BetterUp, a digital employee wellness coaching platform, secured $300 million in a Series E funding round.

Wellington Management, ICONIQ Growth, and Lightspeed Venture Partners led the round with Salesforce Ventures and Mubadala Investment Company, Sapphire Ventures, Morningside Group, SV Angel, and PLUS Capital.

According to a press statement, the latest round brings the company’s valuation to $4.7 billion and total funding to $600 million.

The round also closely follows the company’s $125 million Series D in February 2021.

The company plans to use the latest funds to accelerate its international growth and drive new product innovation. It also plans to develop more personalized solutions for specific workplace needs.

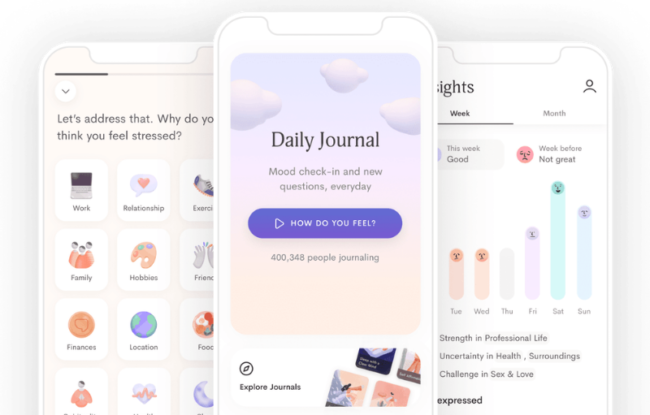

BetterUp provides app-based employee coaching and mental health assistance for businesses and individuals on topics like diversity and inclusion, parenting, nutrition, and sleep. The company said that the app had completed over one million coaching sessions in the last eight years.

“We are in the midst of the great global awakening surrounding hybrid work, mental health, and well-being, and diversity and inclusion,” CEO and co-founder Alexi Robichaux said in a statement.

“Never has the pressure been greater on our global workforce, and as we collectively redefine the workplace, it’s clear that every organization and every employee critically needs support, growth, and transformation.

“From leadership and career development to mental fitness, connection, and belonging, customers are increasingly turning to BetterUp to support the most important part of their business – their people – in the most profound way possible: by focusing on their whole person growth and development, including their behaviors, skills, and mindsets.”

Digital personal health and wellness companies secured $1.8 billion in the first half (1H) of 2021 compared to $300 million in 1H 2020, over a 500% increase year-over-year, according to Mercom Digital Health Funding and M&A Report.