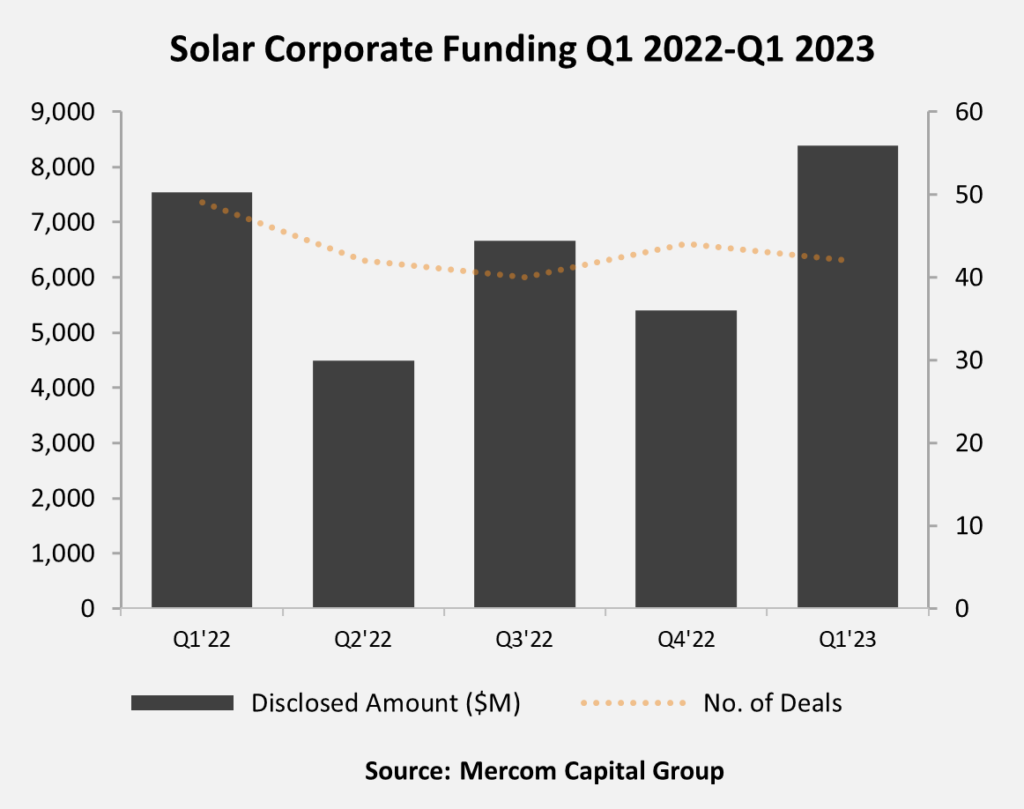

Total corporate funding—including venture capital (VC) funding, public market, and debt financing—into the solar sector in Q1 2023 came to $8.4 billion in 42 deals, a 55% increase compared to $5.4 billion raised in 44 deals in Q4 2022. Funding increased 11% YoY compared to $7.5 billion raised in 49 deals in Q1 2022.

To learn more about Mercom’s Q1 2023 Solar Funding and M&A Report, visit: https://mercomcapital.com/product/q1-2023-solar-funding-ma-report/

“Investments in solar bucked the trend in Q1 despite tough economic conditions. The Inflation Reduction Act is a significant driver for investments in solar. The fundamentals are solid, driven by strong demand for the energy transition worldwide, especially in Europe and the United States,” said Raj Prabhu, CEO of Mercom Capital Group.

Global VC funding for the solar sector in Q1 2023 came to $2.1 billion in 18 deals, a 40% increase compared to $1.5 billion raised in 18 deals in Q4 2022. Year-over-year funding was 75% higher compared to Q1 2022.

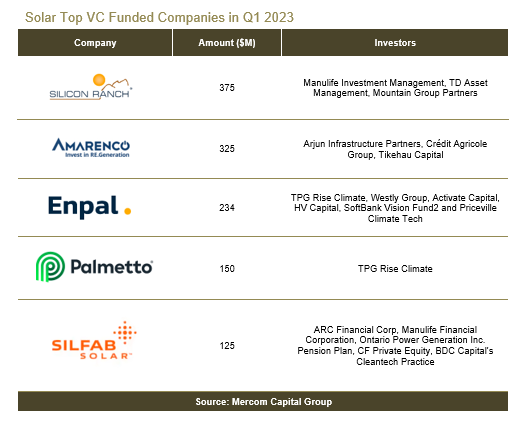

The top VC-funded companies in Q1 2023 were: Silicon Ranch, which raised $375 million; Amarenco, with $325 million; Enpal, with $234 million; Palmetto, with $150 million; and Silfab Solar, with $125 million.

Of the $2.1 billion in VC funding raised in 18 deals during Q1 2023, 64% went to solar downstream companies with $1.4 billion in 10 deals. In Q4 2022, solar downstream companies raised $1.3 billion in 12 deals (85% of $1.5 billion in VC funding).

Public market financing in the solar sector totaled $2.3 billion in seven deals in Q1 2023, an increase of 1,183% compared to $181 million raised in five deals in Q4 2022. YoY, funding declined by 8%, with $2.5 billion raised in four deals in Q1 2022. There were four IPOs announced in Q1 2023 compared to one announced in Q1 2022.

Announced debt financing for the solar sector in Q1 2023 totaled $3.9 billion, a 6% increase compared to Q4 2022 when $3.7 billion was raised. In a YoY comparison, debt financing increased by 3% with $3.8 billion raised in 19 deals in Q1 2022.

A total of 27 solar M&A transactions were recorded in Q1 2023 compared to 38 in Q4 2022 and 29 solar M&A transactions in Q1 2022.

Solar downstream companies led M&A activity with 26 transactions, followed by a balance of system company with one transaction.

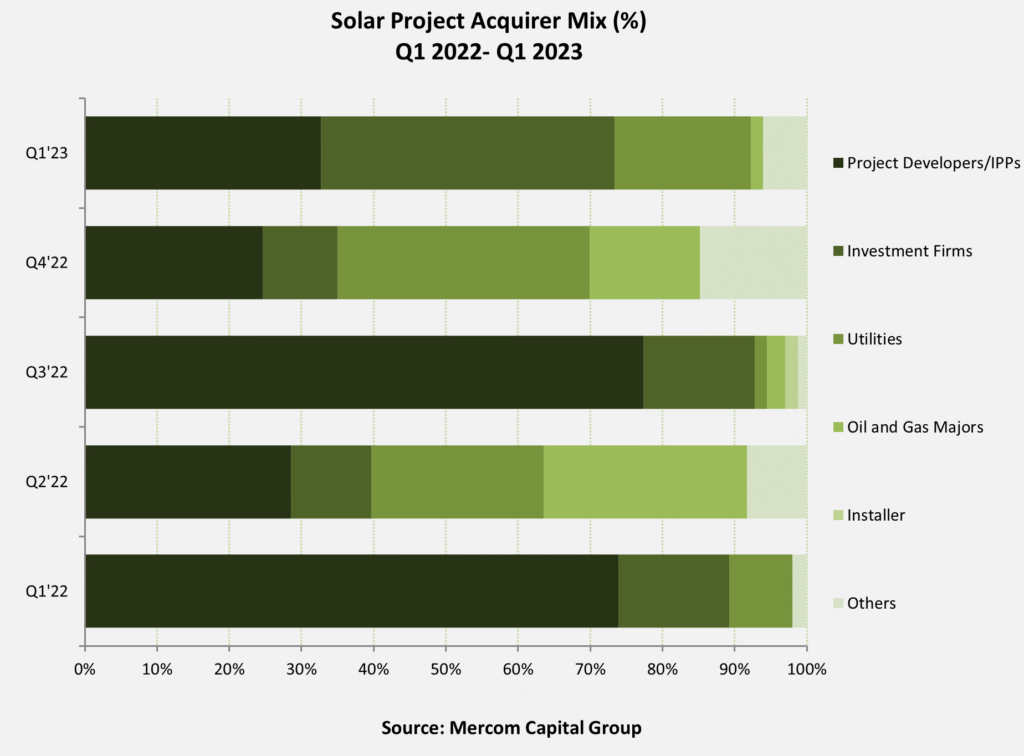

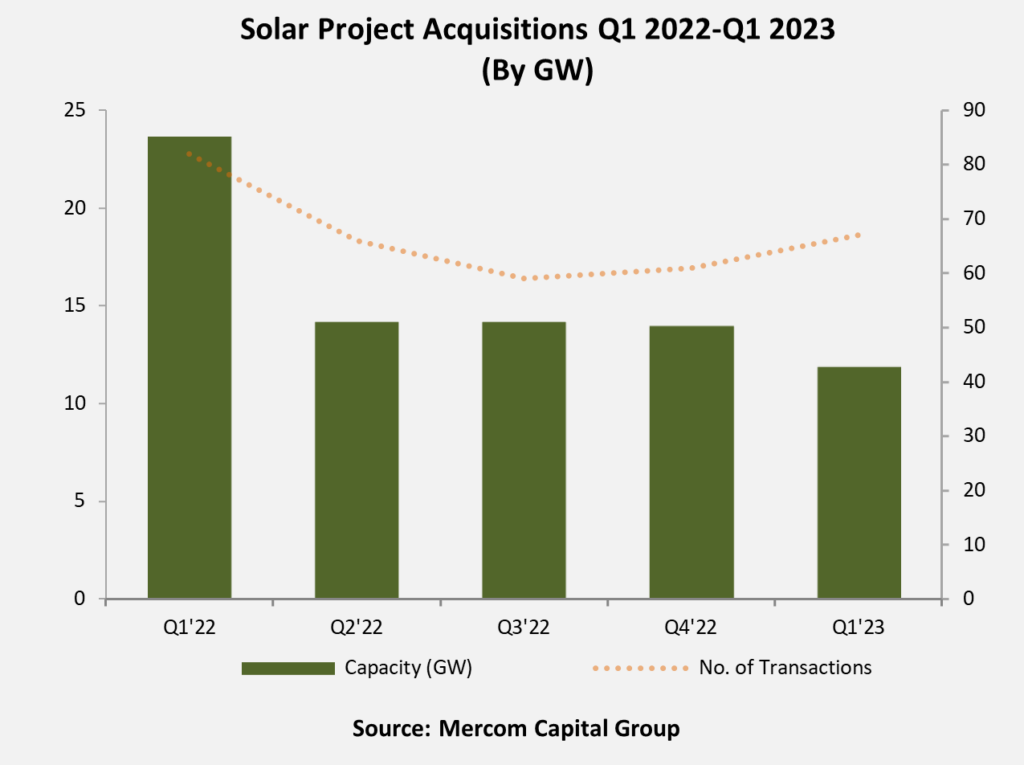

Almost 12 GW of solar projects were acquired in Q1 2023 compared to 14 GW in Q4 2022.

Investment firms and funds were the most active acquirers in Q1 2023, picking up over 4.8 GW of projects, followed by project developers and independent power producers, which acquired 3.9 GW of projects. Electric utilities acquired 2.2 GW of projects, and oil and gas majors acquired 200 MW of projects.