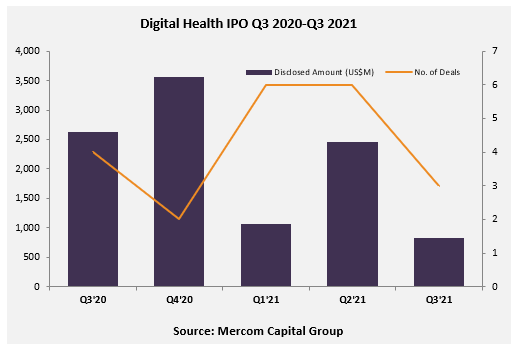

In the first nine months of 2021, a record 15 digital health companies have gone public (4 SPACs and 11 IPOs) compared to six in 2020.

Of the 15 companies that went public, Owlet, Sema4, 23andME, and Hims & Hers went public via the SPAC deals, and 11 digital health companies – Cue Health, Bright Health Group Convey Health Solutions, Dialogue Health Technologies, Doximity, MCI Onehealth, Mednow, Movano, Physitrack, Privia Health, Signify Health, went public through the traditional IPO route.

Top deals in the first 9 months of 2021

Top deals in the first 9 months of 2021

Bright Health Group, a telehealth company, raised $924 million in its IPO. The company offered 51.3 million shares at $18 per share. The company listed its shares on the New York Stock Exchange (NYSE) under the symbol “BHG.”

Signify Health, a value-based care services platform that helps coordinate care between payers, healthcare providers, and community organizations, raised $610 million in its IPO. The company offered 27,025,000 shares of its Class A common stock at $24 per share. Signify Health’s stocks are trading on the NYSE under the ticker symbol “SGFY.”

Doximity, an online social network for doctors, raised $606 million after pricing an IPO above the marketed range. Doximity sold 19 million shares for $26 apiece. The stocks are trading on NYSE, under the ticker symbol of “DOCS.”

DNA testing and analytics technology company 23andMe and VG Acquisition Corp. (VGAC), a special purpose acquisition company, announced the completion of their business combination. The combined company is called 23andMe Holding and started trading on The Nasdaq Global Select Market under the new ticker symbol “ME.” 23andMe raised approximately $592 million in gross proceeds through its business combination.

Sema4, a patient-centered healthcare data analytics company, announced the completion of its business combination with CM Life Sciences, a special purpose acquisition company (SPAC), resulting in approximately $500 million in cash proceeds. The combined company, Sema4 Holdings, started trading its shares of common stock and warrants on the Nasdaq Global Select Market under the ticker symbols “SMFR.”

The creator of an app-connected health monitoring device system, Cue Health, raised $200 million in its IPO. The company has offered 12.5 million shares, priced at $16 each. Its shares are currently trading on the Nasdaq, under the ticker “HLTH.”