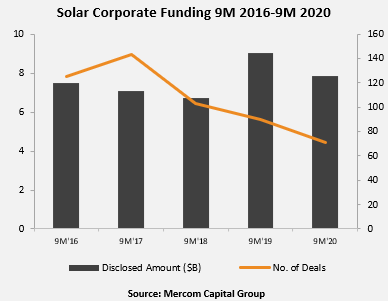

After a weak Q2, corporate funding globally (including venture capital, private equity, public market, and debt financing) in the solar sector in Q3 2020 came to $3.2 billion, compared to $2.3 billion in Q2, a 43% increase QoQ (quarter over quarter). Funding was also higher by 8% year-over-year (YoY) compared to the same quarter last year.

To get the report, visit: https://mercomcapital.com/product/9m-q3-2020-solar-funding-ma-report

However, corporate funding was still 13% lower in 9M of 2020 with $7.9 billion compared to $9 billion raised during 9M 2019.

“After declining in Q2, financing activity was up across the board, whether it was VC, private equity, public market, or debt financing, a clear sign the market is bouncing back after a prolonged shutdown. Transactions in the works that could not make progress in Q1 and Q2 were getting closed in Q3, resulting in a funding surge. Project acquisition activity – an important indicator of the financial health in the solar sector, bounced back strongly in Q3,” said Raj Prabhu, CEO of Mercom Capital Group.

“Solar stocks are on an incredible run so far this year. Of the 24 solar stocks Mercom track’s globally, 12 were up over 100% at the end of Q3 – an unprecedented number,” Prabhu added.

Global venture capital funding (venture capital, private equity, and corporate venture capital) increased in Q3 2020 with $183 million in 15 deals compared to $65 million in five deals in Q2 2020, 182% growth QoQ. Funding was lower by 12% YoY compared to $208 million raised in 11 deals in Q3 2019.

In 9M 2020, VC funding in the solar sector was 61% lower with $394 million compared to $1 billion raised in 9M 2019.

The top VC deals in 9M 2020 were: $72 million raised by Sunseap Group, $50 million raised by Zero Mass Water, $40 million raised by Ecoppia, $37 million raised by Sunseap Group in a separate deal, and $35 million raised by Lumos.

Fifty-five VC investors participated in solar funding rounds in 9M 2020.

Public market financing into the solar sector came to $1.3 billion in four deals in Q3 2020, 75% higher compared to $737 million raised in five deals in Q2 2020. Year-over-year, public market financing was up slightly (2%) compared to the same quarter of 2019. Solar public market financing in 9M 2020 came to $2.1 billion in 10 deals, 9% lower compared to $2.3 billion in 13 deals in 9M 2019.

In Q3 2020, announced debt financing came to $1.8 billion in 16 deals, a 20% increase compared to $1.5 billion from nine deals in Q2 2020. Year-over-year, debt financing was up by 16%. Solar debt financing activity in 9M 2020 was 6% lower, with $5.4 billion in 32 deals compared to 9M 2019.

Six solar securitization deals brought in almost $1.6 billion in 9M 2020.

There were three residential and commercial solar funds announced in Q3 2020 that totaled $400 million.

In 9M 2020, 42 corporate solar M&A transactions (11 disclosed for $7 billion) were announced, compared to 57 transactions (10 disclosed for $600 million) in 9M 2019. Seventeen solar M&A transactions (five disclosed for $6.8 billion) were executed in Q3 2020 compared to 13 in Q2 2020 and 20 transactions in Q3 2019.

The largest M&A transaction in 9M 2020 was Sunrun’s acquisition of Vivint Solar, in an all-stock transaction for $3.2 billion.

Of the 17 M&A deals, 13 involved Solar Downstream companies, followed by two Manufacturing companies, and one each by a Balance of System (BOS) company and a Materials company.

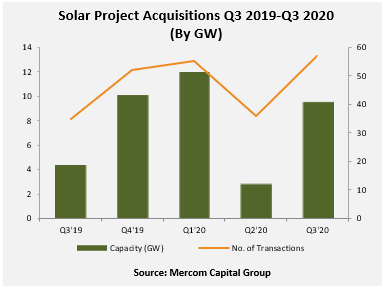

Even with COVID disruptions, project acquisition activity was up 52% in 9M 2020, with 24.3 GW of solar projects acquired, compared to 16 GW acquired in the same period last year. 9.5 GW of solar projects were acquired in Q3 2020, 244% higher compared to 2.8 GW in Q2 2020. In a YoY comparison, acquisition activity was 119% higher, with 4.4 GW acquired in the same quarter last year.

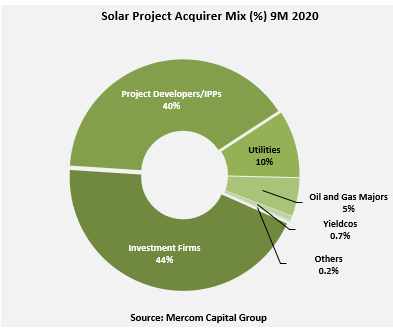

Solar projects continue to be an attractive asset class for investors, and Investment Firms were the most active project acquirers in Q3 2020, picking up 4.2 GW, followed by Project Developers and Independent Power Producers, who acquired 3.8 GW of projects. Utilities acquired 912 MW of projects, and Oil and Gas Majors acquired 514 MW. Yieldcos and other companies acquired 86 MW.

309 companies and investors are covered in this 95-page report. The report contains 83 charts, graphs, and tables.

To learn more about the report, visit: https://mercomcapital.com/product/9m-q3-2020-solar-funding-ma-report