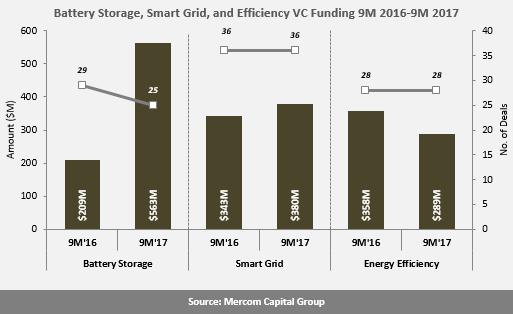

Mercom found that, in the first nine months (9M) of 2017, $1.23 billion was raised by Battery Storage, Smart Grid, and Efficiency companies, up from $910 million raised in 9M 2016.

To get a copy of the report, visit: https://mercomcapital.com/product/q3-2017-battery-storage-smart-grid-efficiency-funding-ma-report/

Battery Storage

In Q3 2017, VC funding for Battery Storage companies dropped to $83 million in seven deals compared to $422 million raised in 10 deals during Q2 2017. A year earlier, $30 million was raised in nine deals in Q3 2016. In 9M 2017, $563 million was raised in 25 deals compared to $209 million raised in 29 deals in 9M 2016.

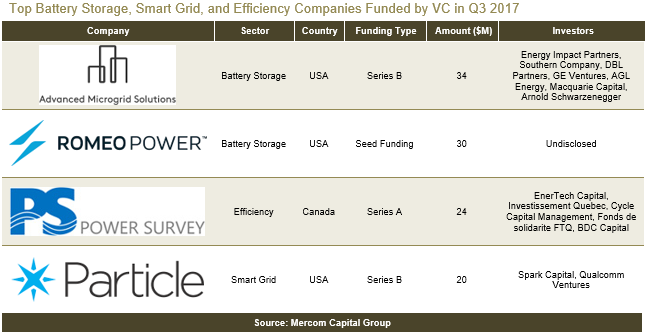

The top VC funded Battery Storage companies in Q3 2017 were: Advanced Microgrid Solutions, which raised $34 million from Energy Impact Partners, Southern Company, DBL Partners, GE Ventures, AGL Energy, Macquarie Capital, and former California Governor Arnold Schwarzenegger; Romeo Power, which raised $30 million; and Gridtential Energy, which secured $11 million from 1955 Capital, East Penn Manufacturing, Crown Battery Manufacturing, Leoch International, Power-Sonic, The Roda Group, and the company’s chairman, Ray Kubis.

In all, 16 investors participated in Battery Storage funding in Q3 2017 with Energy Storage Downstream companies raising the most.

The third quarter saw two debt and public market financing deals in Battery Storage totaling $45 million compared to $107 million raised in seven deals in Q2 2017. In 9M 2017, $174 million was raised in 11 deals compared to six deals that brought in $120 million in 9M 2016.

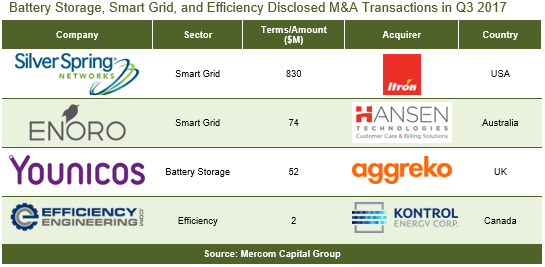

There was one M&A transaction involving a Battery Storage company in Q3 2017 compared to three M&A transactions in Q2 2017. In the first nine months of 2017, there were five transactions (two disclosed), down from nine transactions (two disclosed) in 9M 2016. Two Storage projects were also acquired in Q3 2017.

Smart Grid

VC funding for Smart Grid companies in Q3 2017 totaled $76 million in 14 deals, compared to $139 million raised in eight deals in Q2 2017. In a year-over-year (YoY) comparison, $11 million was raised in seven deals in Q3 2016. In 9M 2017, $380 million was raised in 36 deals compared to $343 million raised in the same number of deals in 9M 2016.

Top VC funded Smart Grid companies included: Particle, which secured $20 million from Spark Capital, Qualcomm Ventures, and previous investors; INTEREL, which raised $11.9 million in funding from Jolt Capital; Roost, which received $10.4 million in funding from Aviva Ventures, Desjardins Insurance, and Fosun RZ Capital; Tritium, which secured $8 million from entrepreneur Brian Flannery; and Innowatts, which raised $6 million from Shell Technology Ventures, Iberdrola Ventures – Perseo, and Energy & Environment Investment.

In all, 28 investors participated in Smart Grid VC funding rounds in Q3 2017, with SG Communications companies raising the most.

A total of $11 million was raised in one debt financing deal in Q3 2017 compared to the $9 million raised in one deal in Q2 2017. In 9M 2017, $20 million was raised in two deals compared to $217 million raised in four deals in 9M 2016.

There were six M&A transactions (two disclosed) in Q3 2017. In Q2 2017, there were six transactions (two disclosed). In 9M 2017, there were 19 transactions (five disclosed) compared to 13 transactions (four disclosed) in 9M 2016.

Efficiency

VC funding raised by Energy Efficiency companies in Q3 2017 came to $47 million in eight deals compared to $29 million raised in six deals in Q2 2017. In a YoY comparison, $61 million was raised in five deals in Q3 2016. In the first nine months of 2017, $289 million was raised by Energy Efficiency companies in 28 deals compared to $358 million raised in the same number of deals in 9M 2016.

The Top VC deals in the efficiency category included: Power Survey and Equipment, which received $24 million in funding from EnerTech Capital, Investissement Quebec, Cycle Capital Management, Fonds de solidarite FTQ, and BDC Capital; Corvi, which received a $10 million strategic investment from Hero Enterprise; and Deco Lighting, which secured $8 million in funding from Siena Funding.

In all, nine investors participated in VC funding in Q3 2017. Within the sector, Efficiency Components companies brought in the most funding.

Announced debt and public market financing for Energy Efficiency technologies plunged to $615 million in four deals in Q3 2017 compared to the $1.4 billion raised in six deals in Q2 2017. In 9M 2017, $2.3 billion was raised in 13 deals compared to the same amount raised in 11 deals in 9M 2016.

There was one Property Accessed Clean Energy (PACE) financing deal in Q3 2017 for $205 million versus three deals in Q2 2017 that raised $668 million. In 9M 2017, $873 million was raised in four deals compared to the $1.3 billion raised in six deals in 9M 2016.

There were two M&A transactions (one disclosed) involving Energy Efficiency companies in Q3 2017, up from just one undisclosed transaction in Q2 2017. For the first nine months of 2017, there were seven transactions (three disclosed), down from 12 transactions in 9M 2016 (four disclosed).

To get a copy of the report, visit: https://mercomcapital.com/product/q3-2017-battery-storage-smart-grid-efficiency-funding-ma-report/

Image credit: g2 Energy