This year (2012) has been a rough and tumble year for the solar industry in general. The year was consumed by anti-dumping and protectionist measures all over the world as countries tried to rescue their own manufacturers in the face of massive over supply and ever-falling prices. So far we have seen the United States announcing final anti-dumping tariffs against Chinese manufacturers (which has yet to have much of an impact on U.S. installations), followed by the European Union filing a similar case also against the Chinese. Meanwhile, China announced its own anti-dumping case against polysilicon suppliers from the United States, EU and South Korea while India just initiated an anti-dumping investigation regarding imports of solar cells against Malaysia, China, Taiwan and the U.S. further escalating the solar trade wars.

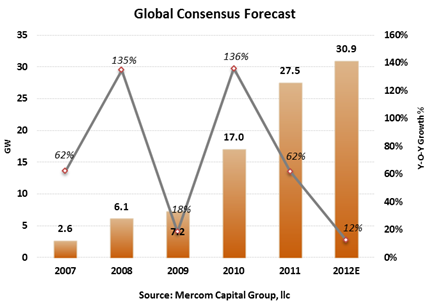

This year could have been far worse. At the beginning of the year, installation forecasts for 2012 looked pretty scary. Germany was not expected to install more than 3.5 GW and everyone was looking for the emerging markets to supplement the demand. But Germany has done it again. Defying the odds, it has once again come to the rescue, and could be the reason why PV installations will show growth year over year in a challenging 2012.

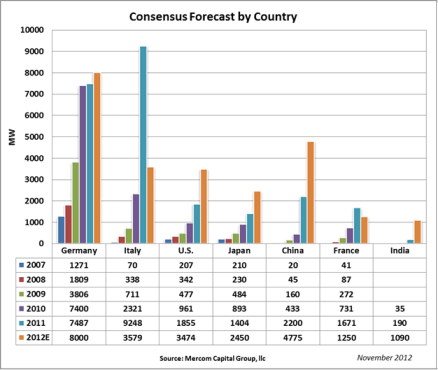

Low module prices continue to drive installations; Tier 1 module prices are hovering around $0.65 and will probably end up down about 30 percent this year. Along with Germany, some of the markets that have been driving installation growth this year are Italy, China, France, Japan, U.S. and India.

Germany

Germany has installed 6,838 MW as of October 2012 and is well on pace to install 8,000 MW this year. Germany was only expected to install 2-3.5 GW based on industry forecasts earlier this year.

The German Federal Network Agency (Bundesnetzagentur) recently announced a reduction in feed-in tariffs (FiT) for PV installations between November 1, 2012 and January 31, 2013. The feed-in-tariffs will decrease by 2.5% per month.

The goal was set for installations to be in the 2,500 MW to 3,500 MW range per calendar year. However, due to larger than expected installations in July, August and September, which amounted to 1.8 GW, this could result in an annual installation of 7.4 GW (according to the set formula (x4), and would exceed the maximum allowed installations by almost 4 GW. Since the installation corridor exceeded the 3-4 GW range, the Bundesnetzagentur has set the overall monthly FiT decrease at 2.5% for November 2012, December 2012 and January 2013.

Germany’s goal is to subsidize its solar program up to 52 GW.

Italy

Italy replaced its solar policy, Conto Energia IV, with Conto Energia V, which calls for a €700M (~$883M) subsidy cap and also provides a FiT premium for solar panels made in Europe to the tune of ~€20 (~$25)/MWh. The Gestore dei Servizi Energetici (GSE) announced that the annual cost of PV incentives has reached €6B (~$7B) in July, triggering a 45 day notice period for Conto Energia V to kick in at the end of August 2012. However, that date is now postponed until October, creating a “mini rush” situation. The Italian Ministry of Economy and Industry’s recently proposed energy strategy reveals intentions of the government to end PV subsidies altogether after Conto Energia V reaches its cap (~$300M is left).

Italy will not get anywhere near its 2011 installation levels, which were over 9 GW, and 2012 is expected to finish in the 3.5 GW range.

United States

The United States continues its strong installation growth in 2012 with the help of utility-scale projects, solar leases and low module prices. The uncertainty surrounding the anti-dumping case against Chinese manufacturers has ended as the final ruling was released in November. So far, the impact from the anti-dumping ruling seems to have had minimal impact on installations and panel prices.

The United States does not have a central, cohesive solar incentive policy. Instead, the market is driven by state Renewable Portfolio Standards (RPS), state and municipal rebate programs and the 30 percent federal investment tax credit (ITC). California, the largest solar market in the country, is fueled by an aggressive RPS of 33 percent by 2020. Almost 30 states have some sort of RPS in place, and about half of them have a solar carve-out. Solar lease programs, where consumers lease systems instead of making the upfront investment, are extremely popular, especially in California, and are largely driving the residential markets there.

U.S. installations may come close to doubling in 2012 compared to 2011.

Japan

Japan has set a goal of achieving 28 GW of cumulative PV installations by 2020. The Ministry of Economy, Trade, and Industry (METI) announced a feed-in-tariff program in June, which will be valid for 20 years. The FiT is one of the most attractive in the world right now, with PV systems below 10 kW receiving ¥42/kWh (~$0.53) and systems above 10 kW receiving ¥40 (~$0.51). For systems less than 10 kW, the government will purchase only the excess power produced for a 10 year period. For systems larger than 10 kW, the government will purchase all of the power produced. The new FiT program is designed to stimulate new large-scale power projects, as there was no FiT available for projects 500 kW or higher previously.

The new FiT is widely expected to kick-start PV installations in a big way; though we have to be wary when the incentives are too generous which usually leads to boom-bust cycles as witnessed in many markets. We are already seeing the positive effects of the new FiT program, with 65 percent growth in Japan’s domestic PV shipments. Domestic shipments in the first three quarters in 2011 amounted to about 890 MW compared to almost 1,500 MW in the first three quarters in 2012. Japan could potentially double its installations in 2012 compared to 2011.

China

The National Energy Administration (NEA) of China has a solar power capacity target of 21 GW by 2015. This has set the pace for Chinese installations in 2012 which could more than double compared to 2011 installations of over 2 GW. The installations in the first half of 2012, according to National Development and Reform Commission (NDRC), was slow at 1.3 GW, which means about 4 GW has to get installed in the second half of 2012.

To support the new 21 GW target, there has to be policy support. According to reports, China’s National Grid would purchase excess distributed PV power (after consumption) at Rmb1 (~$0.16)/kWh, a much higher tariff than previously expected. This tariff is expected to yield a healthy IRR which could help push distributed generation installations.

China still has multiple challenges to address including an economic slowdown, tightening credit by the state owned banks, significant debt exposure to solar manufacturers, bankability issues, low tariffs, bureaucracy, cumbersome permitting processes, and transmission bottlenecks.

France

France has been all over the place when it comes to solar policies this year, cutting its FiTs a few times this year, followed by a shift from a FiT system to a bidding system for large-scale projects above 100 kW. In a reversal, the new administration announced in November a rare tariff increase for PV systems smaller than 100 kW to €0.184 (~$0.240)/kWh from €0.175 (~$0.229)/kWh. There was also a “Made in EU” bonus of 10 percent (on top of the FiT) announced in October. But recent indications are that FiTs for ground mount installations will be cut from €0.10 (~$0.13) to €0.08 (~$0.11).

At the end of the third quarter, installations in France had already reached about 1 GW. France introduced a 500 MW hard cap on new annual installations in 2011 and the current French market is largely a reflection of grandfathered projects from 2010 coming online. There are about 3.5 GW of grandfathered systems with 2 GW expected to be connected in 2011 and 2012.

India

Indian solar installations have been driven by the Jawaharlal Nehru National Solar Mission (JNNSM) with a goal to install 20 GW of solar power by 2022, and various state policies and state RPOs. India is on pace to install over 1 GW in 2012.

JNNSM and most states use a reverse auction process to select projects, while the state of Gujarat (which has the most installations of any India states so far) has a FiT policy in place. India went quickly, from almost no installations three years ago to an estimated 1 GW this year, and has been considered one of the most promising solar markets along with China and Japan. All of that could change with added uncertainty caused by the recent announcement by the government of India to launch an anti-dumping investigation against China, Taiwan, Malaysia and the United States in relation to solar cell imports. Considering India uses a reverse auction model where the lowest bidders win projects, any increase in module costs will make most projects unviable as the projects are being executed on razor thin margins. It should be noted that 2012 is the first significant year of installations in India. There were only a few hundred MW installed until this year. Indian PV manufacturing has always been primarily an export-driven market to European countries mainly.

The state of Tamil Nadu recently announced a new policy with a goal of installing 3,000 MW by 2015 using a reverse bidding process. Though encouraging, state utilities in India continue to operate under massive losses, and are less than prompt when it comes to paying power generators.

This consensus forecast is based on Mercom’s views and methodology with data compiled from: Auerbach Grayson, Auriga. Barclays Capital, BNEF, Citi, Collins Stewart, Credit Suisse, Daiwa, Deutsche Bank, Gartner, Goldman Sachs, GTM Research, HSBC, Hyundai, ICBC China, IMS Research, iSuppli, Jefferies, JP Morgan, Kaufman Bros, KGI, Macquarie Capital, Maxim Group, Mercom Capital Group, Needham, Piper Jaffray, R.W. Baird, Solarbuzz, Stifel Nicolaus, UBS and other government, public and private sources.