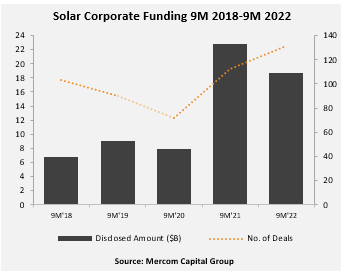

Total corporate funding (including venture capital funding, public market, and debt financing) in 9M 2022 stood at $18.7 billion, 18% lower compared to $22.8 billion raised in 9M 2021. The number of deals increased 17% year-over-year, with 131 in 9M 2022 compared to 112 in 9M 2021.

“Corporate funding in 9M 2022 is behind pace year-over-year, impacted by inflation and high-interest rates but is still ahead compared to the previous six years. There is renewed momentum after the passing of the Inflation Reduction Act. We have seen a resurgence in VC and private equity funding, breaking funding records since 2010. There is no longer any doubt about the growth potential of the solar industry – it is now a race to acquire the right technology and portfolios to scale,” said Raj Prabhu, CEO of Mercom Capital Group.

To get the report, visit: https://tinyurl.com/MercomSolarQ32022

In 9M 2022, venture capital (VC) funding activity rose 150%, with $5.5 billion in 72 deals compared to the $2.2 billion raised in 39 deals in 9M 2021.

The top VC deals in 9M 2022 were: $750 million raised by Intersect Power, $500 million raised by Longroad Energy, $375 million raised by Palmetto, $360 million by Gokin Solar, $350 million raised by Agilitas Energy, $260 million raised by Sun King.

Solar public market financing in 9M 2022 came to $4.9 billion in 11 deals, 22% lower compared to $6.3 billion in 23 deals in 9M 2021.

Announced solar debt financing activity in 9M 2022 totaled $8.3 billion in 48 deals, 42% lower than 9M 2021 when $14.2 billion was raised in 50 deals.

In 9M 2022, eight securitization deals totaled $2.3 billion, a 28% decrease compared to $3.2 billion in 11 deals in 9M 2021. Cumulatively, over $13.4 billion has been raised through securitization deals since 2013.

In 9M 2022, there were a total of 90 solar M&A transactions compared to 83 transactions in 9M 2021.

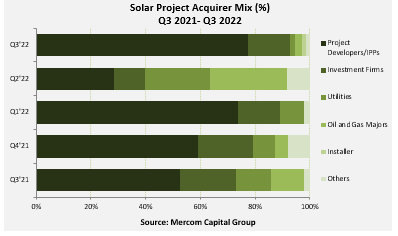

In 9M 2022, there were a total of 207 project acquisitions for 52 GW compared to 200 projects acquired for 55.5 GW in 9M 2021.

Project Developers and Independent Power Producers were the most active acquirers of solar projects in Q3 2022, picking up 10.8 GW, followed by Investment Firms with 2.4 GW. Oil and Gas companies acquired 345 MW of projects; installers acquired 252 MW of projects, and electric utilities acquired 240 MW. Other companies acquired a total of 180 MW.

There are 227 companies and investors covered in this report. It is 100 pages long and contains 84 charts and tables.

To learn more about the report, visit: https://tinyurl.com/MercomSolarQ32022