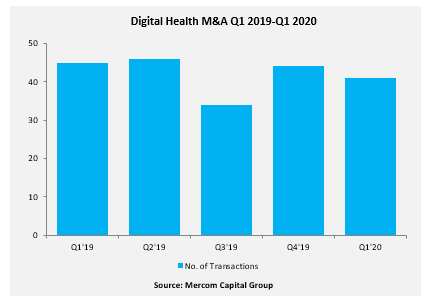

Mergers and acquisitions (M&A) continue to be a popular exit strategy for digital health companies. However, M&A activity in the digital health sector has remained almost flat in the past five quarters.

There were 41 M&A transactions in the digital health sector in Q1 2020, six of which disclosed transaction amounts for a total value of $1.6 billion, according to Mercom Q1 2020, Digital Health Funding & M&A Report. By comparison, there were 44 M&A transactions in Q4 2019, 11 of which disclosed transaction amounts for a total value of $3.8 billion. In a YoY comparison, there were 45 M&A transactions in Q1 2019, seven of which disclosed transaction amounts for a total value of $326 million.

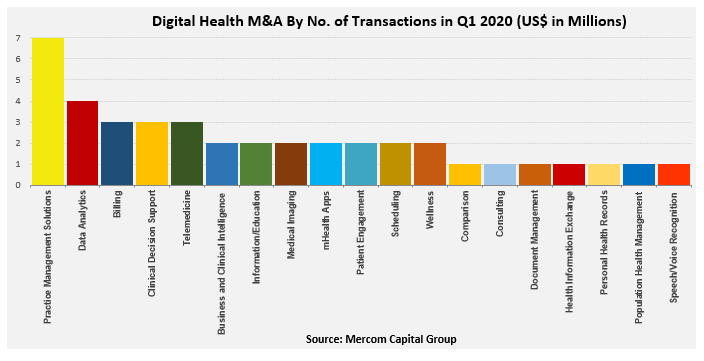

Practice management solutions providers led the M&A activity in Q1 2020, with seven transactions, followed by analytics companies with four. Telemedicine and clinical decision support had three each.

The M&A transactions were spread across four countries, i.e., Canada, Germany, the U.K., and the U.S. (the U.S. recorded the 35 of the total 41 transactions).

The M&A transactions were spread across four countries, i.e., Canada, Germany, the U.K., and the U.S. (the U.S. recorded the 35 of the total 41 transactions).

Top disclosed funding deals in Q1 2020 were the acquisition of telehealth company InTouch Health by Teladoc Health, for $600 million.

AMN Healthcare, healthcare talent and staffing services provider, acquired medical language interpretation and translation services Stratus Video for $475 million.

CompuGroup Medical, a German health care software company, acquired Cerner healthcare IT assets in Germany and Spain, for $248 million.

R1 RCM, a revenue cycle management services to healthcare providers, acquire SCI Solutions, a digital patient scheduling, and engagement platform, for $190 million.

Masimo, the maker of monitoring technologies and connectivity tools for hospitals, acquired the connected care assets of NantHealth for $47.25 million in cash.

The coronavirus pandemic has highlighted the importance of digital health, especially telehealth. We expect some consolidation activity as companies look to acquire critical technologies as well as gain market share.