Israel-based Migdal Insurance, an insurance company, has agreed to buy a 22.5% stake in Doral Renewables’ 300 MW Mammoth Solar II photovoltaic project in Indiana.

Doral Renewables, doing business as Doral LLC, said that the Israeli insurance company and pension manager has agreed to pay up to $75 million to get the stake in the scheme, thus providing a portion of its total capital requirement.

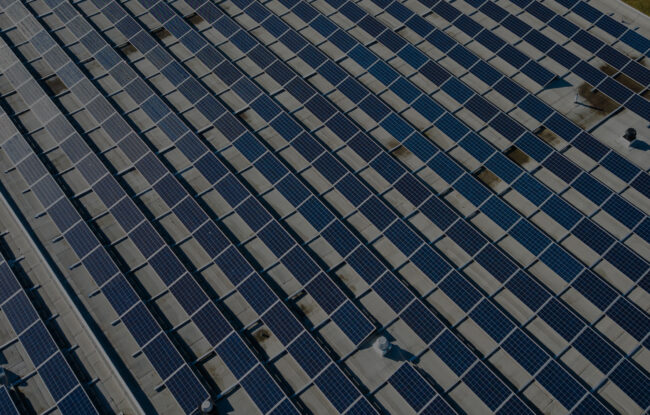

Mammoth Solar II, also known as Mammoth South, is the second phase of the Mammoth Solar complex, with an installed capacity of 1.3 GW. Located in Starke and Pulaski counties in northern Indiana, within the PJM market area, the solar project is expected to produce enough electricity to supply more than 230,000 homes per year once fully operational.

The 480 MW DC Mammoth Solar I was officially opened in October 2021. Migdal Insurance invested $100 million in phase one earlier in 2021 for a minority stake.

Including the latest investment, the Israeli firm has raised its direct investment in the Mammoth Solar project to $175 million.

Yaki Noyman, CEO of the Doral Group, said: “Migdal increasing its investment is a direct expression of the trust offered by Israel’s institutional entities in the renewable energy sector and Doral in particular. We have chosen partners that are interested in generating returns from its investment and its impact on the public and the environment. We continue to initiate and develop more projects in Israel, Europe, and the US.”

According to Mercom’s recently published Q4 2021 solar funding and M&A report, in December 2021, the U.S.-based renewable energy development arm of Israel-based Doral Group, Doral Renewables, acquired a 150 MW Brenneman solar development project in Macon County, Georgia, from Avangrid.

In June 2021, Denmark-based GreenGo Energy Group had sold a portfolio of 360 MW of utility-scale subsidy-free solar projects to Israeli developer Doral Renewable Energy Resources Group under a partnership agreement.