Total corporate funding—including venture capital (VC) funding, public market, and debt financing—into the solar sector in Q1 2022 came to $7.5 billion in 49 deals, a 51% increase compared to $5 billion raised in 32 deals in Q4 2021. However, funding was lower by 7% year-over-year (YoY) compared to Q1 2021.

To learn more about Mercom’s Q1 2022 Solar Funding and M&A Report, visit: https://mercomcapital.com/product/q1-2022-solar-funding-ma-report/

“Although financing activity was strong QoQ with robust demand for solar assets, significant headwinds are building up that can slow the momentum considerably, said Raj Prabhu, CEO at Mercom Capital Group. Continuing supply chain issues, higher inflation, and the interest rate trajectory going forward are already major concerns. Adding to this, if the Department of Commerce decides to impose tariffs on module imports from Malaysia, Cambodia, Thailand, and Vietnam, we could be looking at a substantial dropoff in investment activity.”

Global VC funding for the solar sector in Q1 2022 came to $1.2 billion in 26 deals, a 45% decrease compared to $2.2 billion raised in 19 deals in Q4 2021. Year-over-year funding was 19% higher compared to Q1 2021.

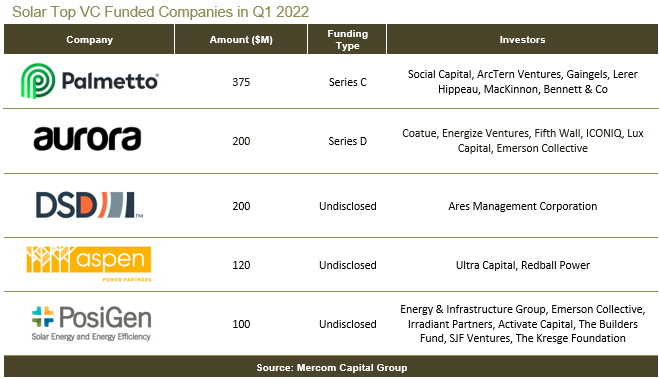

The top VC-funded companies in Q1 2022 were: Palmetto, which raised $375 million, Aurora Solar with $200 million, DSD Renewables with $200 million, Aspen Power Partners with $120 million, and PosiGen with $100 million.

A total of 58 VC investors participated in Q1 2022 compared to 33 in Q4 2021.

Of the $1.2 billion in VC funding raised in 26 deals during Q1 2022, 94% went to solar downstream companies, with $1.15 billion in 20 deals. In Q4 2021, solar downstream companies raised $2 billion in 17 deals (91% of total VC funding).

Public market financing in the solar sector totaled $2.5 billion in Q1 2022, a 115% increase compared to $1.2 billion raised in Q4 2021. There was one IPO announced in Q1. Year-over-year, funding was lower by 9%.

Announced debt financing for the solar sector in Q1 2022 totaled $3.8 billion, a 137% increase compared to Q4 2021 when $1.6 billion was raised. However, debt financing was down 12% YoY.

Four securitization deals brought in $1.1 billion in Q1 2022, a 137% increase compared to $458 million raised in two deals in Q4 2021.

A total of 29 solar M&A transactions were recorded in Q1 2022 compared to 43 in Q4 2021. In a YoY comparison, there were 20 solar M&A transactions in Q1 2021.

Solar downstream companies lead M&A activity with 25 deals.

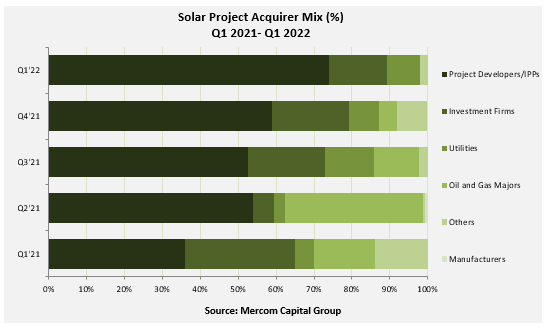

Large-scale solar project acquisition activity remained strong, with over 23 GW of solar projects acquired in Q1 2022 compared to 13.1 GW in Q4 2021. Year-over-year, 15 GW were acquired in Q1 2021. Large-scale solar project acquisitions in Q1 2022 were the second highest recorded to date.

Project developers and independent power producers were the most active acquirers in Q1 2022, with over 17 GW of projects being acquired, followed by investment firms and funds, which acquired 3.6 GW.

Project developers and independent power producers were the most active acquirers in Q1 2022, with over 17 GW of projects being acquired, followed by investment firms and funds, which acquired 3.6 GW.

In Q1 2022, 82 large-scale solar project acquisitions were spread across 20 countries. The United States led in terms of recorded acquisitions with 17 GW, followed by Spain with 1.9 GW and the United Kingdom with over 1 GW of acquisitions.

In Q1 2022, 82 large-scale solar project acquisitions were spread across 20 countries. The United States led in terms of recorded acquisitions with 17 GW, followed by Spain with 1.9 GW and the United Kingdom with over 1 GW of acquisitions.

Three hundred and seventy-five (375) companies and investors are covered in this 89-page report, which contains 67 charts, graphs, and tables.

To learn more about Mercom’s Q1 2022 Solar Funding and M&A Report, visit: https://mercomcapital.com/product/q1-2022-solar-funding-ma-report/