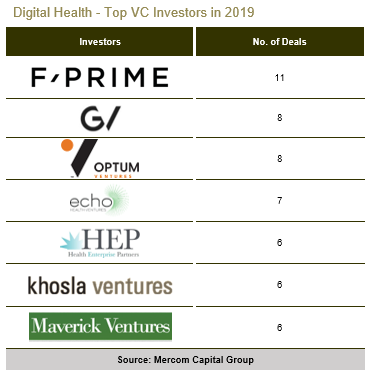

Digital Health companies have continued to rake in billions of dollars in venture funding. Last year, a total of 1,288 investors invested about $9 billion in digital health, according to Mercom Q4 and Annual 2019 Digital Health Funding and M&A Report.

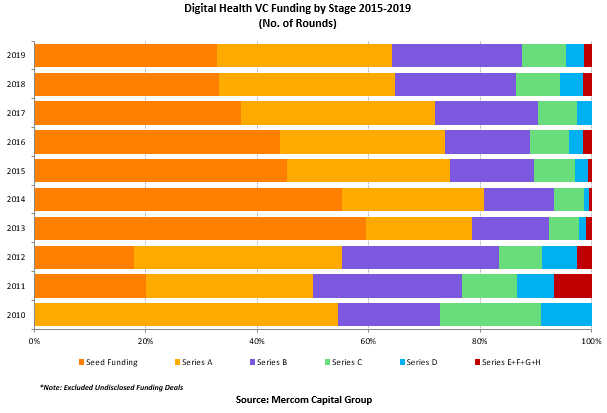

Since 2010, over 5,000 investors have poured in about $44 billion in VC funding. Most of these investors participated in early rounds Seed and Series A rounds.

Digital Health companies in the United States have attracted the most VC funding since 2010, with almost $33 billion, followed by China with $5 billion. The rest of the funding was spread across the world in over 60 countries, including the United Kingdom, Canada, India, and Israel.

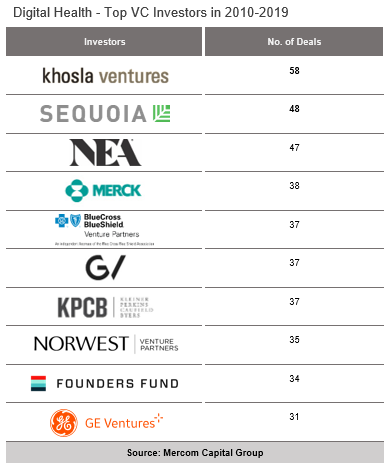

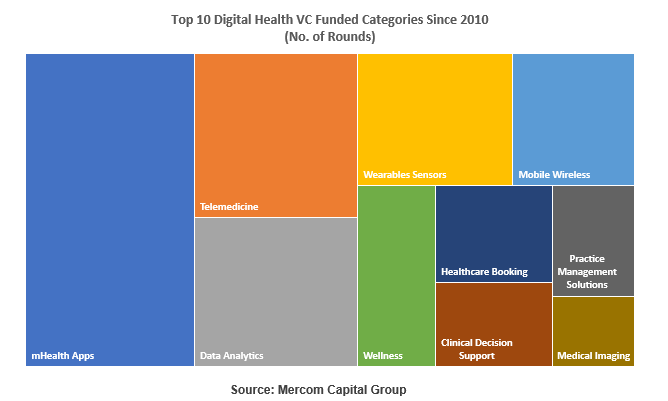

Among the digital health investors, venture capital firm Khosla Ventures has been the most active VC in the space since 2010, investing over $800 million in almost 60 Digital Health companies. Its investment areas included Healthcare Data Analytics, Wearable Sensors, mHealth Apps, Mobile Wireless Devices, and Wellness providers.

Sequoia Capital has invested over $2 billion in Data Analytics, Warehousing, and mHealth Apps. Its latest investments included: Biofourmis, Health Catalyst, Noom, Tencent Trusted Doctors, and Vim.

New Enterprise Associates (NEA) invested over $1.5 billion. Its investment areas included Data Analytics, mHealth, and Telehealth Apps, Wearable Sensors, and Wellness. Its Aetion, Akouos, Catalog Technologies, Cleo, Collective Health, GOQii, Pager, Tempus, WellTok, and Woebot Labs.

Other well-known Digital Health investors included: Merck Global Health Innovation Fund (GHI), which invested over $700 million in 38 Digital Health companies. GV (formerly Google Ventures) and BlueCross BlueShield Venture Partners each invested in 37 companies, with $1.4 billion and $400 million, respectively. Kleiner Perkins invested $1.2 billion in 37 companies, followed by Founders Fund with over $1 billion in 34 companies, Norwest Venture Partners with close to $1 billion in 35 companies, and GE Venture with $610 million in 31 companies.