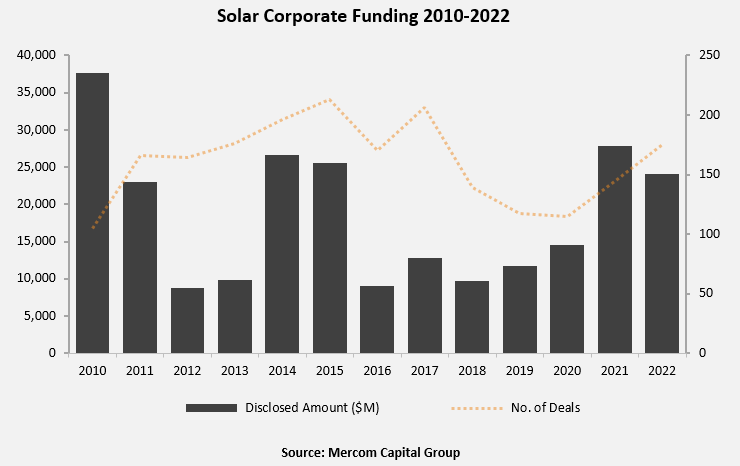

Total corporate funding worldwide in the solar sector, including venture capital and private equity (VC), debt financing, and public market financing, came to $24.1 billion in 2022, a decline of 13% compared to the $27.8 billion raised in 2021. The total deal count, however, was up by over 20% year-over-year (YoY).

To learn more about Mercom’s 2022 Solar Funding and M&A Report, visit: https://mercomcapital.com/product/annual-q4-2022-solar-funding-ma-report

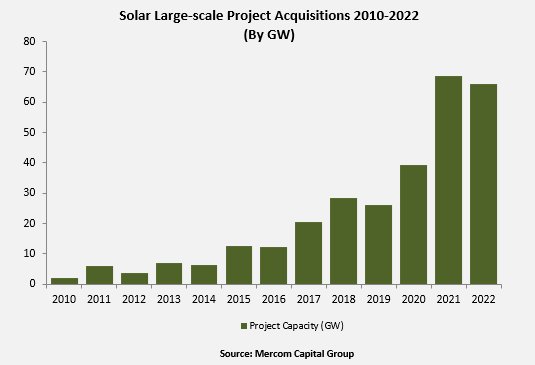

“The war in Ukraine has accelerated demand for solar around the world and the Inflation Reduction Act has boosted the sector in the U.S. In 2022, we saw record venture capital and private equity funding; solar companies were acquired in record numbers; and solar projects saw its second best year for acquisitions,” commented Raj Prabhu, CEO of Mercom Capital Group. But we are beginning to see higher interest rates bite into financing activity which resulted in lower public and debt financing in the second half of the year.

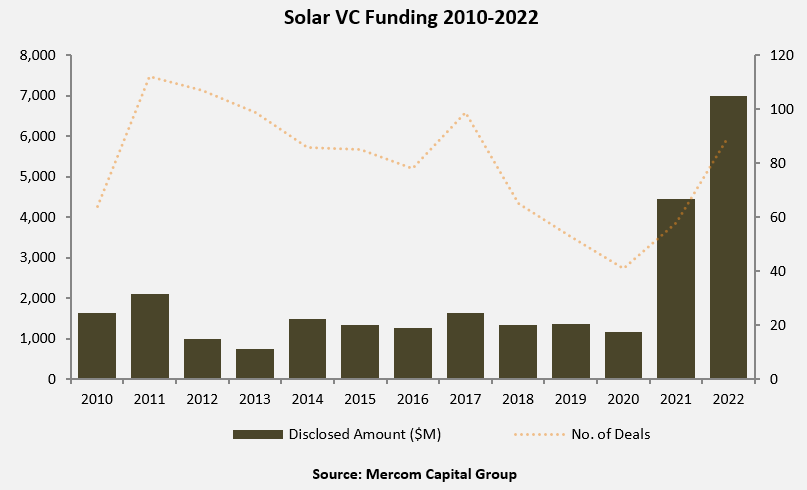

Global venture capital and private equity funding (VC) in the solar sector in 2022 came to $7 billion, a 56% increase compared to $4.5 billion in 2021. This is the highest amount of VC funding in a single year for the solar sector since 2010. There were 21 VC funding deals of $100 million or more in 2022.

Of the $7 billion in VC funding raised in 90 deals in 2022, $5.9 billion (84%) went to 62 Solar Downstream companies. Solar PV companies raised $864 million; Balance of System (BOS) raised $83 million; Thin-Film technology companies raised $76 million; Service Providers raised $44 million; and Concentrated Solar Power companies raised $13 million.

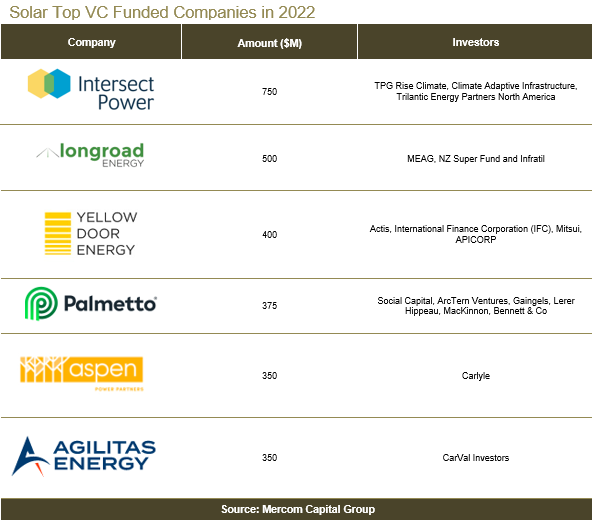

The top VC-funded companies in 2022 were Intersect Power ($750 million), followed by Longroad Energy ($500 million), Yellow Door Energy ($400 million), Palmetto ($375 million), Aspen Power Partners ($350 million), and Agilitas Energy ($350 million).

Public market financing in 2022 totaled $5.1 billion, 32% lower than the $7.5 billion in 2021. The largest deal in 2022 was by JinkoSolar Holding Co’s principal operating subsidiary, Jinko Solar, which raised $1.57 billion through its initial public offering.

In 2022, announced debt financing came to $12 billion, a 24% decline compared to $15.8 billion raised during 2021. Securitization activity was a key contributor with $3.1 billion in 12 deals.

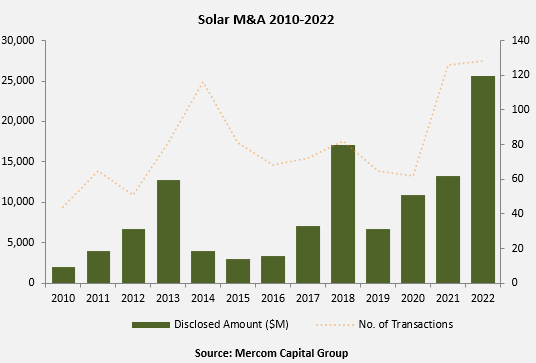

A total of 128 mergers and acquisition (M&A) transactions were recorded in 2022—the highest since 2010 including eight deals exceeding a billion dollars each.

Most of the transactions involved Solar Downstream companies. The largest transaction in 2022 was German power utility RWE’s purchase of Con Edison Clean Energy Businesses (CEB) for $6.8 billion.

There were 268 large-scale solar project acquisitions in 2022 compared to 280 transactions in 2021. In 2022, about 66 GW of solar projects were acquired, with project developers picking up the most, acquiring 35.7 GW. Solar project acquisitions in terms of GW were at the second highest level ever.

225 companies and investors are covered in this 122 page report, which contains 106 charts, graphs, and tables.

To learn more about Mercom’s 2022 Solar Funding and M&A Report, visit: https://mercomcapital.com/product/annual-q4-2022-solar-funding-ma-report

By Raj Prabhu