DRI, an Amsterdam-based renewable energy company and a subsidiary of DTEK Group, announced the acquisition of a 126 MW solar project in Văcărești, Dâmbovița County, Romania, from local developers. Construction of the Văcărești solar project is expected to begin in autumn 2024 and commence operations the following autumn. Once operational, the project is expected to produce 205.8 GWh of electricity.

Recurrent Energy, a solar and energy storage project developer and a wholly owned subsidiary of Canadian Solar secured $513 million in project financing for its 1,200 MWh Papago storage project in Maricopa County, Arizona. The financing includes a $249 million construction and term loan, a $163 million tax equity bridge loan, and a $101 million letter of credit facility. Construction of the Papago storage project is scheduled to begin in the third quarter of 2024, with commercial operations expected to start in the second quarter of 2024.

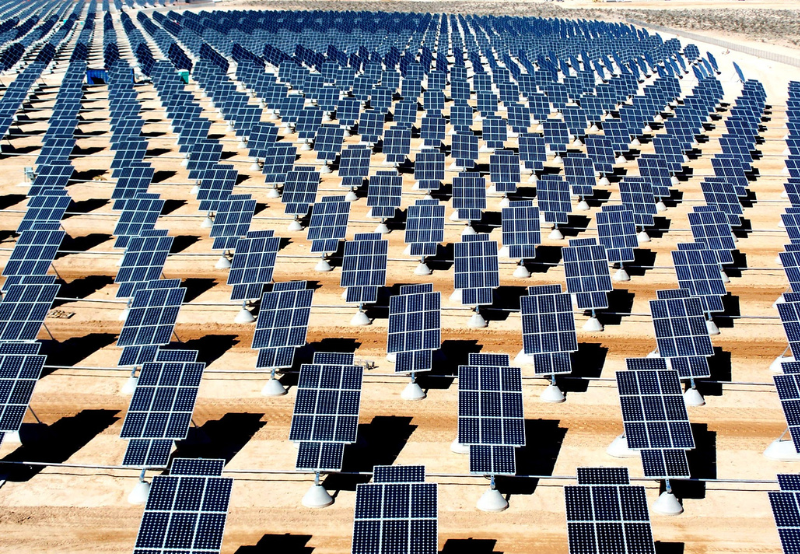

Birch Creek Energy, a utility-scale solar and energy storage project developer, closed financing for its 49 MW Earp solar project in Illinois, U.S. Tax equity was arranged through Foss & Co., permanent debt was provided by West Town Bank & Trust, and construction capital was underwritten and funded by Pathward®, N.A. Earp Solar is project based in Warren County, Illinois. The project is fully operational and generates enough renewable electricity to power over 7,300 households.

Vesper Energy, a developer, owner, and operator of utility-scale renewable energy assets, announced the sale of two PJM assets, Gaucho Solar and Nestlewood Solar projects, to Octopus Energy Generation, a renewable energy asset management firm. The two projects collectively will generate 100 MW of renewable energy annually. The Gaucho Solar project is on 68 acres in Beaver County and Allegheny County, Pennsylvania. The Nestlewood Solar project is located on 610 acres in Clermont and Brown County, Ohio, and offsets power for an e-commerce company as a part of a power purchase agreement.

Click here for reports and trackers on funding and M&A transactions in solar, energy storage, and smart grid sectors.

Read last week’s project finance brief.