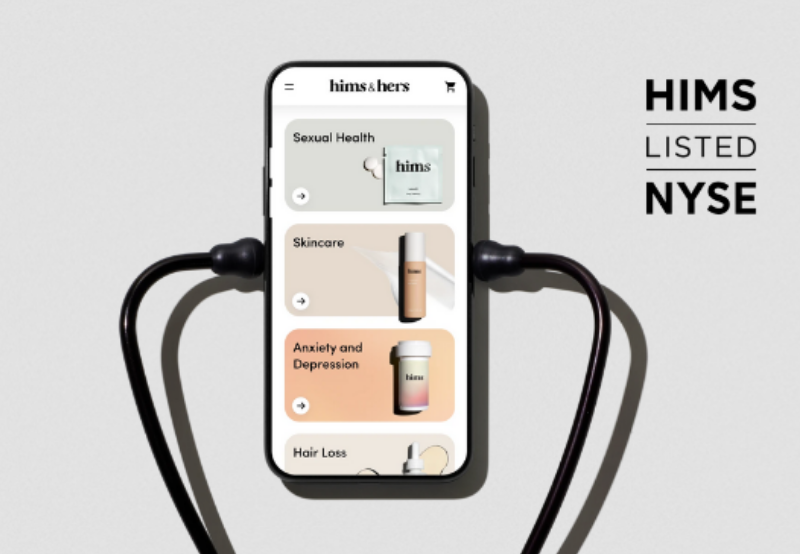

Hims & Hers, an online direct-to-consumer telehealth company that uses remote consultation to prescribe cosmetic and sexual health products, has completed its business combination with blank-check company Oaktree Acquisition Corp.

Hims & Hers announced the business combination deal with Oaktree Acquisition at a $1.6 billion valuation. Hims & Hers is backed by $150 million funding. Investors include Founders Fund, McKesson Ventures, Canadian Pension Plan Investment Board, Atomic, and others.

The company, founded in 2017, has onboarded more than 260,000 members for its platform. Hims was initially focused on helping men with issues like erectile dysfunction and hair loss. The company has since grown to include a women’s health division, known as Hers, developed its own electronic medical record, and added an online pharmacy. Today, the company works with patients to treat around 100 different healthcare issues, including migraines, stomachache, flu symptoms, anxiety, depression, and more.

“We drove tremendous progress in 2020 toward our mission of becoming the front door to the healthcare system,” said Andrew Dudum, CEO and co-founder of Hims & Hers. “Today’s milestone brings us even closer to making modern, affordable care accessible to more Americans. By providing a seamless patient experience combined with proprietary technology, we intend to transform many of healthcare’s most important categories, including primary care and mental health.”

As a result of the business combination, Hims & Hers received $279.5 million, which includes cash proceeds of $204.5 million from Oaktree Acquisition Corp.’s trust account and $75 million from private placement investors, including funds managed by Franklin Templeton and certain Oaktree clients.

LionTree Advisors served as lead financial advisor to Hims & Hers. Citi also served as a financial advisor, and Gunderson Dettmer Stough Villeneuve Franklin & Hachigian served as legal counsel.

Credit Suisse and Deutsche Bank Securities served as capital markets advisors, and private placement agents to Oaktree Acquisition Corp. Deutsche Bank Securities acted as financial advisor to Oaktree Acquisition Corp. Kirkland & Ellis served as legal counsel to Oaktree Acquisition Corp.

More Recently, Talkspace, a telebehavioral healthcare company, and Hudson Executive Investment Corp, a special purpose acquisition company (SPAC), announced a business combination agreement.

The combined company will operate as Talkspace and intends to be listed on NASDAQ under the symbol “TALK.”

The transaction values Talkspace at an initial enterprise value of $1.4 billion (approximately 11x 2021 estimated ($125 million) net revenue of the Talkspace). The company has raised over $100 VC funding to date from Revolution Growth, Norwest Venture Partners, Qumra Capital, Spark Capital, Compound Ventures, SoftBank, TheTime, and others.