Venture capital (VC) funding (including private equity and corporate venture capital) for Smart Grid companies doubled with $222 million in 15 deals compared to $110

Venture capital (VC) funding (including private equity and corporate venture capital) for Smart Grid companies doubled with $222 million in 15 deals compared to $110

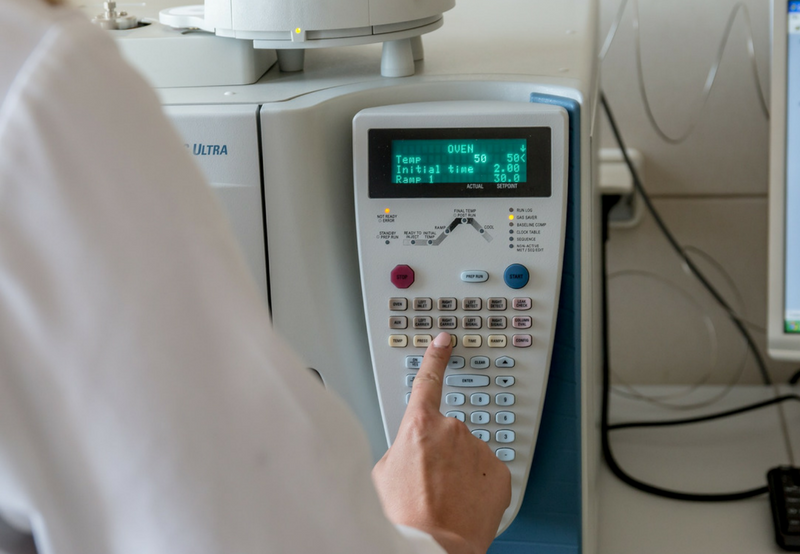

Venture capital (VC) funding in the Health IT sector, including private equity and corporate venture capital, came in at $1.6 billion in 140 deals in

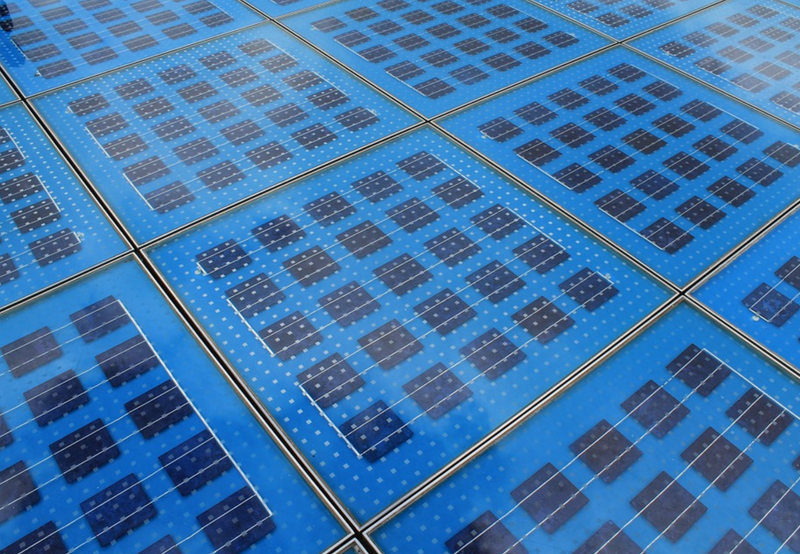

Total corporate funding, including venture capital funding, public market and debt financing into the solar sector in Q2 2016 fell to $1.7 billion this quarter, a

Venture capital (VC) funding (including private equity and corporate venture capital) for Smart Grid companies increased twofold this quarter with $110 million in 14 deals,

Venture capital (VC) funding, including private equity and corporate venture capital, in the Health IT sector increased 27 percent quarter over quarter (QoQ), coming in

Venture capital (VC) funding (including private equity and corporate venture capital) for Smart Grid companies increased slightly to $425 million in 57 deals, compared to

Total global corporate funding in the solar sector, including venture capital/private equity (VC), debt financing, and public market financing, raised by public companies came to

Venture capital (VC) funding (including private equity and corporate venture capital) for Smart Grid companies came to $81 million in 12 deals in Q3 2015,

Venture capital (VC) funding, including private equity and corporate venture capital, in the Health IT sector increased 32 percent quarter over quarter (QoQ), coming in

Venture capital (VC) funding (including private equity) for Smart Grid companies was down with $104 million in 18 deals in Q2 2015, compared to $185