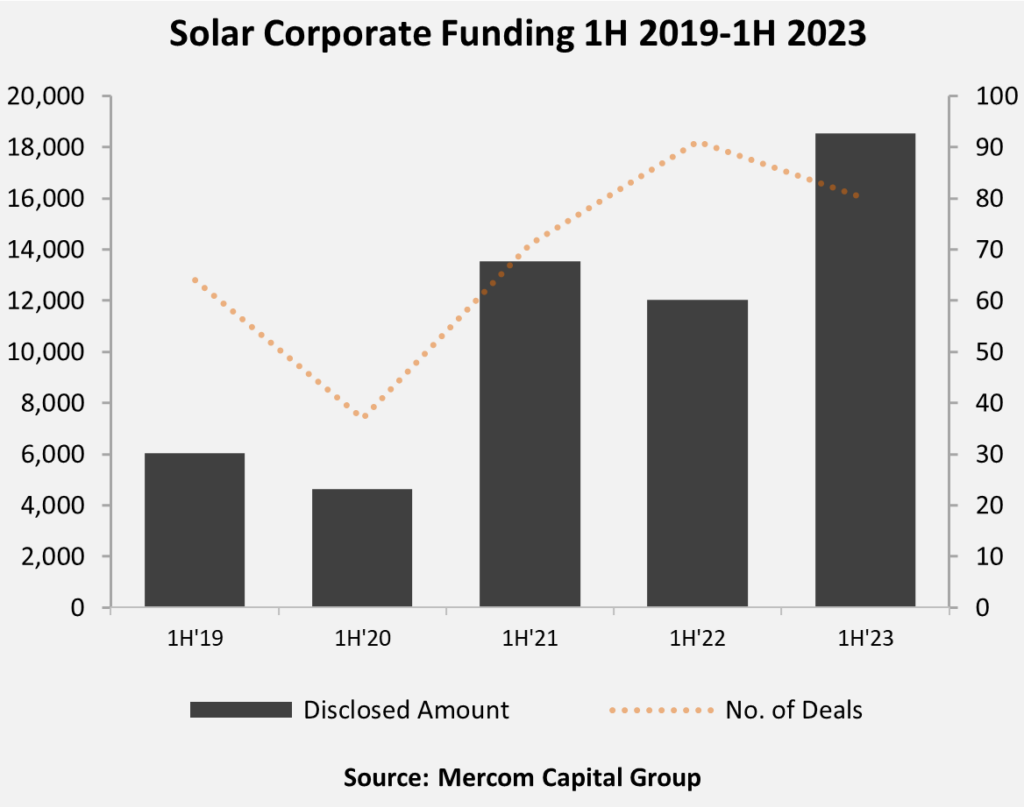

Total corporate funding, including venture capital (VC) funding, public market, and debt financing, in 1H 2023 totaled $18.5 billion, 54% higher year-over-year (YoY) compared to $12 billion raised in 1H 2022. The number of deals decreased by 12% YoY, with 80 deals in 1H 2023 compared to 91 during the same period last year.

To get the report, visit: https://tinyurl.com/MercomSolarQ22023

“Even amidst the tightening financial market conditions and high interest rates, the solar industry remained strong in the first half of the year. Besides AI, cleantech is one of the few sectors still attracting VC interest. Demand due to the Inflation Reduction Act (IRA) is so strong that even interest rate-sensitive public market and debt financing in solar was up year-over-year. The lack of easy money, however, affected M&A activity negatively,” said Raj Prabhu, CEO of Mercom Capital Group.

In 1H 2023, global VC funding activity rose 3% YoY, with $3.8 billion in 33 deals compared to $3.7 billion in 53 deals in the first half of 2022.

Solar downstream companies led financing activity with 17 deals worth $2.5 billion in 1H 2023.

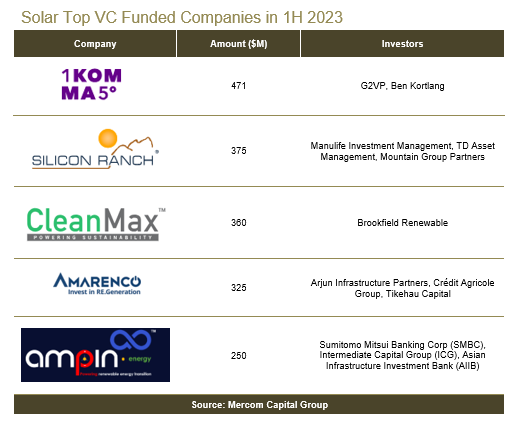

The top VC deals in 1H 2023 were: $471 million raised by 1KOMMA5°, $375 million raised by Silicon Ranch, $360 million raised by CleanMax Solar, $325 million raised by Amarenco, and $250 million raised by Amp Energy India.

A total of 134 VC investors participated in solar funding in 1H 2023.

Solar public market financing in 1H 2023 came to $6.7 billion in 14 deals, 103% higher than $3.3 billion in eight deals in 1H 2022.

Solar debt financing activity in 1H 2023 reached $8 billion in 33 deals, a 60% increase compared to 1H 2022, when $5 billion was raised in 30 deals.

In 1H 2023, seven securitization deals totaled $1.9 billion, a 36% increase YoY compared to $1.4 billion raised in five deals in 1H 2022. Over $16 billion have been raised through securitization deals since 2013.

There were 48 solar M&A transactions in 1H 2023 compared to 53 transactions in 1H 2022. The largest deal was by Brookfield Renewable, which agreed to acquire Duke Energy’s unregulated utility-scale commercial renewables business in the U.S. for approximately $2.8 billion.

In 1H 2023, there were 116 project acquisitions for 25.5 GW of solar projects compared to 148 project acquisitions totaling 37.8 GW in 1H 2022.

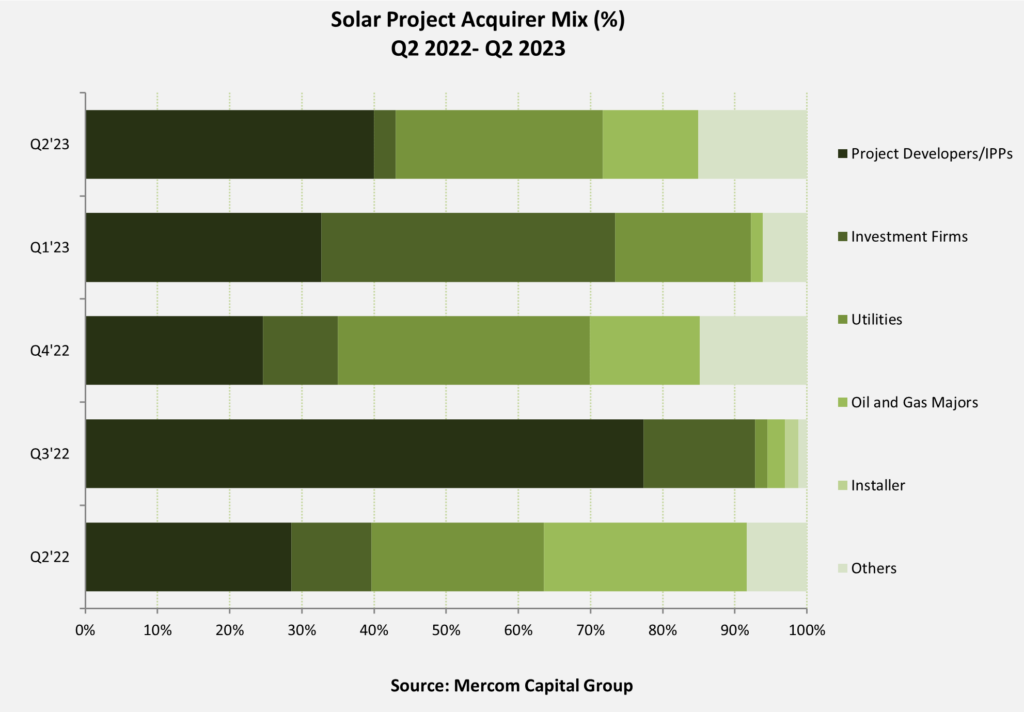

Project developers and independent power producers (IPPs) were the most active acquirers of solar projects in Q2 2023, picking up 5.5 GW, followed by utilities with 3.9 GW. Others—Insurance companies, pension funds, energy trading businesses, industrial conglomerates, and IT firms—acquired another 2.1 GW. Oil and gas companies acquired 1.8 GW of projects, and investment firms acquired 407 MW.

In 1H 2023, there were 116 project acquisitions for 25.5 GW of solar projects compared to 148 project acquisitions totaling 37.8 GW in 1H 2022.

There were 187 companies and investors covered in this report. It is 98 pages long and contains 84 charts, graphs, and tables.

To learn more about the report, visit: https://tinyurl.com/MercomSolarQ22023