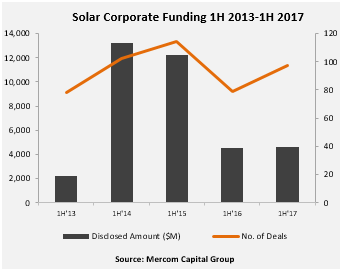

Total corporate funding (including venture capital funding, public market and debt financing) in the first half (1H) of 2017 was slightly up compared to the same period in 2016 with about $4.6 billion raised compared to the $4.5 billion raised in 1H 2016. There were 97 deals in 1H 2017 compared to the 79 deals in 1H 2016.

Corporate funding in the solar sector fell in Q2 with $1.4 billion raised in 37 deals compared to the $3.2 billion raised in 60 deals in Q1 2017. Year-over-year (YoY) funding in Q2 2017 was about 17 percent lower compared to the $1.7 billion raised in Q2 2016.

To learn more about the report, visit: https://mercomcapital.com/product/q2-2017-solar-funding-ma-report/

“There is a great deal of uncertainty in the solar markets right now, which is reflected in funding activity. However, solar public companies, especially on the U.S. stock markets, have done well this year. A lot is riding on how the Suniva anti-dumping case plays out as it will dictate market dynamics going forward,” commented Raj Prabhu, CEO of Mercom Capital Group.

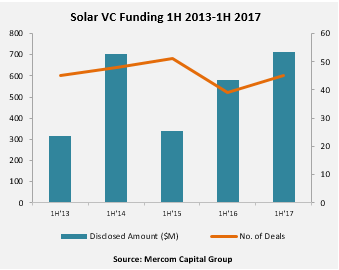

Global VC funding (venture capital, private equity, and corporate venture capital) for the solar sector in 1H 2017 was 23 percent higher with $713 million compared to the $579 million raised in 1H 2016, largely due to a strong first quarter in 2017.

In Q2 2017, VC funding for the solar sector saw a steep decline with $128 million in 23 deals compared to $585 million in 22 deals in Q1 2017. Most of the VC funding in Q2 2017 went to solar downstream companies (72 percent); $92 million was raised in 15 deals.

Top VC deals in 1H 2017 included the $200 million raised by ReNew Power Ventures followed by the $155 million raised by Greenko Energy Holdings, the $125 million secured by Hero Future Energies, Silicon Ranch’s $55 million, $25 million raise by Siva Power and the $25 million raise by Spruce Finance. A total of 55 investors participated in solar funding in 1H 2017.

Solar public market funding was much higher in 1H 2017 compared to the first half of 2016 with $934 million raised compared to $276 million in 1H 2016. Public market financing was slightly up in Q2 2017 with $473 million raised in six deals compared to the $461 million in 13 deals in Q1 2017.

Announced debt financing in 1H 2017 came to $3 billion compared to $3.7 billion in 1H 2016. In Q2 2017, announced debt financing fell to $798 million in eight deals compared to $2.2 billion in 25 deals in Q1 2017. There was one securitization deal in Q2 2017 by Sunnova which raised $255 million.

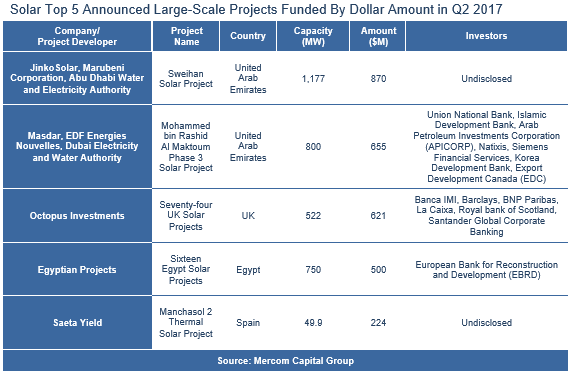

Announced large-scale project funding in 1H 2017 came to $7.4 billion in 81 projects. In Q2 2017, announced large-scale project funding came in at $4.8 billion in 48 deals.

Announced residential and commercial solar funds totaled $1.8 billion in 1H 2017 compared to $2.3 billion in the same period of 2016.

In 1H 2017 there were a total of 40 M&A transactions, compared to 30 in the same period of 2016. There were 11 solar M&A transactions in Q2 2017 compared to 29 solar M&A transactions in Q1 2017 and 16 transactions in Q2 2016. Of the 11 total transactions in Q2, eight involved solar downstream companies, two involved PV manufacturers, and one transaction was by a BOS company.

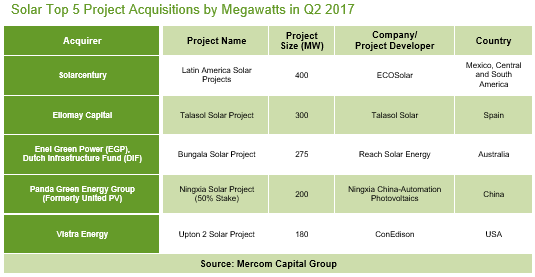

There were 100 large-scale project acquisitions in 1H 2017 totaling 10.6 GW, compared to 90 project acquisitions totaling 4.5 GW in the first half of 2016.

Investment firms and funds were the most active acquirers in 1H 2017, picking up 37 projects totaling 4.2 GW, followed by project developers with 17 transactions for 4.6 GW.

Mercom tracked 206 new large-scale project announcements worldwide in Q2 2017 totaling 11.1 GW.

To learn more about the report, visit: https://mercomcapital.com/product/q2-2017-solar-funding-ma-report/