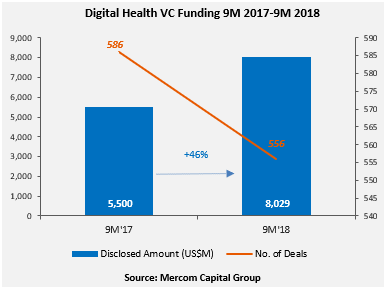

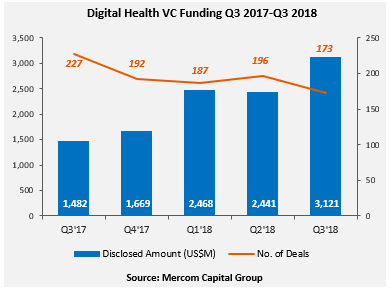

Global VC funding for Digital Health companies in 9M 2018 was 46 percent higher year-over-year (YoY) with a record $8 billion raised in 556 deals compared to the $5.5 billion in 586 deals in 9M 2017. Another annual record will be set in 2018 as the $8 billion has already surpassed the previous high mark of $7.2 billion raised in all of 2017. A new record was also set in Q3 2018 with VC funding coming to $3.1 billion in 173 deals surpassing the $2.4 billion raised in 196 deals in Q2 2018.

To learn more about the report and download a free executive summary, visit: https://mercomcapital.com/product/9m-and-q3-2018-digital-health-healthcare-it-funding-and-ma-report/

Digital Health companies have now received ~$34 billion in the 4,006 VC funding deals, according to Mercom.

Total corporate funding in Digital Health companies – including VC, debt, and public market financing – came to $3.5 billion in Q3 2018 compared to $4.4 billion in Q2 2018.

“For the first time, we saw funding cross $3 billion in a single quarter in digital health and funding raised year-to-date has already surpassed all of 2017 with a realistic chance of hitting $10 billion this year. The sector has significant momentum and substance behind this record funding, from regulatory support to entry of large tech and healthcare companies – including a slew of intellectual property applications and FDA approvals,” said Raj Prabhu, CEO of Mercom Capital Group.

Healthcare Practice-focused companies received 40 percent of the funding in Q3 2018, raising $1.3 billion in 62 deals compared to $702 million in 58 deals in Q2 2018. Healthcare Consumer-centric companies accounted for 60 percent of the funding in Q3 2018, raising $1.9 billion in 111 deals compared to $1.7 billion in 138 deals in Q2 2018.

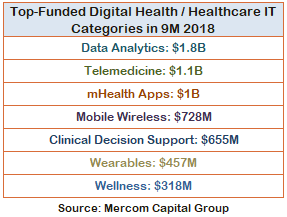

The top funded areas in 9M 2018 were: Data Analytics with $1.8 billion, Telemedicine with $1.1 billion, mHealth Apps with $1 billion, Mobile Wireless with $728 million, Clinical Decision Support with $655 million, Wearables for $457 million, and Wellness with $318 million.

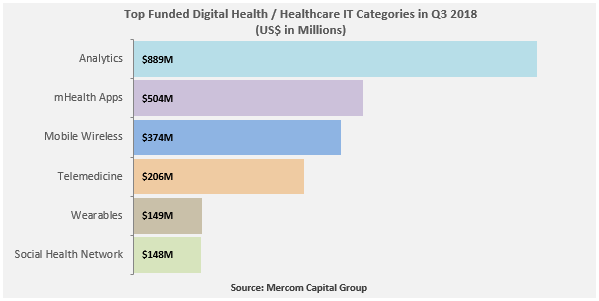

The top funded categories in Q3 2018 were: Data Analytics with $889 million, mHealth Apps with $504 million, Mobile Wireless at $456 million, Telemedicine companies with $374 million, Wearables with $149 million, Social Health Networks with $148 million, and Wellness with $117 million.

There were 68 early stage deals in Q3 2018, including one accelerator/incubator deal.

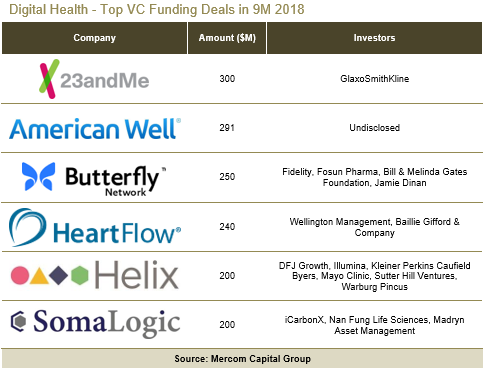

The Top VC deals in 9M 2018 included: $300 million raised by 23andMe, $291 million raised by American Well, $250 million by Butterfly Health Network, $240 million raised by Heartflow, $200 million raised by Helix, and $200 million raised by SomaLogic.

A total of 1,132 investors participated in digital health funding deals in 9M 2018.

Twenty-four different countries recorded Digital Health VC funding deals in Q3 2018.

The pace of M&A activity year-to-date is slightly ahead of last year. In 9M 2018, there were a total of 172 Digital Health M&A transactions, compared to 146 in 9M 2017. M&A activity in Q3 2018 was down with 56 M&A transactions (nine disclosed) compared to the 68 M&A transactions (13 disclosed) in Q2 2018.

mHealth App companies were involved in the most M&A deals in Q3 2018 with eight transactions followed by Data Analytics and Practice Management Solutions with six deals each, then Digital Health Service Providers with three deals.

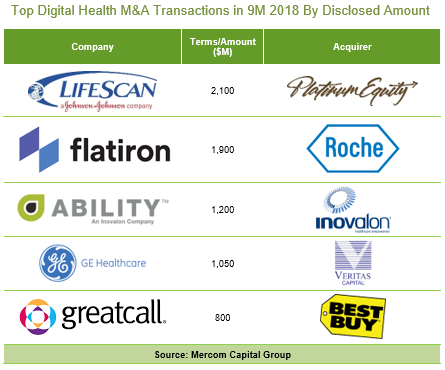

Top M&A transactions in 9M 2018 included: Platinum Equity’s acquisition of LifeScan for $2.1 billion, Roche’s acquisition of Flatiron Health for $1.9 billion, Inovalon’s acquisition of ABILITY Network for $1.2 billion, Veritas Capital’s acquisition of General Electric’s (GE) Healthcare IT division for $1 billion, and Bestbuy’s acquisition of Greatcall for $800 million.

This report is 107 pages in length, contains 67 charts, graphs and tables, and covers 701 investors and companies.

Mercom’s comprehensive report covers deals of all sizes across the globe.

To learn more about the report, visit: https://mercomcapital.com/product/9m-and-q3-2018-digital-health-healthcare-it-funding-and-ma-report/