Total corporate funding (including venture capital funding, public market, and debt financing) for Battery Storage, Smart Grid, and Efficiency companies in 1H 2019 was flat with $2.3 billion compared to $2.4 billion raised in 1H 2018, a four percent decrease year-over-year (YoY). The decline in funding in 1H 2019 was due to lower funding activity in Smart Grid companies, while funding increased in the Battery Storage and Efficiency sectors.

To get a copy of the report, visit: https://mercomcapital.com/product/q2-2019-funding-and-ma-report-for-storage-grid-efficiency

Global VC funding (venture capital, private equity, and corporate venture capital) for Battery Storage, Smart Grid, and Efficiency companies in 1H 2019 was 102% higher with $1.7 billion compared to over $843 million in 1H 2018.

In Q2 2019, VC funding for the Battery Storage, Smart Grid, and Efficiency companies jumped to $1.5 billion in 20 deals compared to $210 million in 23 deals in Q1 2019. Funding amounts were 304% higher YoY compared to the $371 million raised in 28 deals in Q2 2018. The increase in funding activity was largely due to a billion-dollar deal in the Battery Storage sector.

Battery Storage

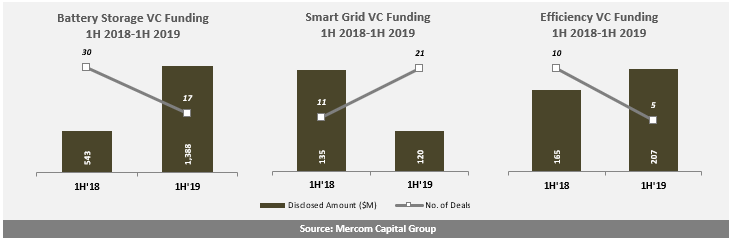

VC funding in Battery Storage companies in 1H 2019 was up by 139% with $1.4 billion in 17 deals compared to the $543 million in 30 deals in 1H 2018. The increase was due to Northvolt’s $1 billion funding round.

The Top 5 VC funding deals in 1H 2019 were the following: Northvolt raised $1 billion, Sila Nanotechnologies raised $170 million, Romeo Power secured $88.6 million, Zenobe Energy secured $32.3 million, and LivGuard Energy Technologies raised ~$32 million. A total of 41 VC investors participated in Battery Storage funding in 1H 2019.

Announced debt and public market financing activity in the first half of 2019 ($547 million in five deals) was 275% higher compared to the first half of 2018 when $146 million was raised in six deals.

There were four announced Battery Storage project funding deals in 1H 2019 bringing in a combined $499 million compared to $34 million in four deals in 1H 2018.

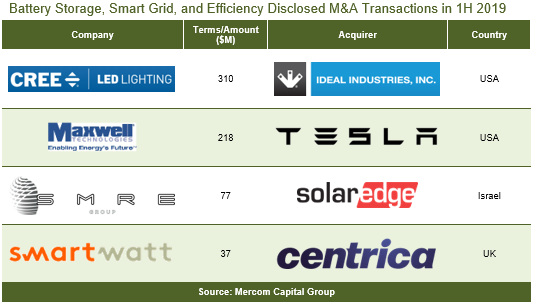

In 1H 2019 there were a total of six (one disclosed) Battery Storage M&A transactions, compared to eight transactions (two disclosed) in 1H 2018. There were two undisclosed Battery Storage M&A transactions in Q2 2019. By comparison, there were four (one disclosed) Battery Storage M&A transactions in Q1 2019 and Q2 2018 apiece.

In the first half of 2019, there were four project M&A transactions (one disclosed) compared to two undisclosed transactions in 1H 2018. There were three project M&A transactions (one disclosed) involving Battery Storage companies in Q2 2019. In Q1 2019, there was one undisclosed M&A transaction. In a YoY comparison, there were two transactions (both undisclosed) in Q2 2019.

Smart Grid

VC funding in Smart Grid companies in 1H 2019 was 11% lower with $120 million compared to the $135 million raised in 1H 2018.

In Q2 2019, VC funding for Smart Grid companies more than doubled to $88 million in six deals compared to $32 million in 15 deals in Q1 2019. Funding amounts were 47% higher YoY compared to $60 million raised in four deals in Q2 2018.

The Top 5 VC funding deals in 1H 2019 were: SmartRent raised $32 million, CleanSpark raised $20 million, Innowatts received $18.2 million, Wirepas raised $16.2 million, and Driivz raised $12 million. A total of 48 VC investors participated in Smart Grid funding in 1H 2019.

Announced debt and public market financing for Smart Grid companies came to $1 million in one deal in 1H 2019 compared to $1.3 billion in two deals in 1H 2018.

In 1H 2019, there were a total of 17 Smart Grid M&A transactions (one disclosed), compared to five transactions (all undisclosed) in 1H 2018. There were eight Smart Grid M&A transactions (all undisclosed) in Q2 2019. By comparison, there were nine Smart Grid M&A transactions (one disclosed) in Q1 2019 and four transactions (all undisclosed) in Q2 2018.

Efficiency

VC funding for Energy Efficiency companies in 1H 2019 was 25% higher with $207 million compared to the $165 million raised in 1H 2018.

In Q2 2019, VC funding for Efficiency companies increased with $107 million in four deals compared to $100 million in one deal in Q1 2019. Funding amounts were 60% higher YoY compared to $67 million raised in six deals in Q2 2018.

The Top 5 VC funding deals in 1H 2019 were as follows: Kinestral Technologies raised $100 million, Budderfly raised $55 million, Carbon Lighthouse secured $32.6 million, and METRON received $11.3 million. A total of 18 VC investors participated in Energy Efficiency funding in 1H 2019.

Announced debt and public market financing activity in the first half of 2019 ($56 million in two deals) was 74% lower compared to 1H 2018 when $212 million was raised in two deals.

Property Accessed Clean Energy (PACE) financing deals in 1H 2019 came to $394 million in two deals compared to $694 million in three deals in 1H 2018.

In 1H 2019 there were a total of eight Efficiency M&A transactions (two disclosed), compared to three transactions (all undisclosed) in 1H 2018. There were seven Efficiency M&A transactions (one disclosed) in Q2 2019. By comparison, there was one disclosed Efficiency M&A transaction in Q1 2019 and two undisclosed M&A transactions in Q2 2018.

There were eight acquisitions made by utilities and oil and gas companies in 1H 2019.

To get a copy of the report, visit: https://mercomcapital.com/product/q2-2019-funding-and-ma-report-for-storage-grid-efficiency

Image credit: Fluence