Total corporate funding (including venture capital funding, public market, and debt financing) in 9M 2018 was down with $3.3 billion raised compared to $3.7 billion raised in 9M 2017, an 11 percent decrease year-over-year (YoY). The decline was due to lower funding activity in the Smart Grid and Efficiency categories as funding increased in Battery Storage.

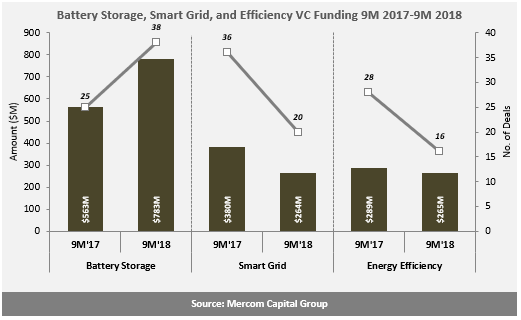

Global VC funding (venture capital, private equity, and corporate venture capital) for Battery Storage, Smart Grid, and Efficiency companies in 9M 2018 was eight percent higher at $1.3 billion compared to the $1.2 billion raised in 9M 2017.

Battery Storage

VC funding for Battery Storage companies in 9M 2018 was 39 percent higher with $783 million raised compared to the $563 million raised in 9M 2017.

In Q3 2018, VC funding for Battery Storage, Smart Grid, and Efficiency companies increased to $469 million in 23 deals compared to $371 million in 28 deals in Q2 2018. Funding was 129 percent higher YoY compared to the $205 million raised in 29 deals in Q3 2017.

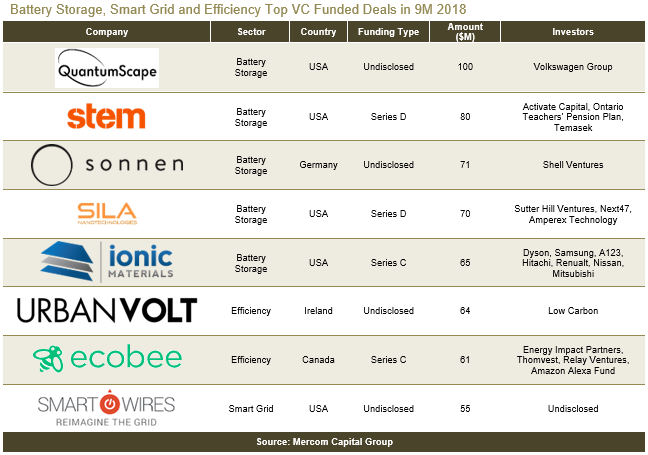

Top 5 VC deals in 9M 2018: $100 million raised by QuantumScape, $80 million raised by Stem, $71 million raised by sonnen, $70 million raised by Sila Technologies, and $65 million secured by Ionic Materials. A total of 51 VC investors participated in Battery Storage funding in 9M 2018.

Announced debt and public market financing activity in the first nine months of 2018 ($446 million in eight deals) was 156 percent higher compared to the first nine months of 2017 when $174 million was raised in 11 deals.

There were six announced Battery Storage project funding deals in 9M 2018 bringing in a combined $72 million compared to $2.1 billion in six deals in 9M 2017.

In 9M 2018 there were a total of 10 Battery Storage M&A transactions compared to three transactions in 9M 2017. There were two Battery Storage M&A transactions in Q3 2018. By comparison, there were four Battery Storage M&A transactions in Q2 2018 and one transaction in Q3 2017.

In the first nine months of 2018, there were seven Battery Storage project M&A transactions compared to four transactions in 9M 2017. There were five Battery Storage project M&A transactions in Q3 2018. By comparison, there were two Battery Storage project M&A transactions in both Q2 2018 and Q3 2017.

Smart Grid

VC funding for Smart Grid companies in 9M 2018 was 31 percent lower with $264 million compared to the $380 million raised in 9M 2017.

In Q3 2018, VC funding for Smart Grid companies increased to $129 million in nine deals compared to $60 million in four deals in Q2 2018. The funding amount was 70 percent higher YoY compared to the $76 million raised in 14 deals in Q3 2017.

Top 5 VC deals in 9M 2018: $55 million raised by Smart Wires, $35 million raised by Volta Charging, $32 million raised by AutoGrid Systems, $31 million raised by Ample, and $27 million raised by Bidgely. A total of 48 VC investors participated in Smart Grid funding in 9M 2018.

Announced debt and public market financing for Smart Grid companies came to $1.3 billion in three deals in 9M 2018 compared to $20 million in two deals in 9M 2017.

In 9M 2018 there were a total of nine Smart Grid M&A transactions, compared to 19 transactions (five disclosed) in 9M 2017. There were four Smart Grid M&A transactions in both Q3 and Q2 2018. By comparison, there were six Smart Grid M&A transactions in Q3 2017.

Efficiency

VC funding for Energy Efficiency companies in 9M 2018 was eight percent lower with $265 million compared to the $289 million raised in 9M 2017.

In Q3 2018, VC funding for Efficiency companies increased to $100 million in six deals compared to $67 million in six deals in Q2 2018. Funding was 113 percent higher YoY compared to $47 million raised in eight deals in Q3 2017.

Top 5 VC deals in 9M 2018: $64 million secured by UrbanVolt, $61 million and $36 million raised by ecobee in two separate deals, $27 million secured by Carbon Lighthouse, and Arcadia Power’s $25 million. A total of 54 VC investors participated in Energy Efficiency funding in 9M 2018.

Announced debt and public market financing activity in 9M 2018 ($212 million in two deals) was 91 percent lower compared to 9M 2017 when $2.3 billion was raised in 13 deals.

Property Accessed Clean Energy (PACE) financing deals in 9M 2018 came to $694 million in three deals compared to $873 million in four deals in 9M 2017.

In 9M 2018 there were a total of three Efficiency M&A transactions, compared to seven transactions (three disclosed) in 9M 2017. There were no Efficiency M&A transactions in Q3 2018. By comparison, there were two Efficiency M&A transactions in both Q2 2018 and Q3 2017.

To get a copy of the report, visit: https://mercomcapital.com/product/q3-2018-funding-and-ma-report-for-storage-grid-efficiency

Image credit: Stem