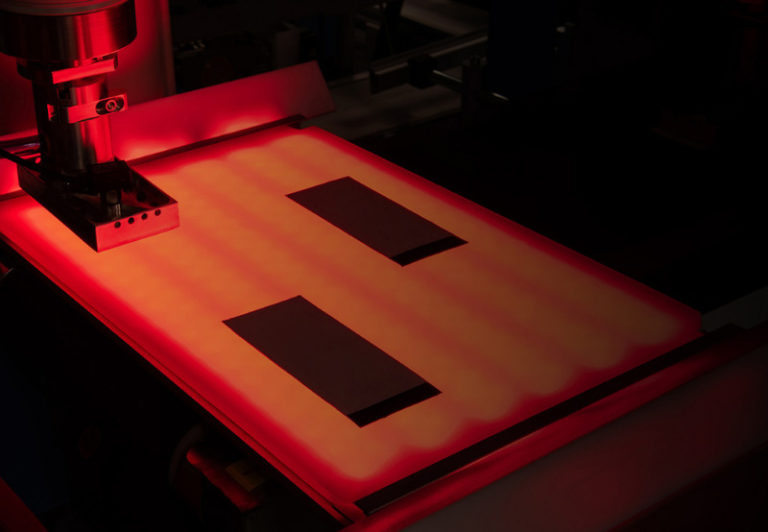

Solid Power, producer of all-solid-state batteries for electric vehicles, raised a $130 million Series B investment round led by the BMW Group, Ford Motor Company, and Volta Energy Technologies. Ford and the BMW Group have also expanded existing joint development agreements with Solid Power to secure all-solid-state batteries for future electric vehicles. Solid Power is currently producing 20-ampere hour (Ah) multi-layer all-solid-state batteries on the company’s continuous roll-to-roll production line, which exclusively utilizes industry-standard lithium-ion production processes and equipment.

Foresight Solar Fund Limited, a closed-ended investment company, acquired a 50% equity stake in Sandridge Battery Storage Limited (SBSL). SBSL holds the development rights to construct the Sandridge battery storage project, a 50 MW lithium-ion battery energy storage system based in Melksham, UK, adjacent to the Sandridge Solar Park, which the company already owns. It will represent a total investment of up to £12.7 million (~$17.6 million) (including construction costs) and will be funded using the company’s existing revolving credit facilities. The investment has been made alongside JLEN Environmental Assets Group, which will also acquire a 50% equity stake.

Equinor, an international energy company, has completed an agreement to buy 100% of the shares in Polish onshore renewables developer Wento from the private equity firm Enterprise Investors for €91 million (~$109 million) in enterprise value, before customary net cash adjustments. Wento’s business plan includes a total net pipeline of around 1.6 GW of solar projects in different stages of development.

EleXsys Energy has completed a £3.65 million (~$5 million) fundraise to support the global expansion of its solar and storage microgrid platform. The Series A capital raise saw investment from the predominantly U.K. and Australian resident investors, with EleXsys Energy itself being incorporated in the U.K. Its tech platform enables grid-connected commercial and industrial solar and battery microgrids, with the raise to allow it to continue its investment as it looks to grow rapidly globally.

Ncondezi Energy announced the completion of the previously announced $500,000 bridge loan between its wholly-owned renewables subsidiary, Ncondezi Green Power, and certain company directors to finance its commercial and industrial 400 kWp solar PV plus 912 kWh battery storage project located in Mozambique.

EnCap Investments, provider of growth capital, announced it has successfully closed EnCap Energy Transition Fund I, with commitments of approximately $1.2 billion. The fund was created to invest in companies that advance the nation’s transition to a lower-carbon future with a focus on creating wind, solar, and energy storage enterprises.

For reports and trackers on funding and M&A transactions in solar, energy storage, smart grid, and efficiency sectors, click here.

Read last week’s funding roundup.

Image credit: Solid Power