Q1 2024 Funding and M&A Report for Storage and Grid

$299.00 – $399.00

Click here to download our Q1 2024 Funding and M&A Executive Summary on Energy Storage and Smart Grid.

Energy Storage

Corporate funding in Energy Storage came to $11.7 billion in 29 deals in Q1 2024 an increase of 432% year-over-year (YoY) compared to $2.2 billion in 27 deals in Q1 2023. In a quarter-over-quarter (QoQ) comparison, funding increased 216% compared to the $3.7 billion raised in 26 deals in Q4 2023.

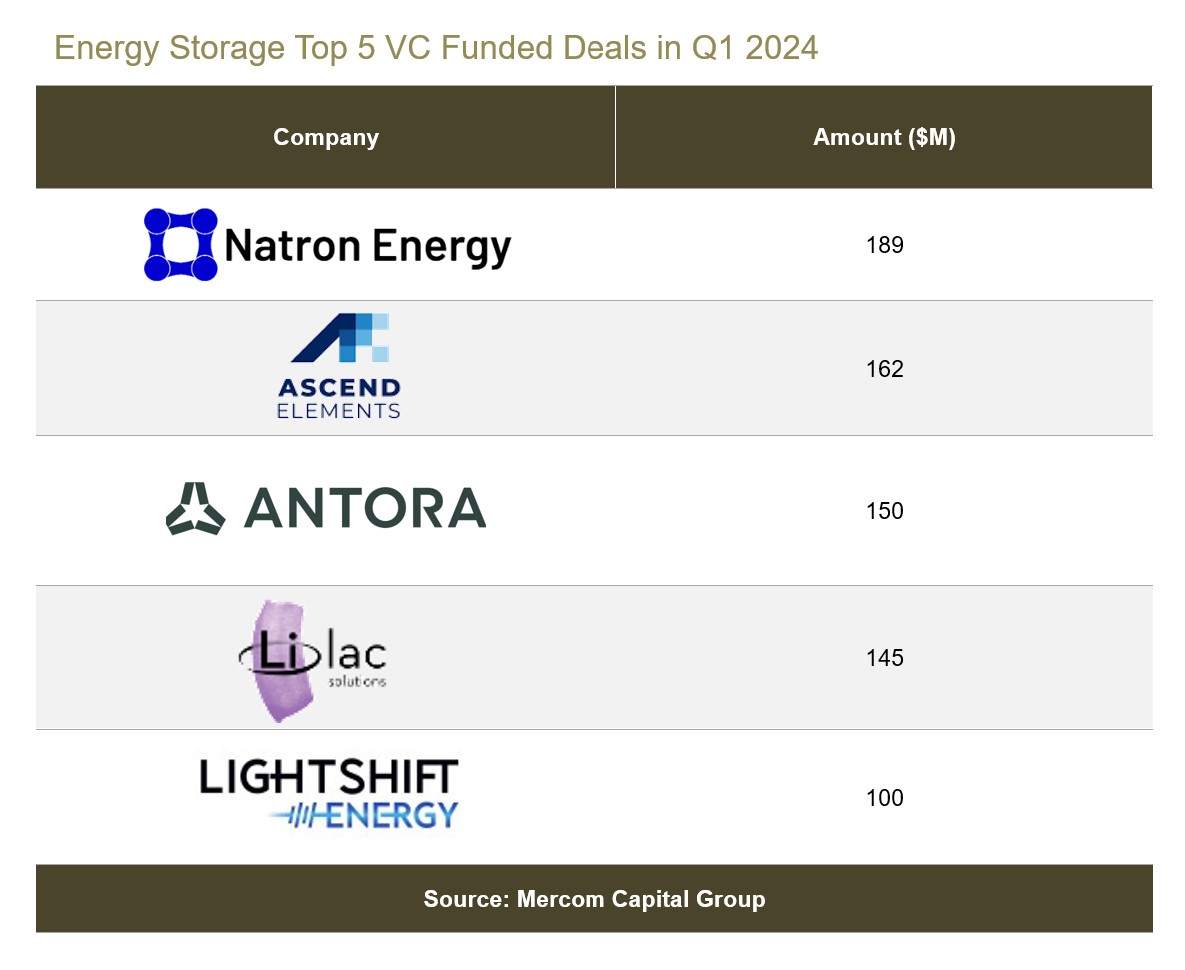

VC funding for Energy Storage companies increased by 9% YoY, with $1.2 billion in 23 deals in Q1 2024 compared to $1.1 billion raised in 19 deals in Q1 2023. Comparing QoQ, funding in Q1 2024 increased by 92% compared to $625 million in 18 deals in Q4 2023.

Eight-one VC investors participated in Energy Storage funding this quarter.

There were eight M&A transactions involving Energy Storage companies in Q1 2024, a double-digit increase from Q1 2023.

Smart Grid

Smart Grid VC funding increased by 134% in Q1 2024, with $656 million raised in 12 deals compared to $280 million in 14 deals in Q1 2023. In a QoQ comparison, funding in Q1 2024 was 197% higher compared to Q4 2023, when $221 million was raised in 10 deals.

Fifty investors participated in VC funding this quarter.

In Q1 2024, there was one corporate M&A transaction compared to four transactions in Q1 2023.

Mercom Capital Group’s Energy Storage and Smart Grid Funding and M&A Reports are comprehensive high-quality reports delivering superior insight, market trends and analysis. These reports help bring clarity to professionals in the current financial landscape of the smart grid industry.

The Quarterly Funding and M&A Reports contain quarter-over-quarter (QoQ) information on market activity displayed in easy-to-digest charts, graphs and tables, as well as data-driven analysis covering:

- Venture capital funding deals including top investors, QoQ trends, and a breakdown of charts and graphs by stage;

- VC funding by technology;

- Debt and other funding deals;

- Mergers and Acquisitions (M&A) including QoQ trends, with charts and graphs by technologies;

- Battery and storage funding deals;

- Smart Grid funding deals;

- Energy Efficiency funding deals;

- New cleantech funds;

This report also contains comprehensive lists of all announced deals and transactions during the quarter, including:

- VC deals and investors;

- M&A transactions and acquirers;

- New cleantech funds.

There were 234 companies and investors covered in this report. The report is 88 pages in length and contains 64 charts, graphs and tables.