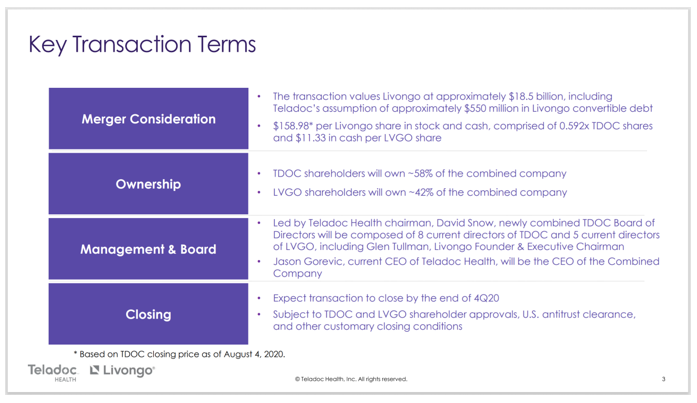

Telehealth provider Teladoc has entered into a definitive agreement to acquire Livongo Health, a digital chronic care management company, the deal valued at $18.5 billion is one of the largest digital health M&A transactions ever.

Livongo Health, founded in 2008, had raised over $230 million VC funding from venture capital firms including, General Catalyst, Kinnevik, Kleiner Perkins Caufield & Byers, Microsoft Ventures, Sapphire Ventures, Zaffre Investments, 7wire Ventures, Echo Health Ventures.

Teladoc Health, which became public in 2015, had raised over $80 million VC funding.

Livongo, which went public last year, has seen a 236% rise in stock price since its initial public offering and a whopping 411% increase in stock price so far this year. Teledoc stock price reached an all-time high this week, and the stock has risen by almost 141% YTD in 2020.

The newly combined company will be called Teladoc Health and will be headquartered in Purchase, New York. Upon completion of the acquisition, Teladoc Health will hold 58%, and Livongo Health will hold 42% of the combined company.

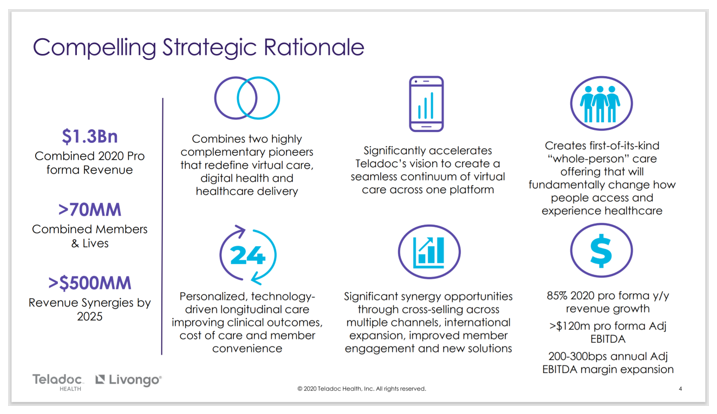

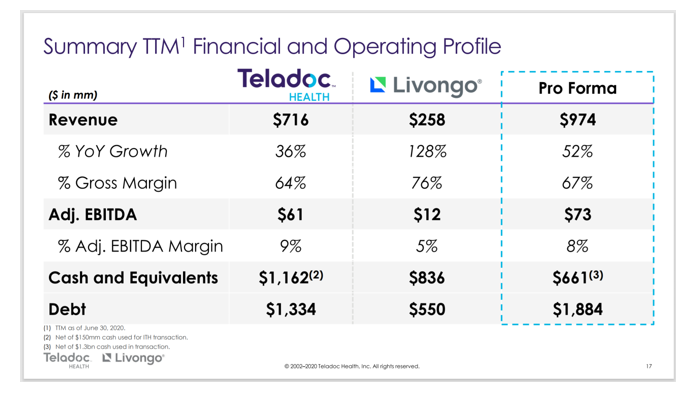

The combined company is expected to generate $1.3 billion in revenue in 2020, representing year-over-year growth of 85%. The adjusted (EBITDA) earnings before interest, taxes, depreciation, and amortization is expected to reach $120 million for 2020.

Jason Gorevic, Teladoc’s current CEO, will be the CEO of the combined company. Led by Teladoc Health chairman, David Snow, the newly combined Teladoc Health Board of Directors will be composed of eight members of the Teladoc Health Board and five members of the Livongo Board.

“This highly strategic combination will create the leader in consumer-centered virtual care and provides a unique opportunity to further accelerate the growth of our data-driven member platform and experience,” said Glen Tullman, Livongo Founder and Executive Chairman.

Glen Tullman added, “By expanding the reach of Livongo’s pioneering Applied Health Signals platform and building on Teladoc Health’s end-to-end virtual care platform, we’ll empower more people to live better and healthier lives. This transaction recognizes Livongo’s significant progress and will enable Livongo shareholders to benefit from the long-term upside as the combined company is positioned to serve an even larger addressable market with a truly unmatched offering.”

The transaction is expected to close by the end of this year, pending regulators and shareholders’ approval.

The transaction is expected to close by the end of this year, pending regulators and shareholders’ approval.

Lazard served as exclusive financial advisor to Teladoc Health and Paul, Weiss, Rifkind, Wharton & Garrison served as legal advisor.

Morgan Stanley served as exclusive financial advisor to Livongo Health and Skadden, Arps, Slate, Meagher & Flom served as legal advisor.

Telehealth visits have risen exponentially during the pandemic, and both these companies have benefitted significantly from it. The deal comes at a time when valuations have reached their peak for both the companies. It remains to be seen how this transaction plays out in the long-term after the effects of COVID ease, and patients begin to see their doctors in person again.

Image Credit: Livongo Health