Total corporate funding into the solar sector encompassing venture capital/private equity (VC), debt and public market financing increased 175 percent in 2014 with $26.5 billion, compared to $9.6 billion in 2013.

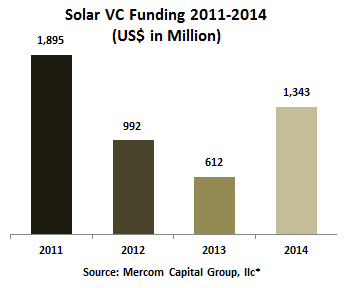

Global VC investments more than doubled to $1.3 billion in 85 deals in 2014, compared to $612 million in 98 deals in 2013.

To get a copy of this report, please email us at info@mercomcapital.com.

“The big story coming out of 2014 was the revival of capital markets – solar companies were able to access funding through multiple avenues like VC, public markets, IPOs and debt in record numbers, while the quest for lower cost of capital continued with Yieldcos and securitization deals. The solar sector has come a long way from being perceived as a speculative high risk investment to attracting investors based on low risk attractive dividend yields,” said Raj Prabhu, CEO of Mercom Capital Group.

Solar downstream companies saw the largest amount of VC funding in 2014 with $1.1 billion in 44 deals, accounting for 85 percent of venture funding. Investments in PV technology companies reached $75 million in 12 deals and Balance of Systems (BoS) companies were close behind with $73 million in seven deals. Concentrated Solar Power (CSP) companies came in at $59 million in three deals, followed by thin film companies with $52 million in nine deals.

The Top 5 VC funded companies in 2014 were Sunnova Energy, a provider of residential solar service to homeowners through its network of local installation partners offering leases and PPAs, which raised a total of $505 million in three separate deals; followed by Sunrun, a provider of residential solar-power systems and third party finance, raising $150 million; Renewable Energy Trust Capital, a finance platform established to acquire and own solar projects and provide a single equity capital source, brought in $125 million; Sungevity, a provider of residential solar installations and third party finance, raised $72.5 million; and GlassPoint Solar, a provider of solar steam generators to the oil and gas industry for applications such as Enhanced Oil Recovery (EOR), raised $53 million.

A total of 119 VC investors were active in 2014, with 12 investors participating in more than one round in 2014 including: Acero Capital, Acumen Fund, DBL Investors, E.ON, Ecosystem Integrity Fund, Novus Energy Partners, Omidyar Network, SolarCity, Sustainable Development Technology Canada, Trident Capital, Vision Ridge Partners, and Vulcan Capital.

Public market financing increased considerably to $5.2 billion in 52 deals in 2014, up from just $2.8 billion in 39 deals in 2013. In 2014 seven IPOs brought in more than $2 billion combined including, Vivint Solar, Scatec Solar, Thai Solar Energy and Sky Solar. Yieldcos accounted for three of the IPOs for $1.5 billion going to Abengoa Yield, Terraform Power and NextEnergy Solar Fund.

Announced debt financing in 2014 totaled almost $20 billion in 58 deals, compared to $6.2 billion in 38 deals in 2013. China accounted for $15.8 billion of the debt activity.

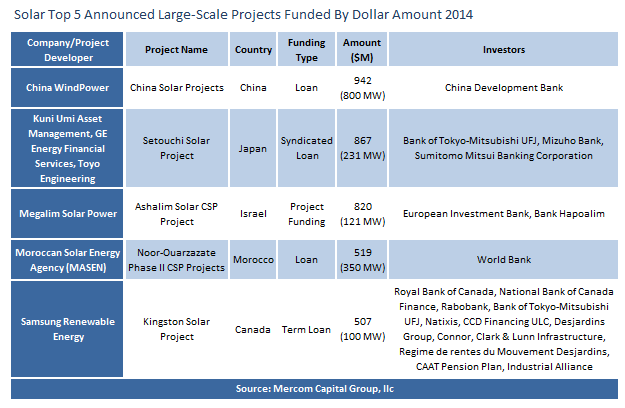

Large-scale project funding announced in 2014 totaled $14.2 billion in 144 deals. The largest project funding deal announced in 2014 was the $942 million loan raised by China WindPower Group for a portfolio of projects totaling 800 MW. Top investors in large-scale projects were Mizuho Bank with 12 projects and Bank of Tokyo-Mitsubishi UFJ with 10 projects.

Residential and commercial funds showed strong growth in 2014 with 34 announced funds totaling $4 billion. SolarCity, SunPower, Vivint Solar, SunEdison and Syncarpha Capital were top fundraisers in 2014.

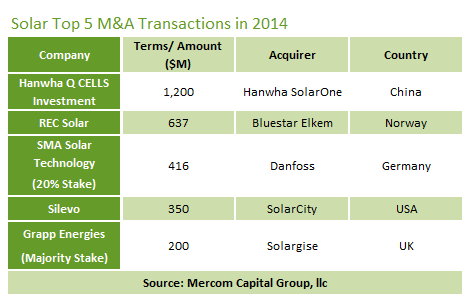

Corporate M&A activity in solar totaled $4 billion in a record 116 transactions compared to $12.7 billion in 81 transactions in 2013. Consolidation activity continued among solar downstream companies with 57 transactions followed by manufacturers and equipment companies with 35 transactions. In a bid to vertically integrate, SolarCity has made the most acquisitions in the last five years with seven, followed by First Solar and SunPower with six apiece. The largest M&A transaction in 2014 was the $1.2 billion acquisition of Hanwha Q CELLS Investment by Hanwha SolarOne, followed by Bluestar Elkem’s acquisition of REC Solar for approximately $637 million. Danfoss acquired a 20 percent stake in SMA Solar Technology for $416 million; SolarCity acquired Silevo for $350 million and Solargise acquired a majority stake in Grapp Energies for $200 million.

Large-scale solar project acquisitions totaled $3.2 billion in 2014, compared to $1.7 billion in 2013. Transaction activity was up 46 percent year-over-year, with 163 deals in 2014. A total of 6.4 GW of large-scale solar projects were acquired in 2014. Good solar projects with solid returns continue to be in heavy demand and are being acquired at a record pace. Competition to acquire quality projects intensified with the emergence of Yieldcos.

The fourth quarter of 2014 was active for large-scale project development around the globe. Mercom tracked 241 project announcements totaling almost 9.5 GW for the quarter and 736 project announcements totaling 34.4 GW for 2014 in various stages of development globally.

Image credit: My Generation Energy