Digital health investment activity was robust during the first half of the (1H 2020), despite COVID-19 crisis. The first half of 2020 shattered all previous 1H global VC funding records with $6.3 billion in new investments. The funding amount was 24% higher compared to the $5.1 billion raised 1H 2019.

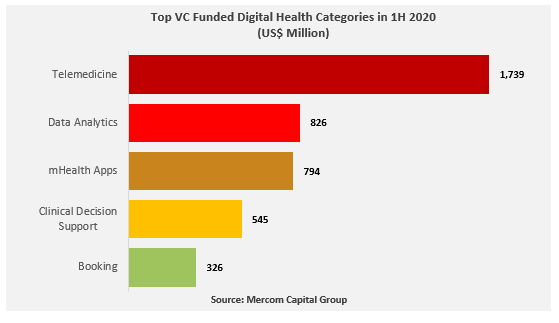

Telemedicine companies led the funding activity during 1H 2020, raising almost $1.8 billion in VC funding. The funding amount increased by 52% compared to 1H to 2019, when $896 million was raised. Optum Ventures led the telemedicine financing activity during 1H 2020, investing in four telemedicine companies. Other investors made multiple investments during 1H 2020: Seven Peaks Ventures, Bessemer Venture Partners, General Catalyst, Health Catalyst Capital, and Fusian Capital.

Other categories that received sizable funding during 1H 2020

Other categories that received sizable funding during 1H 2020

Healthcare Data Analytics companies raised $826 million in 1H 2020. The funding amount decreased by 26% compared to 1H to 2019, when $1.1 billion was raised. GV (formerly Google Ventures), Andreessen Horowitz, Oak HC/FT, M25, and Healthworx led the financing activity during 1H 2020, with multiple investments.

In a notable deal, genomic and clinical data management software platform DNAnexus secured $100 million in Series G funding round. Perceptive Advisors and Northpond Ventures co-led the financing round, with GV (formerly Google Ventures) and others.

mHealth Apps raised $794 million in 1H 2020. The funding activity was up in 1H 2020 by 27%, compared to $627 million raised in 1H 2020. Optum Ventures led mHealth apps financing activity during 1H 2020, with three investments. Octopus Ventures and Serena Ventures each made two investments. In the largest funding deal, ClassPass, a provider of app-based fitness and wellness classes across multiple gyms and studios, raised $285 million in a Series E funding round. L Catterton and Apax Digital led the round, with participation from existing investor Temasek.

Clinical Decision Support companies raised $545 million in 1H 2020. The funding activity was up in 1H 2020 by 90%, compared to $287 million raised in 1H 2020. Oak HC/FT led the financing during 1H 2020 with two investments. In a large financing deal, Concerto HealthAI, an AI-enabled precision oncology platform, raised $150 million in Series B financing. Declaration Partners led the round with participation from Maverick Ventures, AllianceBernstein PCI, and SymphonyAI Group.

Healthcare service Booking companies received $326 million from 33 investors during 1H 2020, compared to $336 million raised from 27 investors in 1 H 2019.

Other categories that received over $200 million during 1H 2020 include Wearable Sensors, Wellness, Medical Imaging, Practice Management Solutions, and Mobile Wireless.

To learn more about the report and download a free executive summary, visit: https://mercomcapital.com/product/1h-q2-2020-digital-health-healthcare-it-funding-ma-report