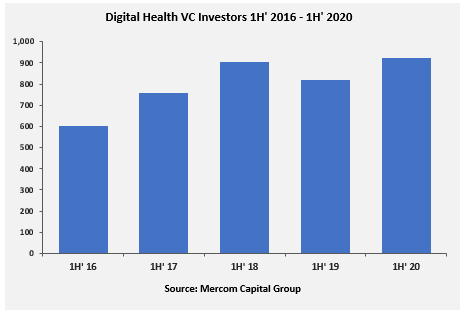

A total of 921 investors funded over $6 billion in 303 digital health companies in 1H 2020, according to Mercom 1H & Q2 2020 Digital Health Funding and M&A Report.

One hundred and twelve investors made two or more investments during 1H 2020, and a total of 921 investors participated in funding deals in 1H 2020 compared to 821 investors in 1H 2019.

To learn more about the investor data, please visit: https://mercomcapital.com/digital-health-reports-news/

Optum Ventures, a venture capital firm that invests in healthcare IT companies, led the investment activity. The firm has invested over $300 million in eight digital health companies. Most of the investments were made in companies focused on telehealth and mHealth apps. The investment portfolio includes – Heartbeat Health, Holmusk, Mindstrong, RubiconMD, DocASAP, Kaia Health, and DispatchHealth.

Oak HC/FT, a venture growth equity fund that invests in healthcare IT and financial services technology, invested $350 million in seven digital health companies. Digital health companies focused on clinical decision support and analytics were the prime targets. The fund’s investment portfolio includes DispatchHealth, axialHealthcare, Vesta Healthcare, Komodo Health, and Oncology Analytics.

UnityPoint Health Ventures (the corporate venture capital arm of UnityPoint Health), which invests in early-stage companies, made six investments, funding over $60 million. Its portfolio includes companies focused on telehealth – such as b.well Connected Health, Bright.md, and CareSignal (previously Epharmix).

Andreessen Horowitz (known as a16z), a venture capital firm based in Silicon Valley, California, invested $280 million in six digital health companies. Data analytics companies were the top target. The firm’s investments include Ribbon Health, Komodo Health, PatientPing, among others.

GV (formerly Google Ventures), the venture capital investment arm of Alphabet, invested over $450 million in five investments. The firm’s main targets were data analytics companies. Its investment portfolio includes Verana Health, DNAnexus, and PatientPing. GV invested almost $2 billion in over 40 digital health companies since 2010, according to Mercom database.

Other investors who made four or more investments during 1H include, Y Combinator, Venrock, General Catalyst, Khosla Ventures, Lux Capital, F-Prime Capital, and Founders Fund.