Global VC funding (venture capital, private equity, and corporate venture capital) for Battery Storage, Smart Grid, and Efficiency companies in 9M 2019 was 54% higher with over $2 billion compared to $1.3 billion raised in 9M 2018.

To get a copy of the report, visit: https://mercomcapital.com/product/9m-and-q3-2019-funding-and-ma-report-for-storage-grid-efficiency

Total corporate funding (including venture capital funding, public market, and debt financing) for the Battery Storage, Smart Grid, and Energy Efficiency sectors in 9M 2019 was down with $2.7 billion compared to $3.3 billion in 9M 2018.

Battery Storage

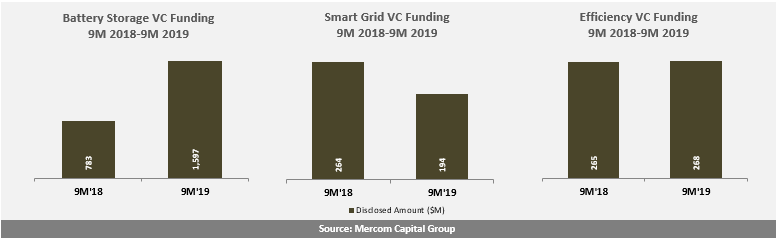

VC funding for Battery Storage companies in 9M 2019 was up 104% with $1.6 billion in 25 deals compared to the $783 million in 38 deals in 9M 2018. The increase was primarily due to Northvolt’s $1 billion funding round in Q2 2019.

The Top 5 VC funding deals in 9M 2019: Northvolt raised $1 billion, Sila Nanotechnologies raised $170 million, Energy Vault raised $110 million, Romeo Power secured $89 million, and Form Energy raised $40 million. A total of 60 VC investors participated in Battery Storage funding in 9M 2019.

Announced debt and public market financing activity in the first nine months of 2019 ($560 million in seven deals) was 24% higher compared to the first nine months of 2018 when $450 million was raised in nine deals.

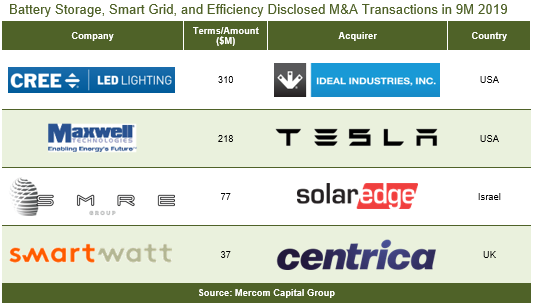

There were a total of 10 (two disclosed) Battery Storage M&A transactions both in 9M 2019 and 9M 2018 each.

In the first nine months of 2019, there were eight project M&A transactions (two disclosed) compared to seven undisclosed transactions in 9M 2018.

Smart Grid

VC funding in Smart Grid companies in 9M 2019 was 27% lower with $194 million compared to $264 million in 9M 2018.

The Top 5 VC funding deals in 9M 2019: eSmart Systems raised $34 million, SmartRent raised $32 million, CleanSpark raised $20 million, Volta Charging raised $20 million, and Innowatts received $18 million. A total of 63 VC investors participated in Smart Grid funding in 9M 2019.

Announced debt and public market financing for Smart Grid companies came to $45 million in two deals in 9M 2019 compared to $1.3 billion in three deals in 9M 2018.

In 9M 2019, there were a total of 23 Smart Grid M&A transactions (one disclosed), compared to nine deals (all undisclosed) in 9M 2018.

Efficiency

VC funding for Energy Efficiency companies in 9M 2019 was flat with $268 million compared to the $265 million raised in 9M 2018.

The Top 5 VC funding deals in 9M 2019 were: Kinestral Technologies raised $100 million, Budderfly raised $55 million, Cimcon Lighting raised $33 million, Carbon Lighthouse secured $33 million, and 75F received $18 million. A total of 33 VC investors participated in Energy Efficiency funding in 9M 2019.

Announced debt and public market financing activity in the first nine months of 2019 ($56 million in two deals) was 74% lower compared to 9M 2018 when $212 million went into two deals.

In 9M 2019, there were a total of nine Efficiency M&A transactions (two disclosed), compared to three transactions (all undisclosed) in 9M 2018.

To get a copy of the report, visit: https://mercomcapital.com/product/9m-and-q3-2019-funding-and-ma-report-for-storage-grid-efficiency

Image credit: Amazon Web Services