Total corporate funding (including venture capital funding, public market, and debt financing) for Battery Storage, Smart Grid, and Efficiency companies in 1H 2020 was down 38% year-over-year (YoY) with $1.5 billion compared to $2.4 billion raised in 1H 2019.

To get a copy of the report, visit: https://mercomcapital.com/product/1h-q2-2020-funding-ma-report-storage-grid-efficiency

Global VC funding (venture capital, private equity, and corporate venture capital) for Battery Storage, Smart Grid, and Efficiency companies in 1H 2020 was 51% lower with $858 million compared to over $1.8 billion in 1H 2019.

In Q2 2020, VC funding for Battery Storage, Smart Grid, and Efficiency companies increased with $605 million in 26 deals compared to $252 million in 16 deals in Q1 2020. Funding amounts were 61% lower YoY compared to the $1.5 billion raised in 21 deals in Q2 2019. The decrease in funding activity was primarily due to a billion-dollar deal in the Battery Storage sector in Q2 2019.

Battery Storage

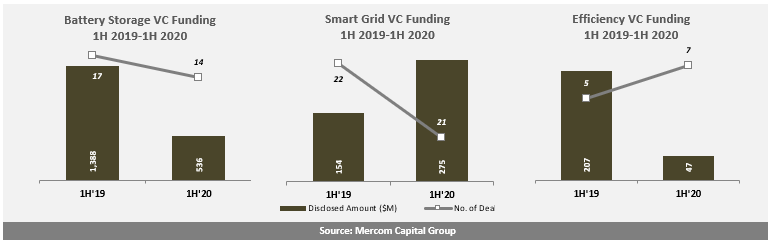

VC funding in Battery Storage companies in 1H 2020 was down by 61%, with $536 million in 14 deals compared to $1.4 billion in 17 deals in 1H 2019. The decrease was due to Northvolt’s $1 billion funding round in Q2 2019.

The Top 5 VC funding deals in 1H 2020 were the following: QuantumScape raised $200 million, ProLogium Technology raised $100 million, Demand Power Group secured $71 million, Highview Power secured $46 million, and Nanotech Energy raised $28 million. A total of 26 VC investors participated in Battery Storage funding in 1H 2020.

Announced debt and public market financing activity in the first half of 2020 ($180 million in five deals) was 67% lower compared to the first half of 2019 when $547 million was raised in five deals.

There were five announced Battery Storage project funding deals in 1H 2020, bringing in a combined $26 million compared to $499 million in four deals in 1H 2019.

In 1H 2020 there were a total of eight (all undisclosed) Battery Storage M&A transactions compared to six transactions (one disclosed) in 1H 2019.

Smart Grid

VC funding in Smart Grid companies in 1H 2020 was 79% higher with $275 million compared to the $154 million raised in 1H 2019.

In Q2 2020, VC funding for Smart Grid companies more than doubled with $194 million in 14 deals compared to $81 million in seven deals in Q1 2020. Funding amounts were 59% higher YoY compared to $122 million raised in seven deals in Q2 2019.

The Top 5 VC funding deals in 1H 2020 were: SmartRent raised $60 million, SmartWires raised $43 million, FreeWire Technologies received $25 million, Urbint raised $20 million, and Urjanet raised $15 million.

Announced debt and public market financing for Smart Grid companies came to $10 million in three deals in 1H 2020 compared to $1 million in one deal in 1H 2019.

In 1H 2020, there were a total of six Smart Grid M&A transactions (all undisclosed) compared to 18 transactions (one disclosed) in 1H 2019.

Efficiency

VC funding for Energy Efficiency companies in 1H 2020 was 77% lower with $47 million compared to the $207 million raised in 1H 2019.

In Q2 2020, VC funding for Efficiency companies increased with $40 million in four deals compared to $7 million in three deals in Q1 2020. Funding amounts were 63% lower YoY compared to $107 million raised in four deals in Q2 2019.

The Top 5 VC funding deals in 1H 2020 were as follows: Juganu raised $18 million, BrainBox AI raised $12 million, SmartAC.com secured $10 million, Rebound Technologies received $5 million, and HyperBorean received $2 million.

Announced debt and public market financing activity in the first half of 2020 ($500 million in one deal) was 793% higher compared to 1H 2019 when $56 million was raised in two deals.

In 1H 2020 there was one disclosed Efficiency M&A transaction compared to eight transactions (two disclosed) in 1H 2019.

To get a copy of the report, visit: https://mercomcapital.com/product/1h-q2-2020-funding-ma-report-storage-grid-efficiency