Total corporate funding (including venture capital funding, public market, and debt financing) for Energy Storage, Smart Grid, and Efficiency companies in 1H 2022 was up significantly year-over-year (YoY) with $17 billion compared to $10.4 billion raised in 1H 2021.

To get a copy of the report, visit: https://mercomcapital.com/product/1h-q2-2022-funding-ma-report-for-storage-grid-efficiency

Global VC funding (venture capital, private equity, and corporate venture capital) for Energy Storage, Smart Grid, and Efficiency companies come in 20% lower in 1H 2022 with $3.9 billion compared to $4.9 billion in 1H 2021. One large deal in Q2 2021 contributed to the difference.

In Q2 2022, VC funding for Energy Storage, Smart Grid, and Efficiency companies increased to $2.4 billion in 34 deals compared to $1.6 billion in 37 deals in Q1 2022. Funding amounts were 34% lower YoY compared to the $3.6 billion raised in 28 deals in Q2 2021.

Energy Storage

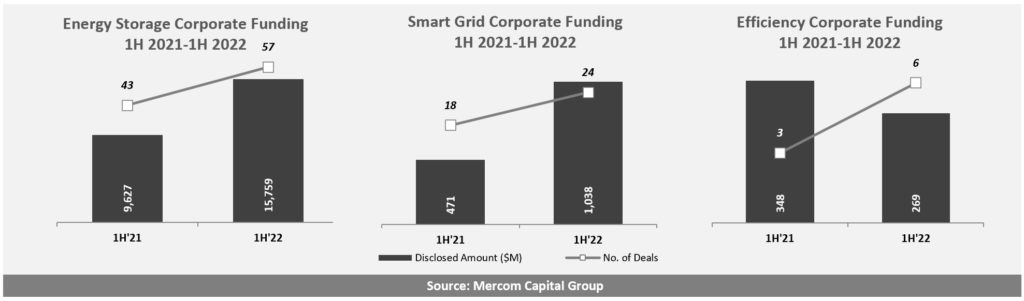

In 1H 2022, $15.8 billion was raised in corporate funding from 57 deals, 64% higher compared to $9.6 billion raised in 43 deals in 1H 2021.

Corporate funding in energy storage is on pace to be the highest ever in 2022. A higher share of financing activity in energy storage has steadily shifted from VC funding to public and debt funding as a significant number of companies have gone public over the past two years.

VC funding in Energy Storage in 1H 2022 was down significantly with $2.9 billion in 45 deals compared to $4.4 billion in 34 deals in 1H 2021. One large funding deal in Q2 2021 contributed to the difference.

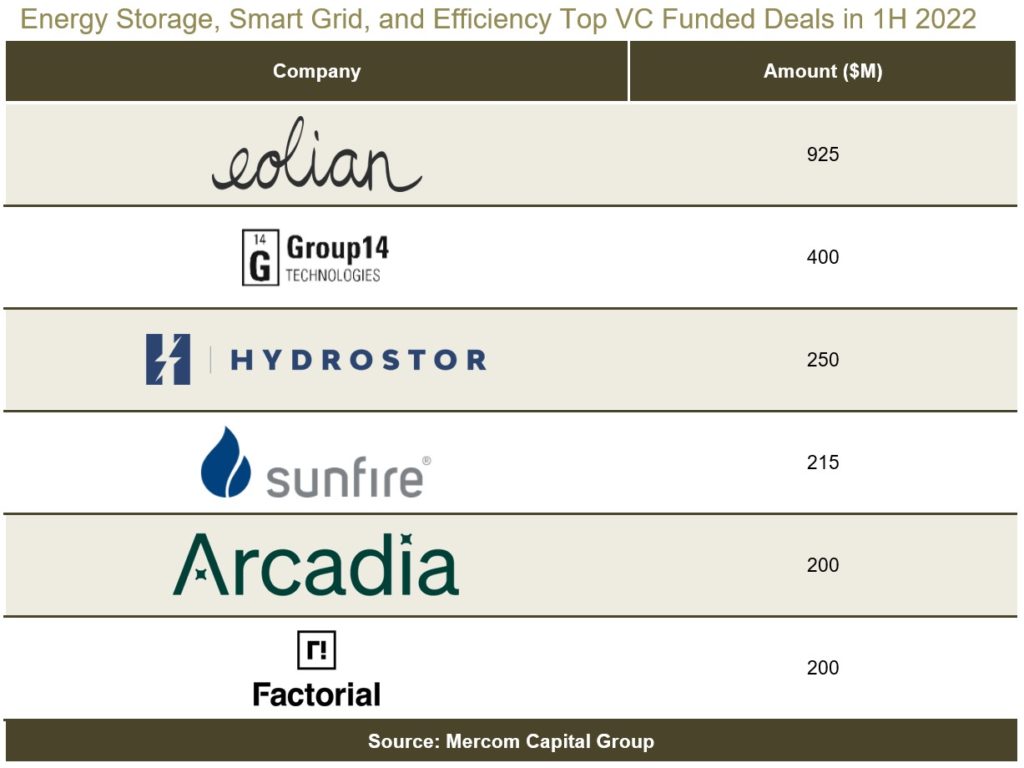

The Top 5 VC funding deals in 1H 2022 were: Eolian, which raised $925 million, Group 14 Technologies with $400 million, Hydrostor with $250 million, Sunfire with $215 million, and Factorial Energy, which raised $200 million. A total of 165 VC investors participated in Energy Storage funding in 1H 2022.

Announced debt and public market financing activity in the first half of 2022 ($12.8 billion in 12 deals) spiked compared to the first half of 2021 when $5.2 billion was raised in nine deals.

There were 16 announced Energy Storage project funding deals in 1H 2022, bringing in a combined $3.8 billion compared to $1.2 billion in six deals in 1H 2021.

In 1H 2022, there were a total of 13 (six disclosed) Energy Storage M&A transactions compared to nine transactions (two undisclosed) in 1H 2021.

Smart Grid

VC funding in Smart Grid companies in 1H 2022 was 58% higher with $731 million compared to the $463 million raised in 1H 2021.

In Q2 2022, VC funding for Smart Grid companies increased to $419 million in eight deals compared to $312 million in 12 deals in Q1 2022. Funding amounts were 138% higher YoY compared to $176 million raised in seven deals in Q2 2021.

The Top 5 VC funding deals in 1H 2022 were: Arcadia with $200 million, Freewire Technologies with $125 million, Tibber with $100 million, Span with $90 million, and GridX with $40 million.

Announced debt and public market financing for Smart Grid companies came to $307 million in four deals in 1H 2022 compared to $8 million in one deal in 1H 2021.

In 1H 2022, there were a total of 10 Smart Grid M&A transactions (two disclosed) compared to 11 transactions (all undisclosed) in 1H 2021.

Efficiency

VC funding for Energy Efficiency companies in 1H 2022 was $269 million compared to the $5 million raised in 1H 2021.

Two Energy Efficiency companies raised $160 million in VC funding in Q2 2022 compared to $109 million in four deals in Q1 2022. In a YoY comparison, an undisclosed amount was raised in one deal in Q2 2021.

There were no debt or public market financing deals for Energy Efficiency technology companies in 1H 2022. In 1H 2021, $343 million was raised in one deal.

In the first half of 2022, there were no M&A transactions. In 1H 2021, there was one disclosed M&A transaction for $300 million.

To get a copy of the report, visit: https://mercomcapital.com/product/1h-q2-2022-funding-ma-report-for-storage-grid-efficiency