Annual and Q4 2022 Solar Funding and M&A Report

$599.00 – $799.00

Total Corporate Funding in 2022

Totals $24.1 Billion

– See the Details!

Click here to download the Executive Summary.

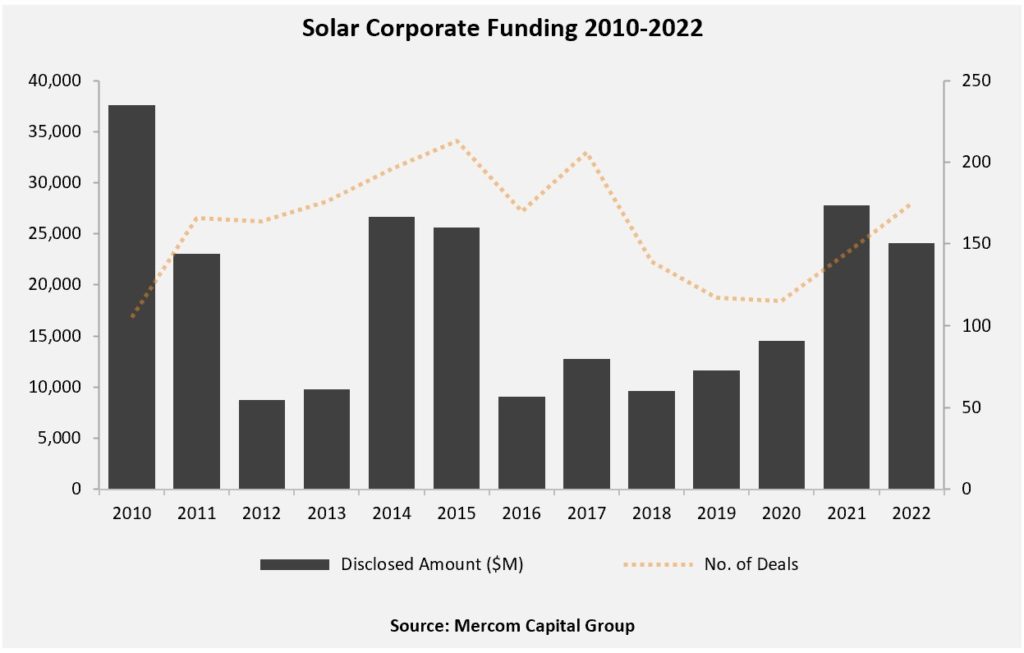

Total corporate funding worldwide in the solar sector, including venture capital and private equity (VC), debt financing, and public market financing, came to $24.1 billion, a decline of 13% compared to the $27.8 billion raised in 2021. The total deal count, however, was up by over 20% year-over-year (YoY).

“The war in Ukraine has accelerated demand for solar around the world and the Inflation Reduction Act has boosted the sector in the U.S. In 2022, we saw record venture capital and private equity funding; solar companies were acquired in record numbers; and solar projects saw its second best year for acquisitions,” commented Raj Prabhu, CEO of Mercom Capital Group. But we are beginning to see higher interest rates bite into financing activity which resulted in lower public and debt financing in the second half of the year.

Global venture capital and private equity funding (VC) in the solar sector in 2022 came to $7 billion, a 56% increase compared to $4.5 billion in 2021.

Public market financing in 2022 totaled $5.1 billion, 32% lower than the $7.5 billion in 2021.

In 2022, announced debt financing came to $12 billion, a 24% decline compared to $15.8 billion raised during 2021.

A total of 128 mergers and acquisition (M&A) transactions were recorded in 2022—the highest since 2010 including eight deals exceeding a billion dollars each.

There were 268 large-scale solar project acquisitions in 2022 compared to 280 transactions in 2021.

There were 255 companies and investors covered in this report. It is 122 pages in length and contains 106 charts, graphs, and tables.

Mercom Capital Group’s Quarterly Solar Funding and M&A Reports are comprehensive high-quality reports delivering superior insight, market trends, and analysis. These reports help bring clarity to professionals in the current financial landscape of the solar industry.

Also available:

Custom Excel Sheets with all transactions for the quarter, and

Custom Research with data from the past 5 years!

Contact us to learn more and get pricing!

Quarterly market and deal activity displayed in easy-to-digest charts, graphs, and tables, alongside data-driven analysis.

The report covers all types of deals and financing activity, including:

- Venture capital funding deals, including top investors, QoQ and YoY trends, and a breakdown of charts and graphs by technology, sector, stage, and country;

- Large-scale project funding deals, including top investors, QoQ and YoY trends and breakdown charts and graphs by technology and country;

- Public market financing, including equity financing, private placements, and rights issues;

- Debt and other funding deals, as well as QoQ and YoY trends;

- Third-party residential/commercial project funds;

- Large-scale project acquisitions and active project acquirers;

- Large-scale project announcements in various levels of development throughout the world;

- Mergers and acquisitions (M&A), including QoQ and YoY trends, a breakdown of charts and graphs by technology and sector, as well as project M&A activity;

- New cleantech and solar funds;

- New large-scale project announcements;

- Large-scale project costs per MW.

This report also contains comprehensive lists of all announced Q4:

- VC funding, debt financing, public equity financing, and project funding deals;

- VC and project funding investors;

- M&A transactions;

- Project acquisitions by amounts and megawatts;

- M&A, and project M&A transactions;

- Large-scale project announcements.

Mercom’s comprehensive report covers deals of all sizes across the globe. Have questions about the report? Email us here.