding-ma-report