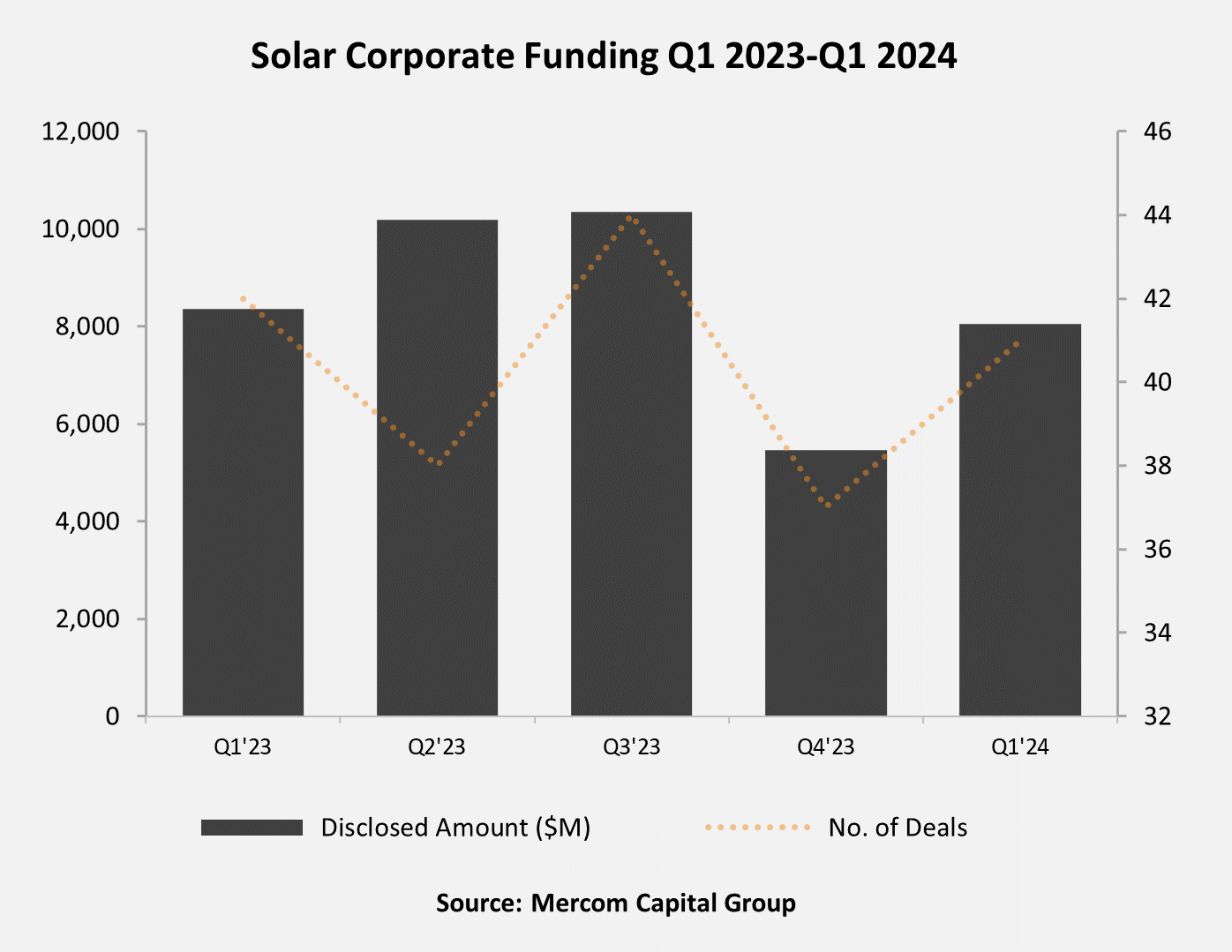

Total corporate funding into the solar sector in Q1 2024 came to $8.1 billion in 41 deals, a 4% decline year-over-year (YoY) compared to the $8.4 billion raised in 42 deals in Q1 2023. Funding increased 47% quarter-over-quarter (QoQ) compared to the $5.5 billion raised in 37 deals in Q4 2023.

To learn more about Mercom’s Q1 2024 Solar Funding and M&A Report, visit: https://mercomcapital.com/product/q1-2024-solar-funding-ma-report/

“The solar sector is experiencing peak uncertainty and a challenging investment climate. The sector is grappling with multiple hurdles, including the likelihood of prolonged high-interest rates, higher labor and construction costs due to inflation, and supply chain issues, coupled with trade disputes and tariffs,” commented Raj Prabhu, CEO of Mercom Capital Group. “Although a crash in Chinese module prices has spurred demand, it has made investments in manufacturing projects unattractive, even with incentives. VC investments were down, and M&A activity continues to be subdued. Given the current market conditions, it wouldn’t be surprising if the recovery is delayed further in conjunction with rate cuts.”

Global VC funding for the solar sector in Q1 2024 came to $406 million in 13 deals, an 81% decline YoY compared to $2.1 billion raised in 18 deals in Q1 2023. Funding declined 68% QoQ compared to the $1.3 billion raised in 19 deals in Q4 2023.

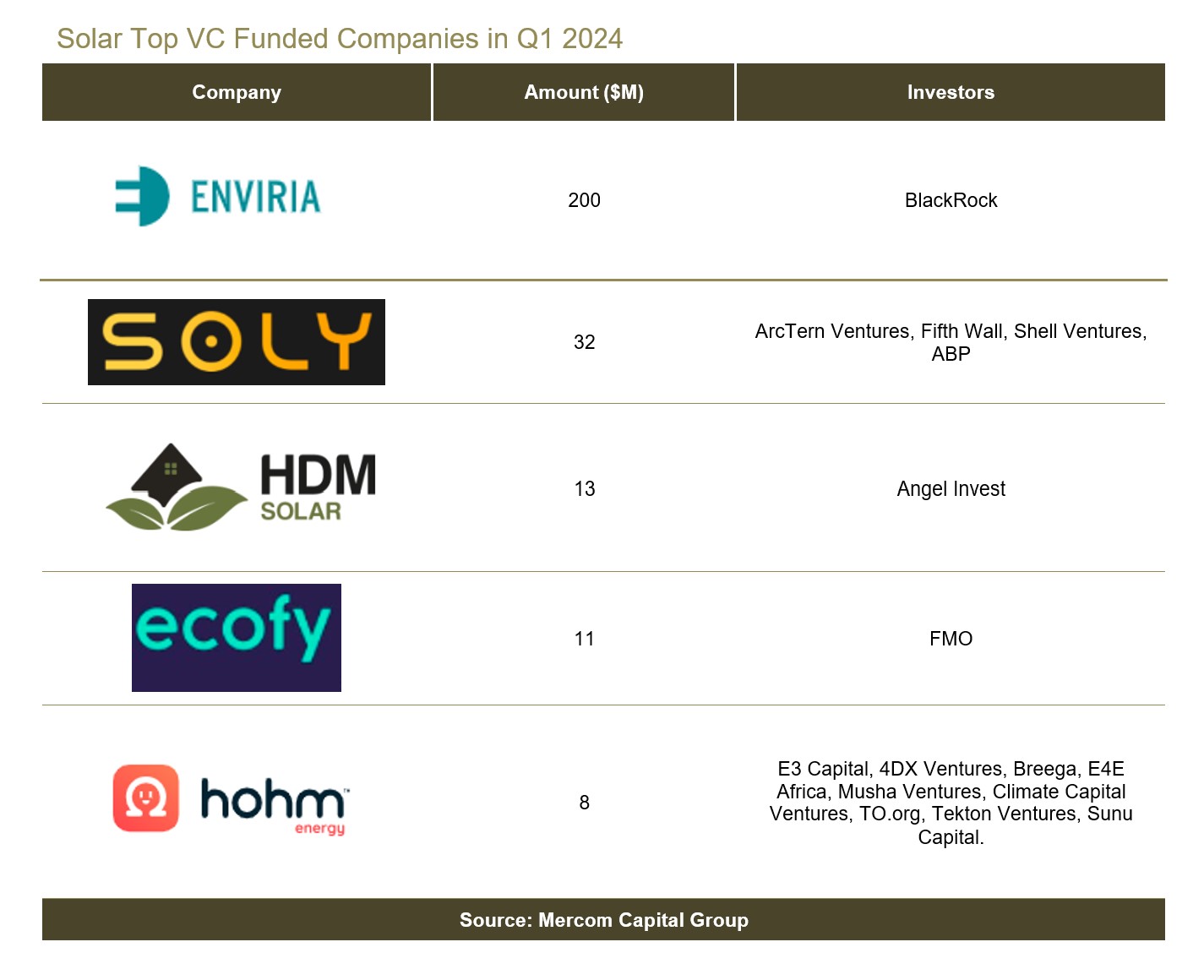

The top VC-funded companies in Q1 2024 were: ENVIRIA, which raised $200 million; Soly, with $32 million; HDM Solar, with $13 million; Ecofy, with $11 million; and Hohm Energy, with $8 million.

Of the $406 million in VC funding raised in 13 deals during Q1 2024, 70% went to solar downstream companies, with $283 million in 10 deals. In Q4 2023, solar downstream companies raised $914 million in 14 deals (72% of total VC funding). In a YoY comparison, solar downstream companies accounted for 63% of VC funding in Q1 2023, bringing in $1.3 billion in 10 deals.

Public market financing in the solar sector totaled $1.4 billion in six deals in Q1 2024, a decline of 39% YoY compared to $2.3 billion raised in seven deals in Q1 2023. However, QoQ funding increased by 627% compared to $195 million raised in three deals in Q4 2023, which was a very weak quarter.

Announced debt financing for the solar sector in Q1 2024 totaled $6.2 billion in 22 deals, a 59% increase YoY compared to Q1 2023, when $3.9 billion was raised in 17 deals. QoQ debt financing increased 55%, with $4 billion raised in 15 deals in Q4 2023.

A total of 21 solar M&A transactions were recorded in Q1 2024, the same amount as in Q4 2023, but about 22% lower compared to 27 solar M&A deals in Q1 2023.

Solar downstream companies led M&A activity with 18 transactions, followed by one balance of system, manufacturer, and one service provider company.

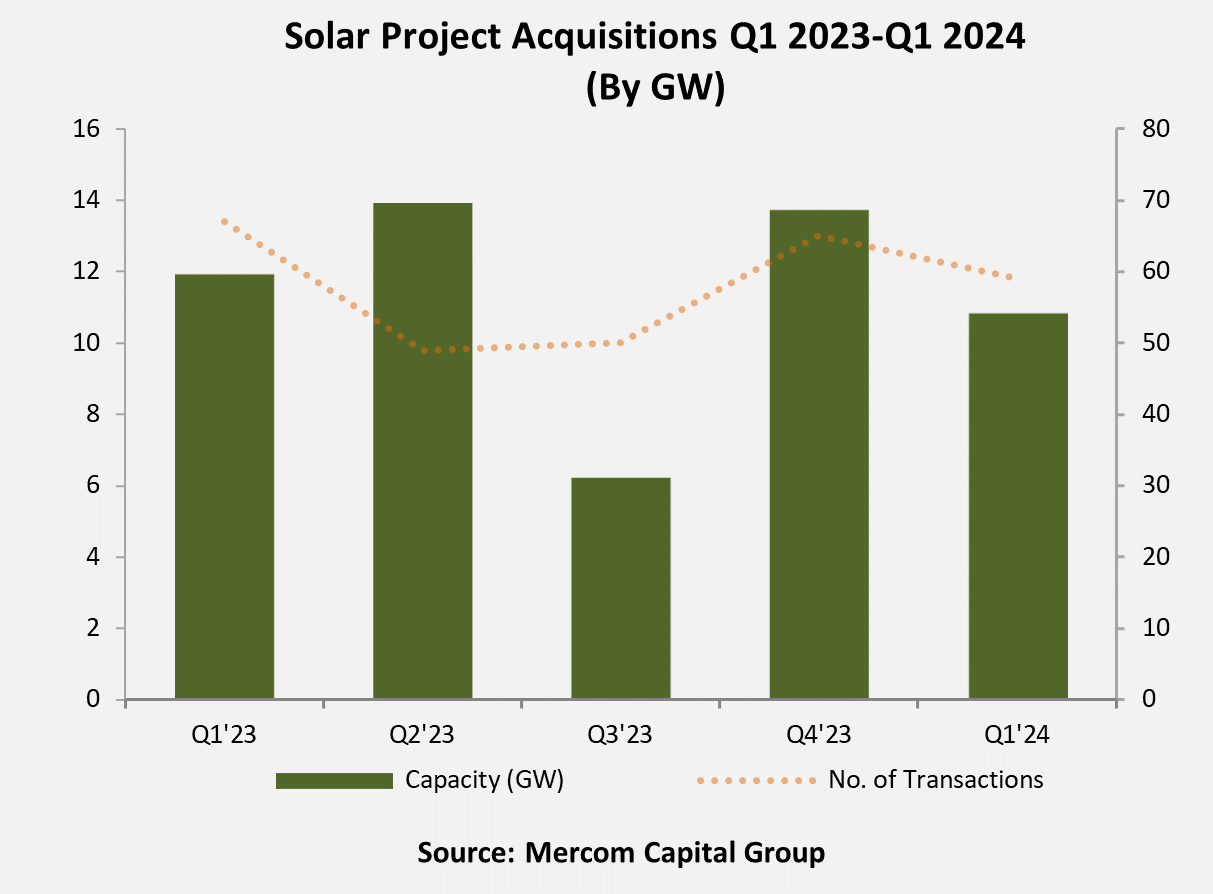

Almost 10.8 GW of solar projects were acquired in Q1 2024 compared to 11.9 GW in Q1 2023. In a QoQ comparison, 13.7 GW of solar projects were acquired in Q4 2023.

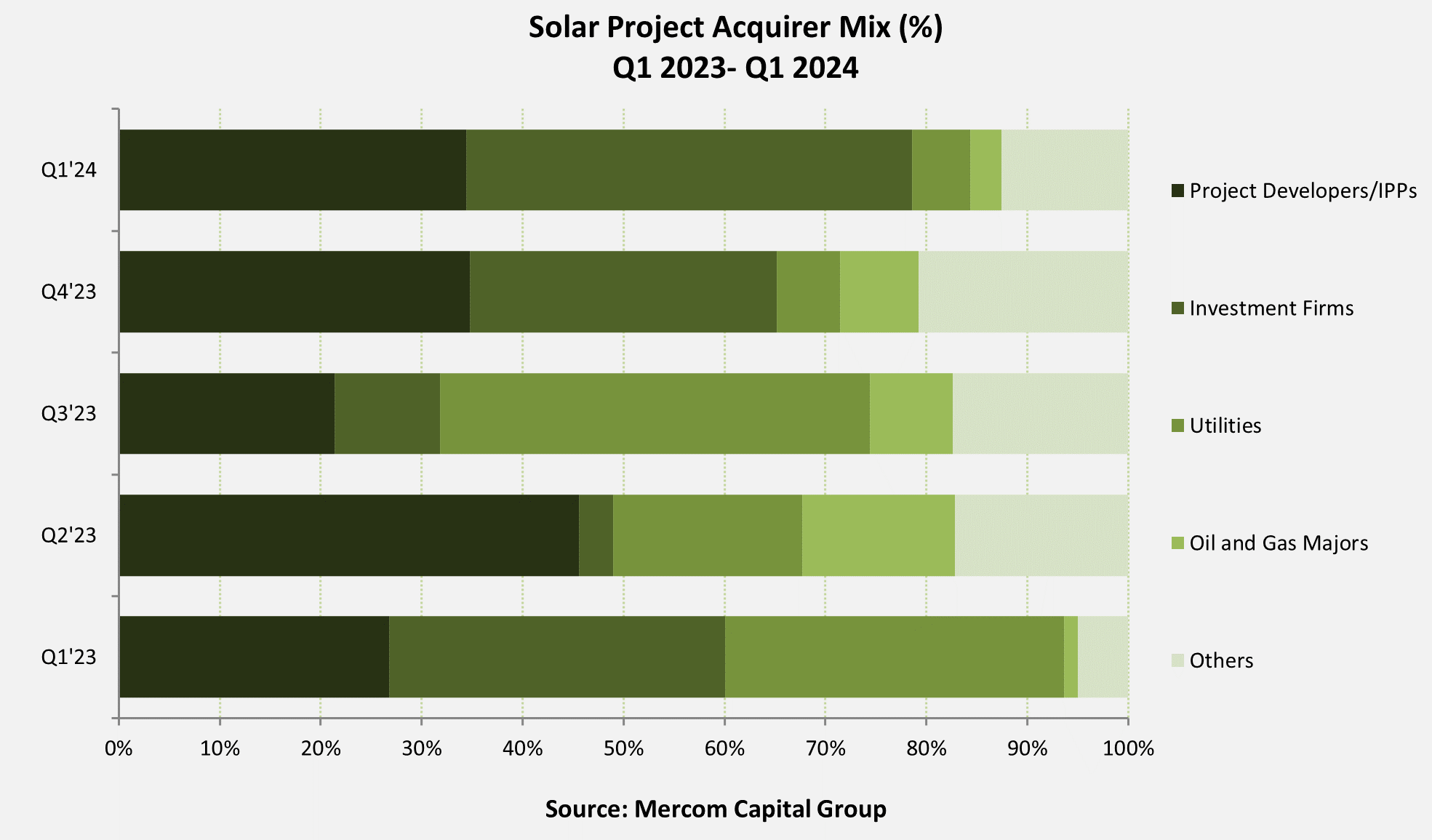

Investment firms and funds were the most active acquirers in Q1 2024, with over 4.4 GW of projects acquired. They were followed by project developers and independent power producers, which acquired 3.5 GW of projects. Electric utilities acquired 1.3 GW of projects, and oil and gas majors acquired 309 MW of projects. Telecommunications companies, integrated energy trading companies, insurance companies, and other undisclosed acquirers acquired the rest.

There were 274 companies and investors covered in this 97-page report, which contains 66 charts, graphs, and tables.

To learn more about Mercom’s Q1 2024 Solar Funding and M&A Report, visit:

https://mercomcapital.com/product/q1-2024-solar-funding-ma-report/