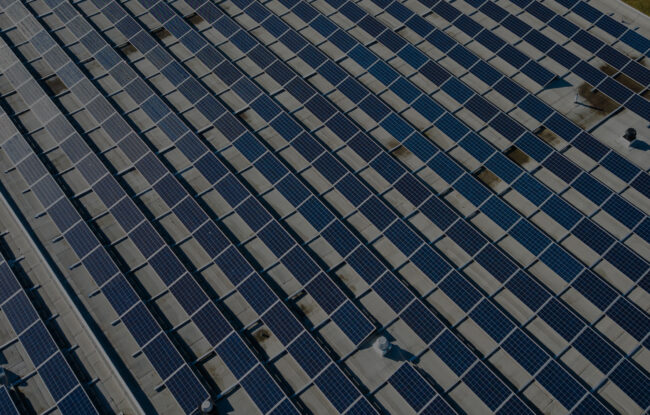

Ingka Investments, the investment arm of Ingka Group, acquired 300 MW of ready-to-build solar PV projects in Romania. The total investment in the solar PV project will amount to over €200 million (~$211.74 million). The project is located in Dâmbovița County, northwest of Bucharest, and has a total installed capacity of 300 MW that, once operational towards the end of 2025, will produce enough renewable energy for the equivalent of roughly 95,000 European households.

Gore Street Energy Storage Fund, a UK-based energy storage fund, secured financing for a 200 MW energy storage project in Imperial County, California. The First Citizens Bank, through its energy finance business, served as the lead agent. The company’s subsidiary, Big Rock ESS Assets, owns the 200 MW/ 400 MWh California battery storage project, which will benefit from contracted revenue through the Resource Adequacy program. The financing will support the remaining development of the project and provide Gore Street Energy Storage with additional liquidity for its growing portfolio.

Atlas Renewable Energy, a solar and wind project developer, reached an agreement to sell 546 MW portfolio of operating solar assets with Engie Brasil Energia Complementares Participações, a part of the Engie Group in Brazil. The operating portfolio includes solar power assets, namely, Juazeiro, Sao Pedro, Sol do Futuro, Sertao Solar, and Lar do Sol, and located across the states of Bahia, Ceara and Minas Gerais.

Enfinity Global, a renewable energy company, has agreed to sell a minority stake in its 400 MW operating solar projects portfolio in the U.S. to Kyushu Electric, a Japan-based utility company. Upon completion of the deal, Kyushu Electric will hold a 40% equity interest in the portfolio. Enfinity Global will retain a 60% equity interest and will be the long-term asset manager of the portfolio.

SUNfarming, a solar project developer and installer, secured mezzanine debt financing in a double-digit million amount for 185 MW of solar projects. The subordinated debt was provided by a managed account, which is administered by Prime Capital. The funds were raised in the form of bearer bonds at the level of group companies. Capcora acted as the exclusive financial advisor to SUNfarming in the transaction.

Click here for reports and trackers on funding and M&A transactions in solar, energy storage, and smart grid sectors.

Read last week’s project finance brief.