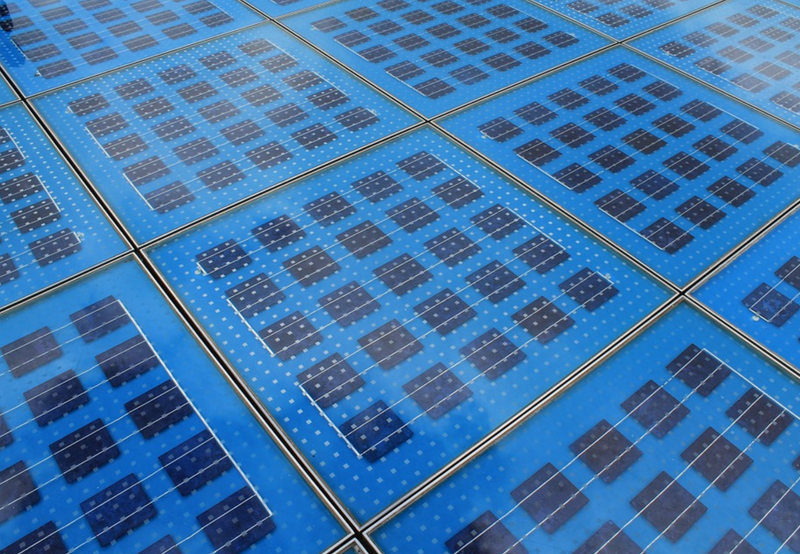

Total global corporate funding in the solar sector, including venture capital/private equity (VC), debt financing, and public market financing, raised by public companies came to

Total global corporate funding in the solar sector, including venture capital/private equity (VC), debt financing, and public market financing, raised by public companies came to

Venture capital (VC) funding (including private equity and corporate venture capital) for Smart Grid companies came to $81 million in 12 deals in Q3 2015,

Venture capital (VC) funding, including private equity and corporate venture capital, in the Health IT sector increased 32 percent quarter over quarter (QoQ), coming in

Venture capital (VC) funding (including private equity) for Smart Grid companies was down with $104 million in 18 deals in Q2 2015, compared to $185

Venture capital (VC) funding, including private equity and corporate venture capital, in the Health IT / Digital Health sector increased 53 percent QoQ, coming in

Venture Capital (VC) funding in the Smart Grid sector in Q1 2015 came in at $185 million in 15 deals, compared to $59 million in

Total global corporate funding in the solar sector, including venture capital/private equity (VC), debt financing, and public market financing raised by public companies, almost doubled

Venture capital (VC) funding in the Health IT / Digital Health sector dipped by about 35 percent, coming in at $784 million in 142 deals

Venture capital (VC) funding into smart grid technology companies was $383 million in 73 deals in 2014, compared to $410 million in 64 deals in

Venture capital (VC) funding in the Health IT sector more than doubled in 2014, coming in at $4.7 billion in 670 deals compared to $2.2