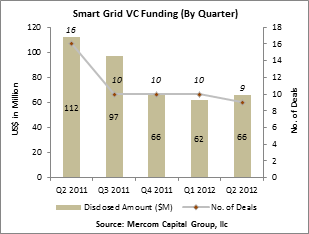

Smart grid venture capital (VC) funding in Q2 2012 totaled $66 million in nine deals. VC funding levels remained weak in the last three quarters (Q4 2011: 10 deals, $66 million; Q1 2012: 10 deals, $62 million).

Raj Prabhu, Managing Partner at Mercom Capital Group commented, “Funding levels continue to be extremely weak in the smart grid sector, a reflection of shifting business models as the industry continues to struggle to understand customer needs and address customer misconceptions along with security concerns and other issues.”

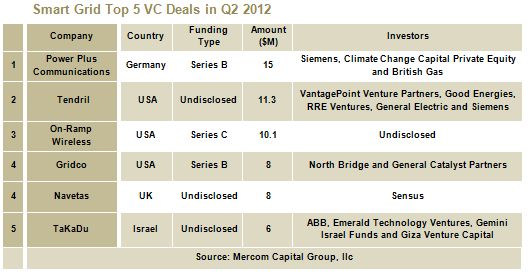

The top VC deal in Q2 2012 was the $15 million raised by Power Plus Communications, a broadband powerline communication systems company, followed by $11.3 million raised by Tendril, an energy management company. Other top deals included $10.1 million raised by On-Ramp Wireless, a low-power monitoring and control applications provider, $8 million each raised by Gridco, a developer of utility-scale power management systems, and Navetas, an energy measurement, management and conservation company, and $6 million raised by TaKaDu, a provider of advanced monitoring solutions for water distribution networks.

Twenty-two different investors participated in nine VC deals in Q2 2012, but only Siemens was involved in multiple deals (two). There were only eight investors in Q1 2012.

Merger & Acquisition (M&A) activity in Q2 2012 totaled $14 billion in seven transactions. Top M&A transactions were the $11.8 billion acquisition of Cooper Industries, a grid and equipment company by Eaton, the $2.3 billion acquisition of smart meter company Elster by UK investment company Melrose and the $72 million acquisition of ZigBee systems developer Ember by Silicon Labs.

To get a copy of this report, please email us at info@mercomcapital.com.