Energy Storage

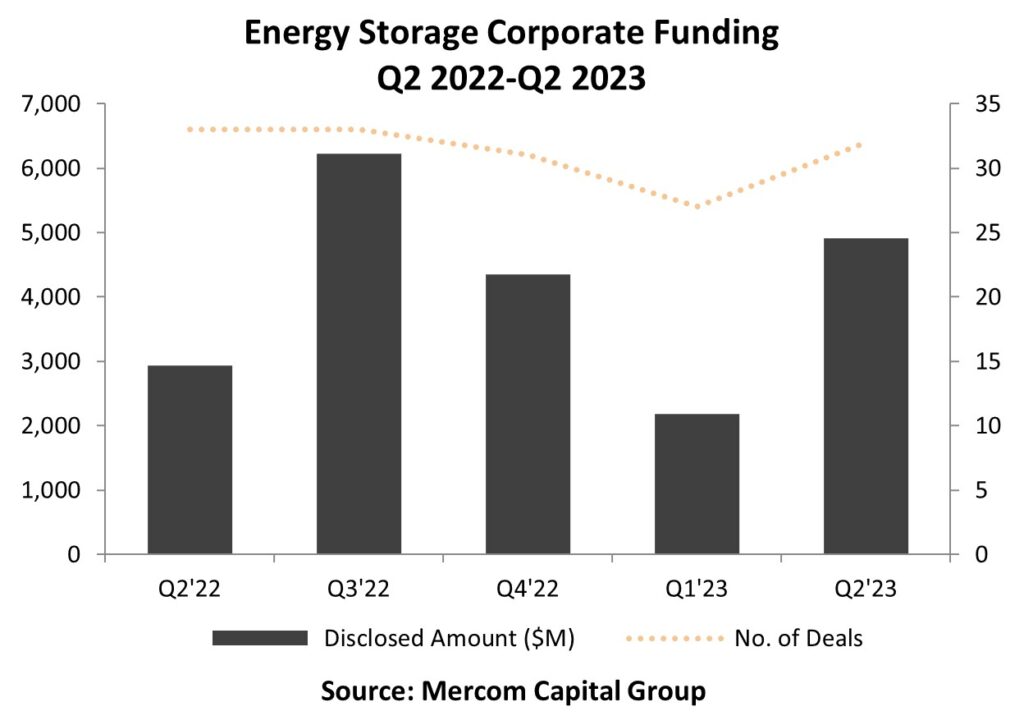

Corporate funding in Energy Storage bounced back in Q2 2023 with $4.9 billion raised in 32 deals, a 126% increase quarter-over-quarter (QoQ). Funding was up 67% year-over-year (YoY).

To get a copy of the report, visit: https://mercomcapital.com/product/1h-q2-2023-funding-ma-report-storage-grid

Corporate funding into Energy Storage companies reached $7.1 billion in 59 deals in 1H 2023, a 55% decrease YoY compared to $15.8 billion in 60 deals in 1H 2022. LG Energy Solutions’ $10.7 billion IPO in January 2022 distorted the YoY comparison.

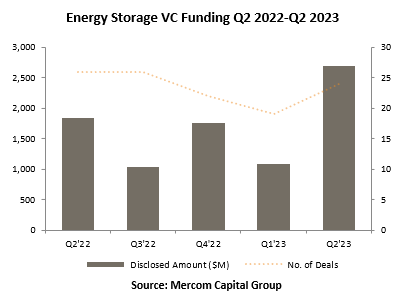

VC funding for Energy Storage in 1H 2023 was up 27%, with $3.8 billion in 43 deals compared to $3 billion in 48 deals in 1H 2022. VC funding for Energy Storage companies was also up in Q2 2023 with $2.7 billion in 24 deals, a 148% increase QoQ compared to $1.1 billion in 19 deals in Q1 2023. With strong tailwinds from the U.S. Inflation Reduction Act (IRA), energy storage companies across the supply chain, from materials to project developers, were attractive to investors.

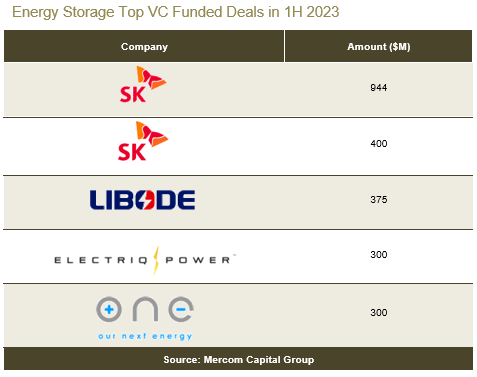

The Top 5 Energy Storage VC funding deals in 1H 2023 were: SK on, which raised $944 million and $400 million in two separate deals; Libode New Material raised $375 million; and Electriq Power and Our Next Energy, which raised $300 million each.

Announced debt and public market financing activity in the first half of 2023 ($3.3 billion in 16 deals) was lower compared to the first half of 2022, when $12.8 billion was raised in 12 deals.

There were 17 announced Energy Storage project funding deals in 1H 2023, bringing in a combined $4.1 billion compared to $3.8 billion in 16 deals in 1H 2022.

In 1H 2023, eight (one disclosed) Energy Storage M&A transactions were completed, compared to 13 deals (six disclosed) in 1H 2022.

Smart Grid

In 1H 2023, Smart Grid companies raised $1.8 billion in corporate funding in 33 deals, a 64% increase compared to $1.1 billion raised in 25 deals in 1H 2022. Boosted by significant investments into smart charging, VC funding in Smart Grid companies in 1H 2023 was 32% higher, with $986 million compared to the $746 million raised in 1H 2022.

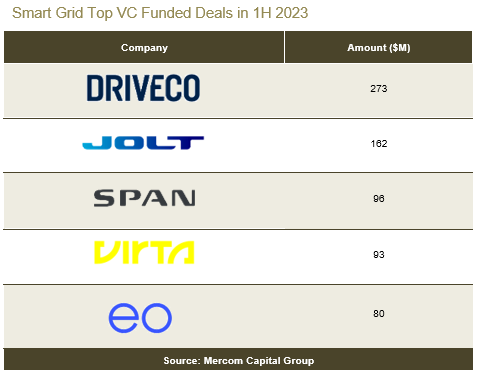

The Top 5 Smart Grid VC funding deals in 1H 2023 were: Driveco with $273 million, Jolt Energy with $162 million, SPAN with $96 million, Virta with $93 million, and EO Charging with $80 million.

Announced debt and public market financing for Smart Grid companies came to $839 million in seven deals in 1H 2023 compared to $307 million in four deals in 1H 2022.

In 1H 2023, there were six Smart Grid M&A transactions (three disclosed) compared to 10 transactions (two disclosed) in 1H 2022.

To get a copy of the report, visit: https://mercomcapital.com/product/1h-q2-2023-funding-ma-report-storage-grid